Stay Ahead Financially

Understanding Cash Flow: Tips for Seasonal Service Businesses

Est. reading time: 11 min

Seasonal service businesses often experience peaks and valleys in revenue, making it challenging to maintain steady cash flow. Understanding and managing cash flow effectively can ensure your business thrives during both busy and slow periods.

What Is Cash Flow?

Cash flow refers to the movement of money in and out of your business. It’s the lifeblood of any service business, helping you cover expenses, invest in growth, and weather slow seasons. Positive cash flow means more money is coming in than going out, while negative cash flow can signal trouble.

Challenges for Seasonal Businesses

Seasonal businesses—like snow removal, landscaping, or moving services—face unique cash flow challenges:

- Inconsistent Income: Peaks during busy seasons can create a false sense of financial security, while slow periods can leave you scrambling for funds.

- High Overheads: Ongoing expenses like insurance, equipment maintenance, or software tools continue year-round, even when income dips.

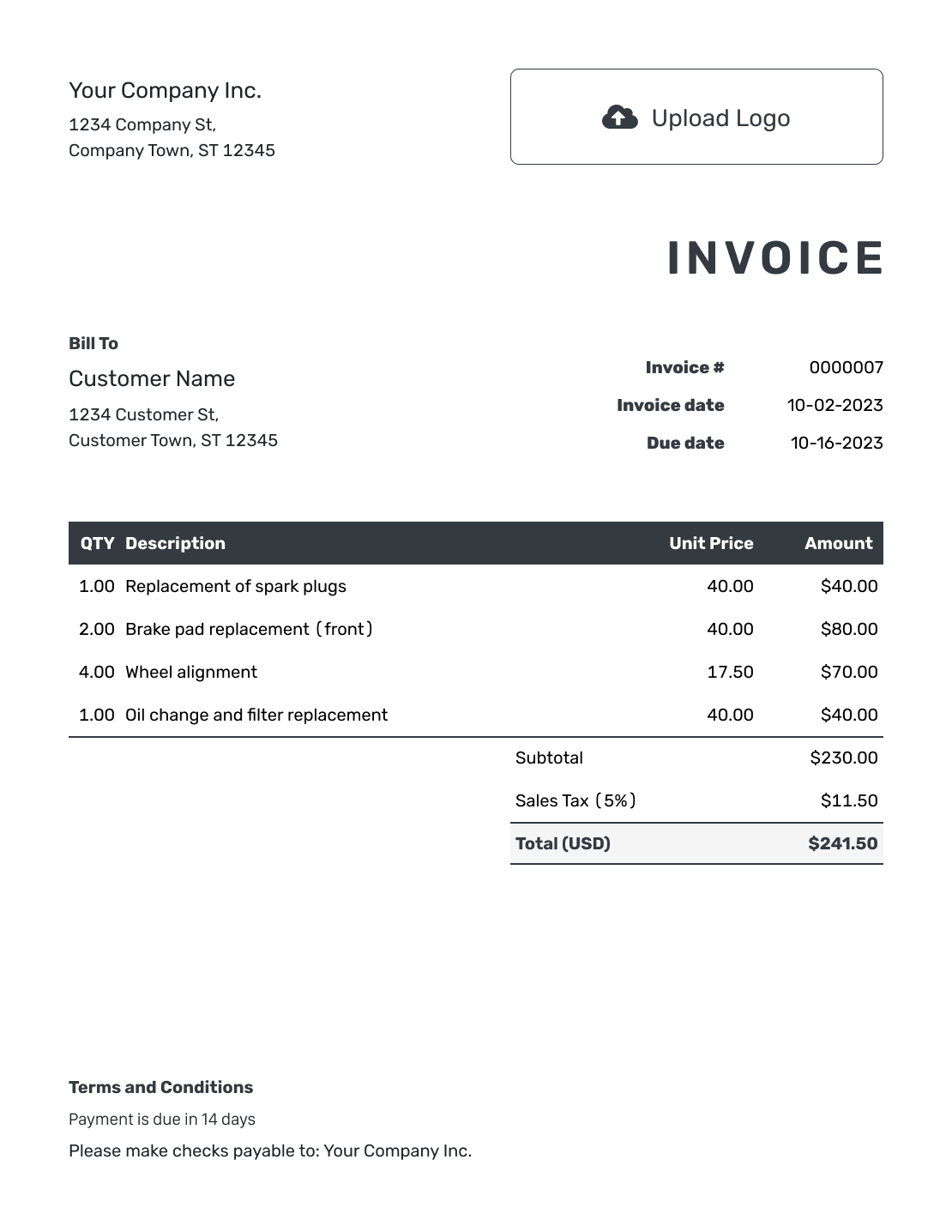

- Customer Delays: Late payments can disrupt cash flow. Using Docelf’s invoice template can help you stay on top of payments and remind customers to settle their accounts promptly.

