Understanding

Bank Reconciliation

Est. reading time: 6 min

Bank reconciliation might sound complicated, but it's simply about comparing your business's financial records with your bank statement. This process ensures everything matches and helps you maintain accurate financial records. Think of it as balancing your business's checkbook to catch any errors or missing information.

What Is Bank Reconciliation?

Bank reconciliation is the process of ensuring that your financial records align with your bank statement. It's a way to check for discrepancies, such as unrecorded payments, duplicate transactions, or bank errors.

For example, if your records show a payment to a vendor that's not reflected on the bank statement, reconciliation will help you identify the issue and correct it.

Why Is It Important?

Regular bank reconciliation keeps your finances in check. Here's why it matters:

- Improves accuracy: Ensures your records reflect your actual financial position.

- Prevents fraud: Helps you spot unauthorized transactions or errors quickly.

- Supports cash flow management: Gives you a clear picture of your available funds.

- Simplifies tax preparation: Ensures your records are complete and ready for tax reporting.

How to Do Bank Reconciliation

Bank reconciliation is straightforward when broken into steps. Here's how to do it:

Step 1: Compare Records with the Bank Statement

Start by comparing the transactions in your financial records (like your cash book or accounting software) to those listed on the bank statement. Look for matches and note any differences.

Step 2: Identify Discrepancies

Common discrepancies include:

- Unrecorded transactions: Payments or deposits that appear on the bank statement but not in your records.

- Errors: Mistakes in either the bank statement or your records.

- Timing issues: Transactions recorded in your books that haven't cleared the bank yet, like checks.

Step 3: Make Adjustments

Adjust your records for any discrepancies you find. For example, add missing payments or correct errors. Here's an example formula to reconcile:

| Reconciled Balance = | Bank Balance + Deposits in Transit - Outstanding Checks |

Step 4: Confirm Everything Matches

Once adjustments are made, review your records and the bank statement to ensure they match. If they do, your reconciliation is complete!

