Understanding

Accounts Payable

Est. reading time: 5 min

Accounts payable might sound like a complicated financial term, but it's really just a fancy way of describing the money your business owes to suppliers. It's what you need to pay for goods and services you’ve already received but haven't paid for yet.

For example, if you buy office supplies on credit, the amount you owe becomes part of your accounts payable. It stays there until you settle the bill.

What Is Accounts Payable?

Accounts payable is the total amount of money your business owes to suppliers and vendors. These are your unpaid bills. It could include anything from utility bills to payments for raw materials or professional services.

This term is often used in accounting to show how much a business needs to pay within a short time, usually within 30 to 90 days. Keeping track of accounts payable helps ensure you don't miss payment deadlines or harm your relationships with suppliers.

Key Features of Accounts Payable:

- Short-Term Obligation: These are debts that need to be paid soon, typically within weeks or months.

- Part of Cash Flow: Paying your accounts payable reduces your available cash but also keeps your business running.

- Reflects Business Health: Managing accounts payable well shows that your business is organized and financially responsible.

Why Is Accounts Payable Important?

Accounts payable is more than just a list of bills to pay. It helps you keep your business financially healthy. Here's why it matters:

- Keeps Cash Flow Steady: Knowing how much you owe helps you plan your expenses and avoid surprises.

- Strengthens Vendor Relationships: Paying on time builds trust and can lead to better terms in the future.

- Avoids Late Fees: Staying on top of payments saves you from penalties or extra charges.

How to Manage Accounts Payable

Managing accounts payable effectively is essential for running a smooth business. Here are some simple steps to help you:

1. Track Your Bills

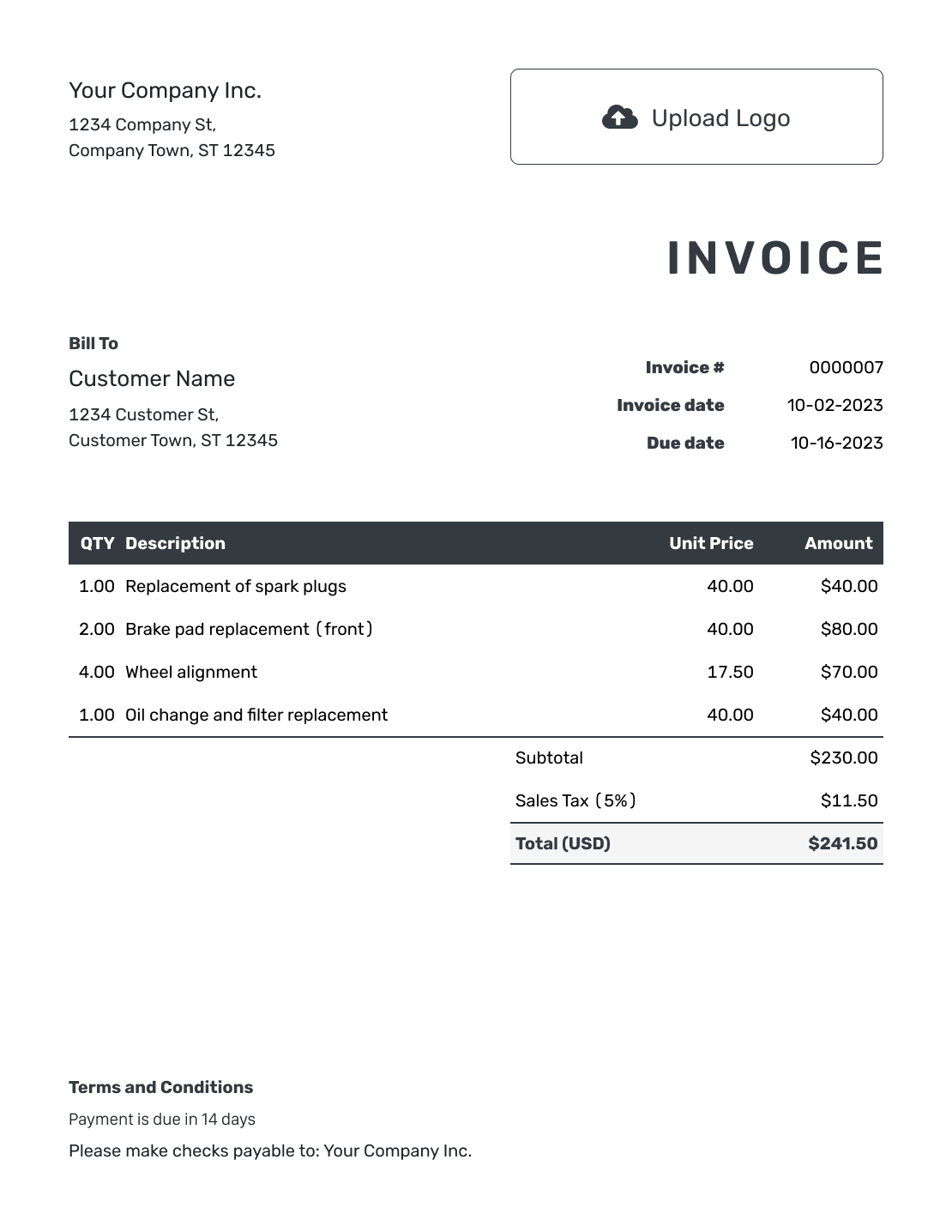

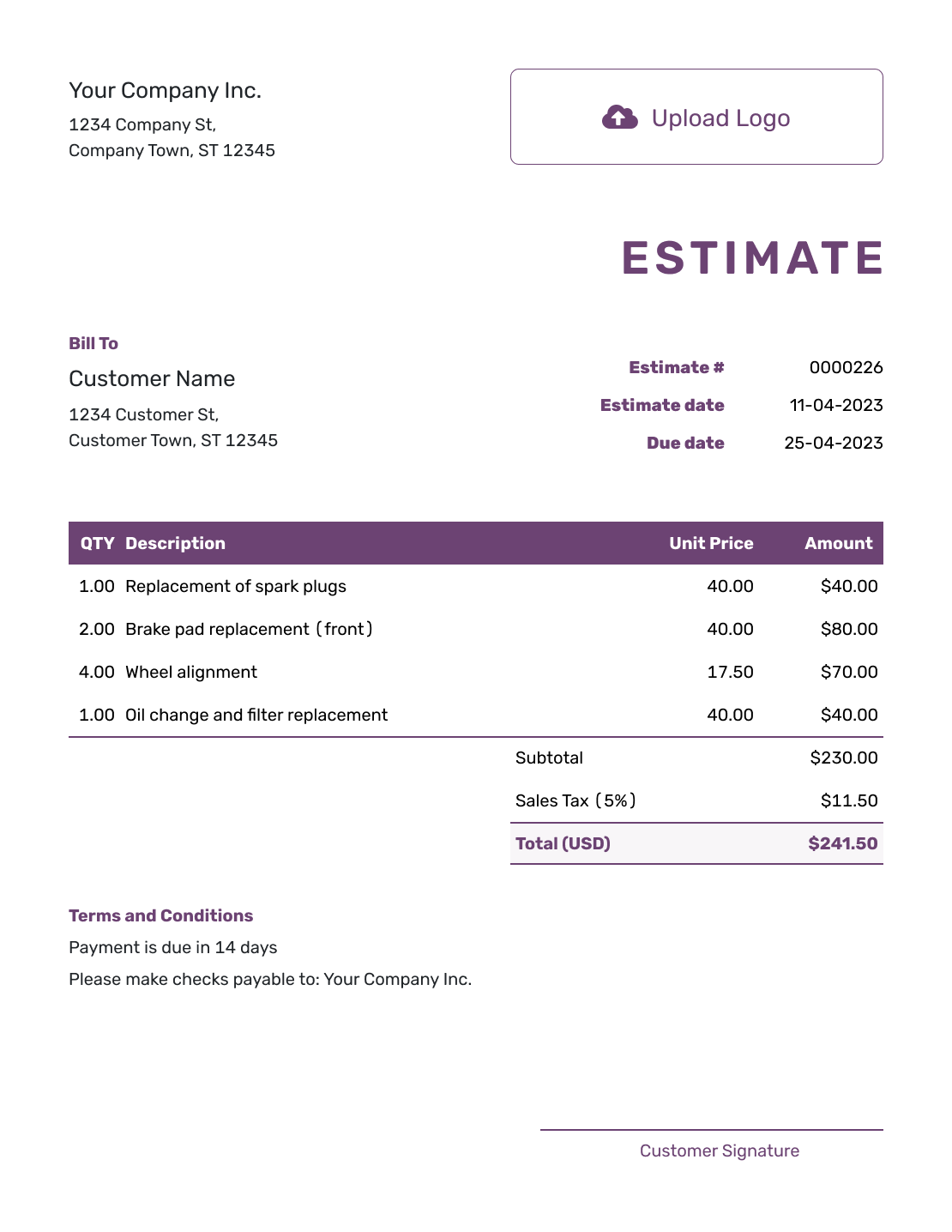

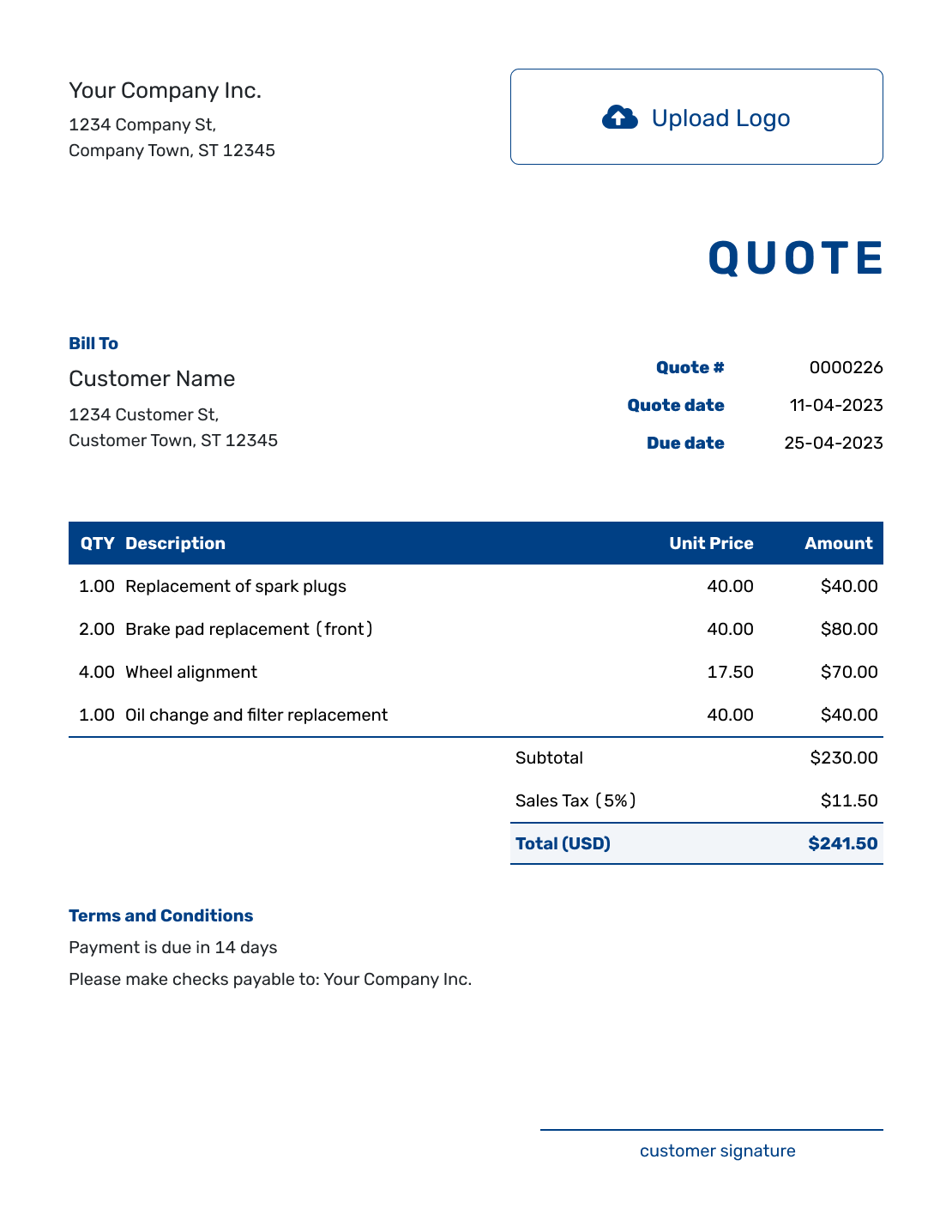

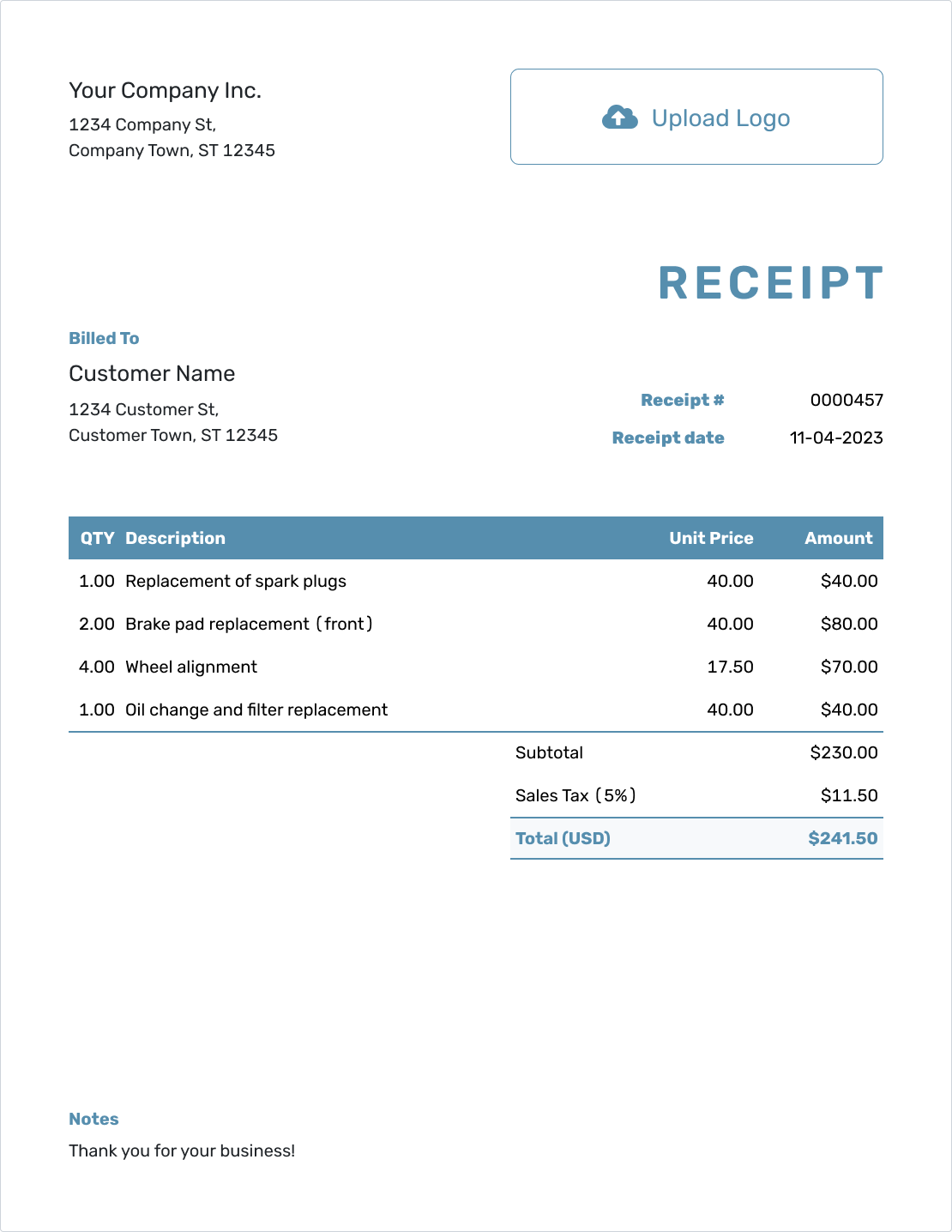

Keep all your bills and invoices in one place. Use a system to record due dates, amounts, and payment methods.

2. Set Payment Reminders

Don't rely on memory to pay your bills. Set reminders to ensure you never miss a due date.

3. Verify Invoices

Always check invoices to ensure the charges are correct. Look out for errors or unexpected fees.

4. Take Advantage of Discounts

Some suppliers offer discounts for early payments. If your cash flow allows, pay early to save money.

5. Prioritize Payments

If you can't pay all your bills at once, prioritize the most critical ones, like utilities or essential supplies.

The Docelf Advantage

Docelf makes managing accounts payable easy and stress-free. Here's how our platform can help:

- Stay Organized: Keep all your invoices in one place for easy access and tracking.

- Improve Communication: Easily share invoice details with your team or vendors as needed.

Ready to simplify your accounts payable process? Start your free trial with Docelf today and see the difference!