Strategies for Managing Cash Flow

1. Create a Budget

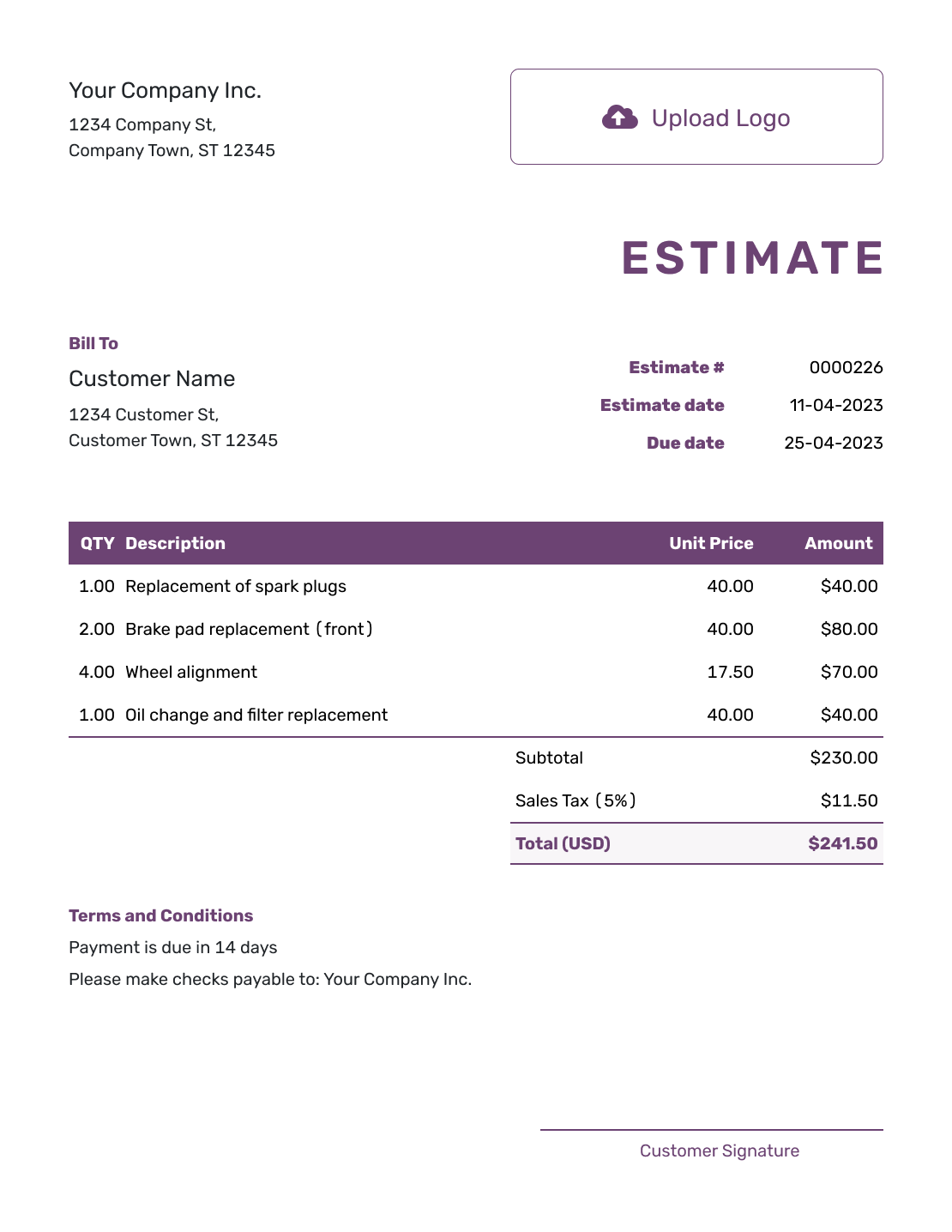

Plan ahead by creating a detailed budget for your peak and off-seasons. Include fixed costs, like rent and insurance, and variable costs, like materials or fuel. Tools like Docelf’s estimate template can help you predict expenses for upcoming projects.