The Docelf Advantage

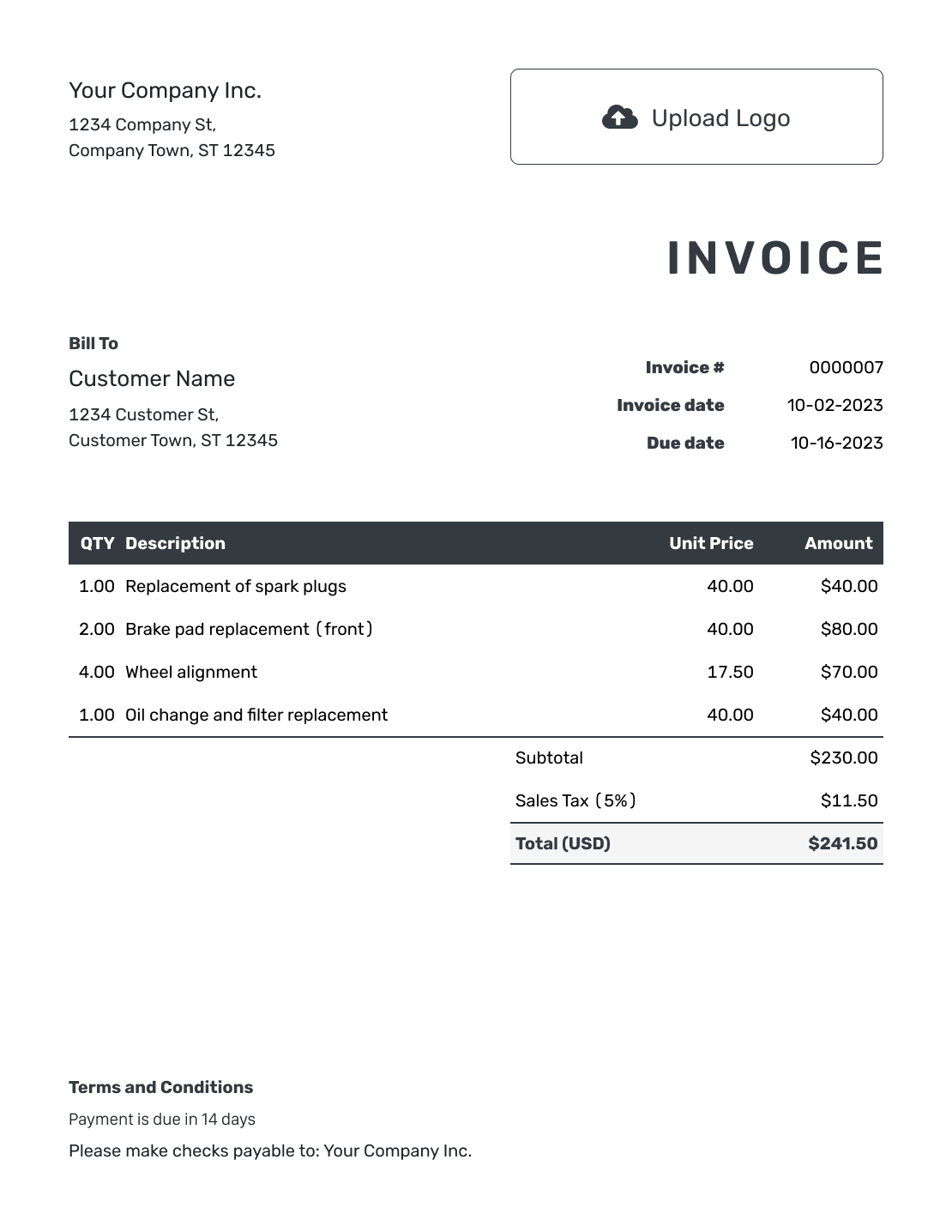