2. Save During Peak Seasons

Set aside a portion of your earnings during busy months to cover expenses during slower periods. This financial cushion helps you avoid taking on unnecessary debt.

3. Offer Pre-Season Discounts

Encourage customers to book early by offering discounts for services scheduled before your busy season. For example, a painter could offer lower rates for interior jobs booked during the winter.

4. Diversify Your Services

Consider offering complementary services during off-seasons. A landscaping business could offer snow removal in winter, or a cleaning service might add holiday organization packages.

5. Track Payments and Expenses

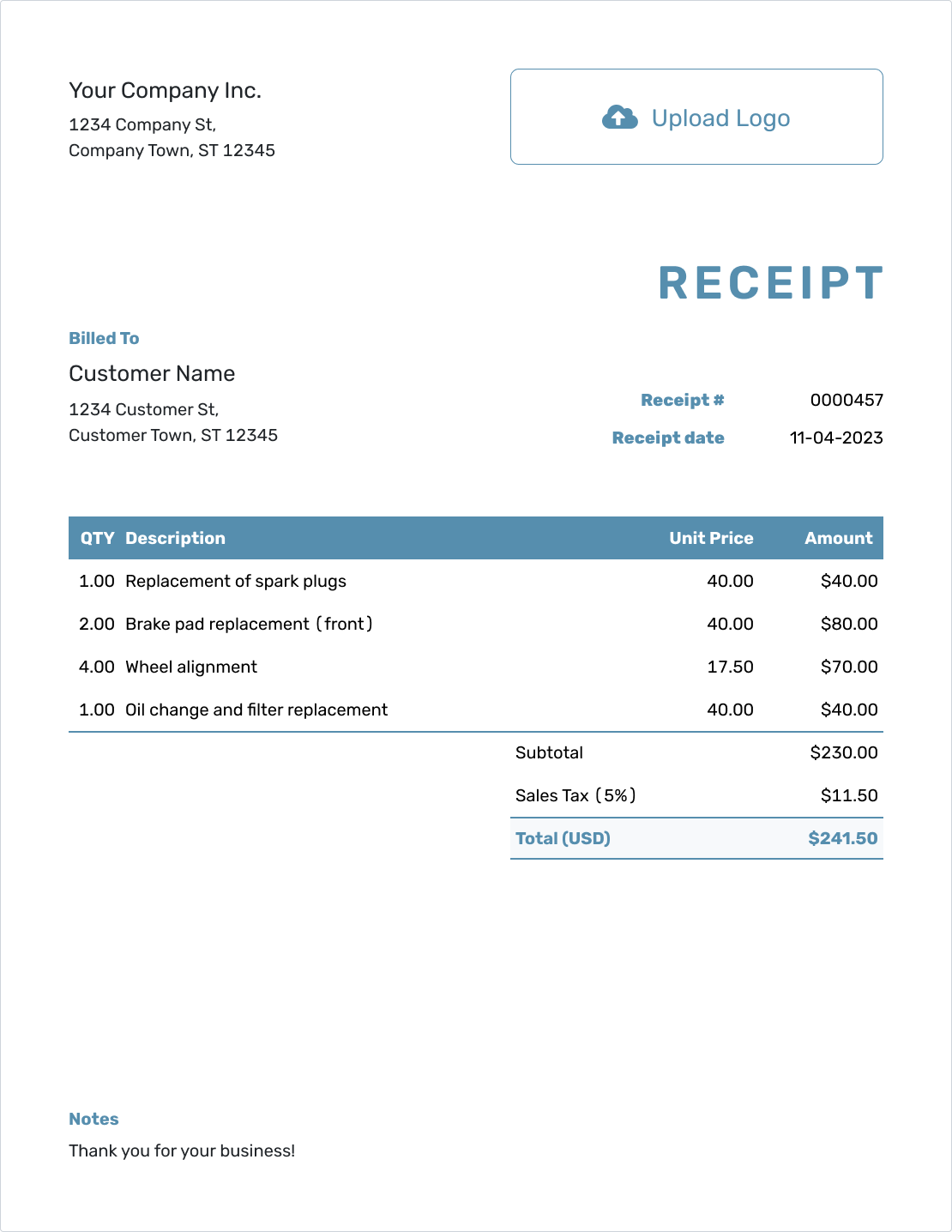

Stay organized with tools like Docelf’s receipt template to record expenses and ensure your accounts are up to date. Tracking overdue payments with an invoice template keeps cash flow predictable.

6. Adjust Your Rates

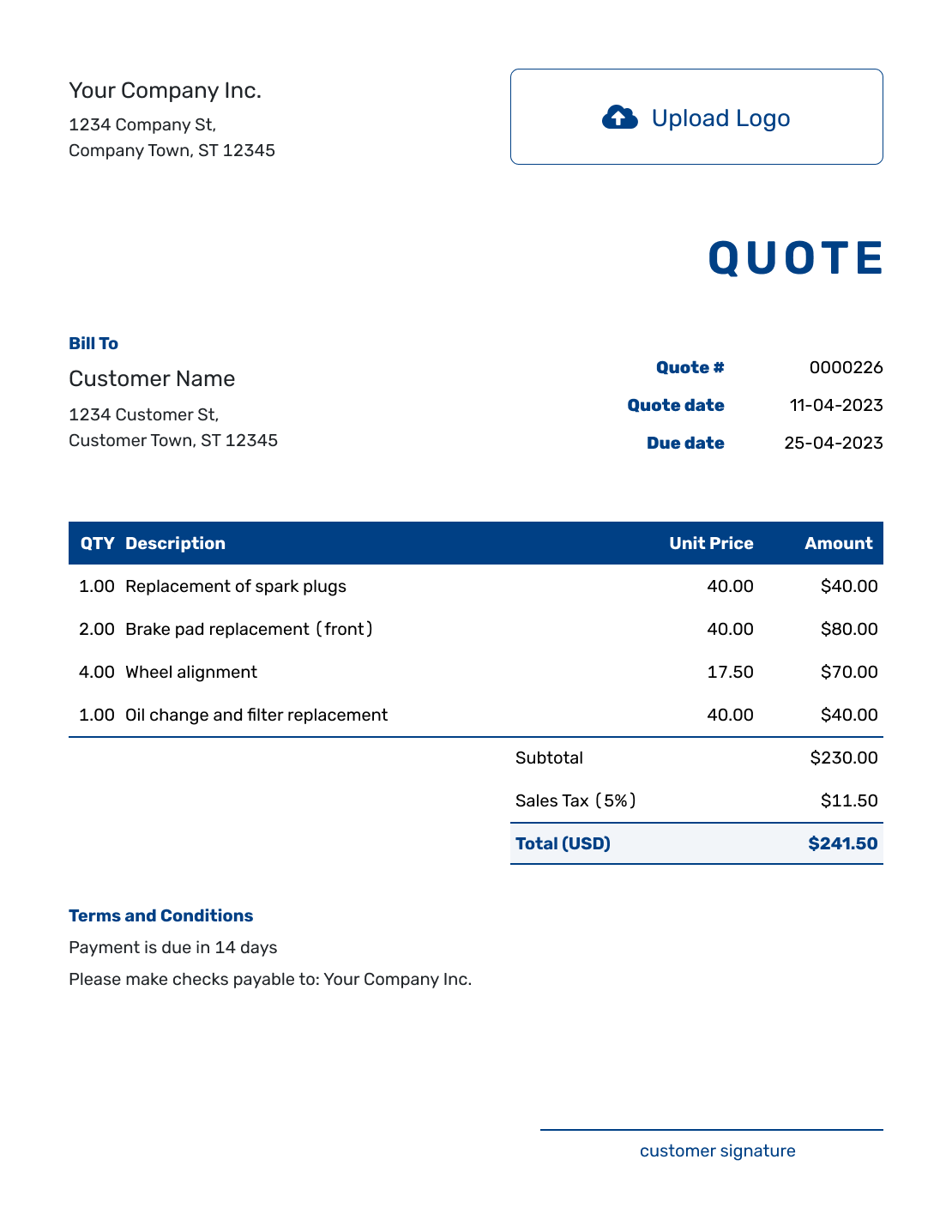

During peak seasons, consider increasing your rates slightly to reflect demand. Use a quote template to provide clear pricing to your customers, ensuring they understand the value of your services.

How Docelf Helps

Managing cash flow doesn’t have to be overwhelming. Docelf offers tools that simplify tracking and planning your finances:

- Professional Invoices: Use our invoice template to send clear, branded invoices and keep your payments on track.

- Accurate Estimates: Create detailed, professional estimates with our estimate template.

- Organized Records: Keep receipts and expenses tidy with our receipt template.

- Win More Jobs: Impress clients with detailed, transparent quotes using our quote template.

Ready to take control of your cash flow? Sign up for Docelf today and simplify your financial management.