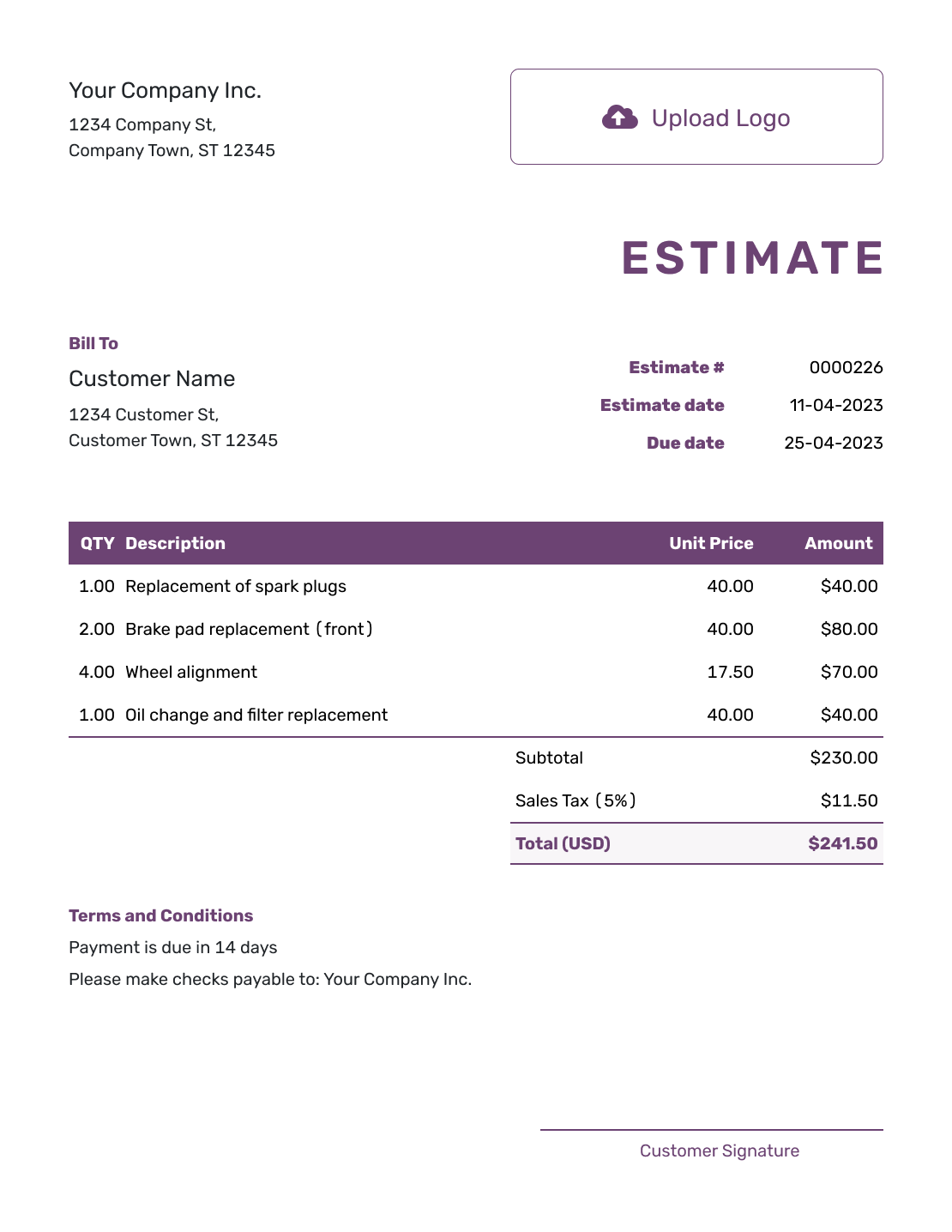

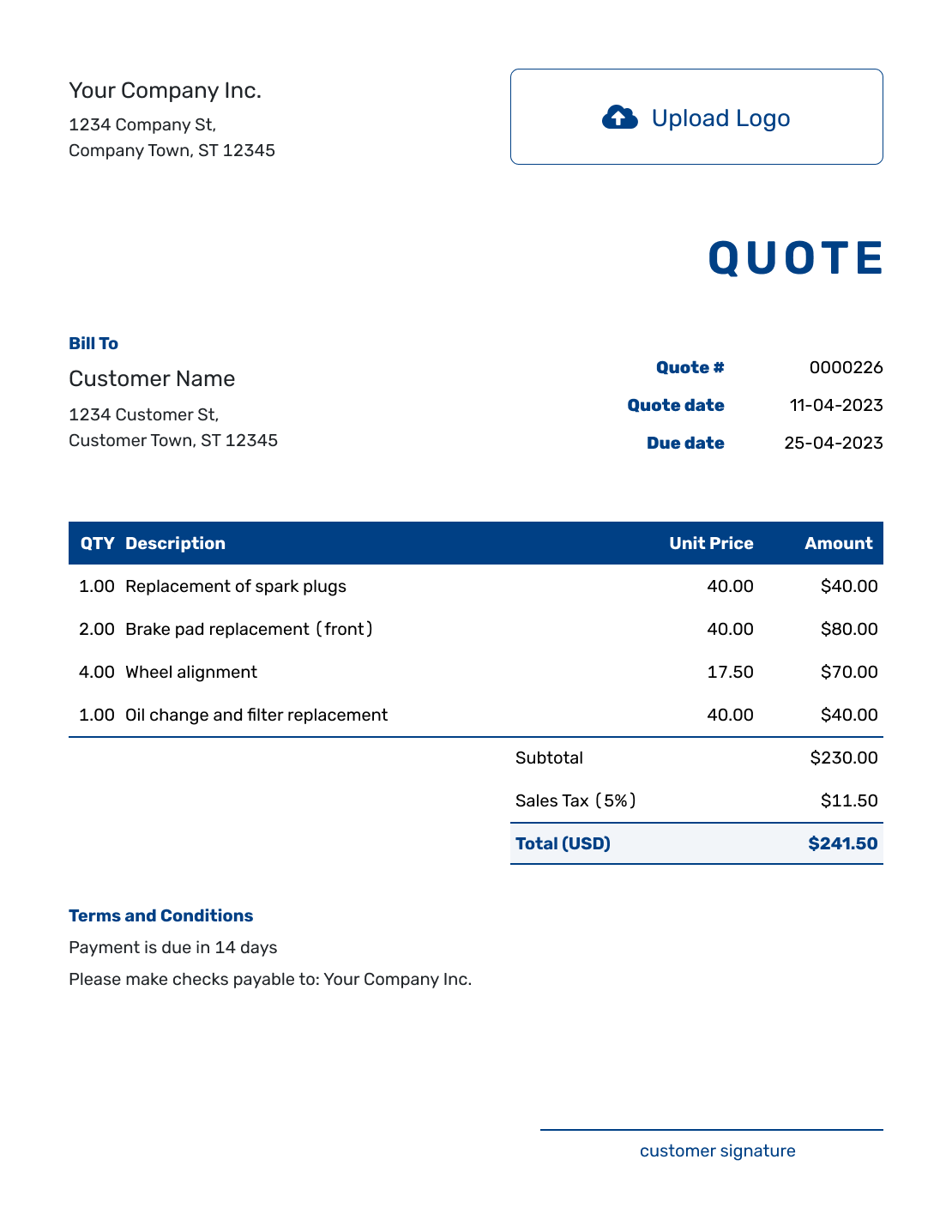

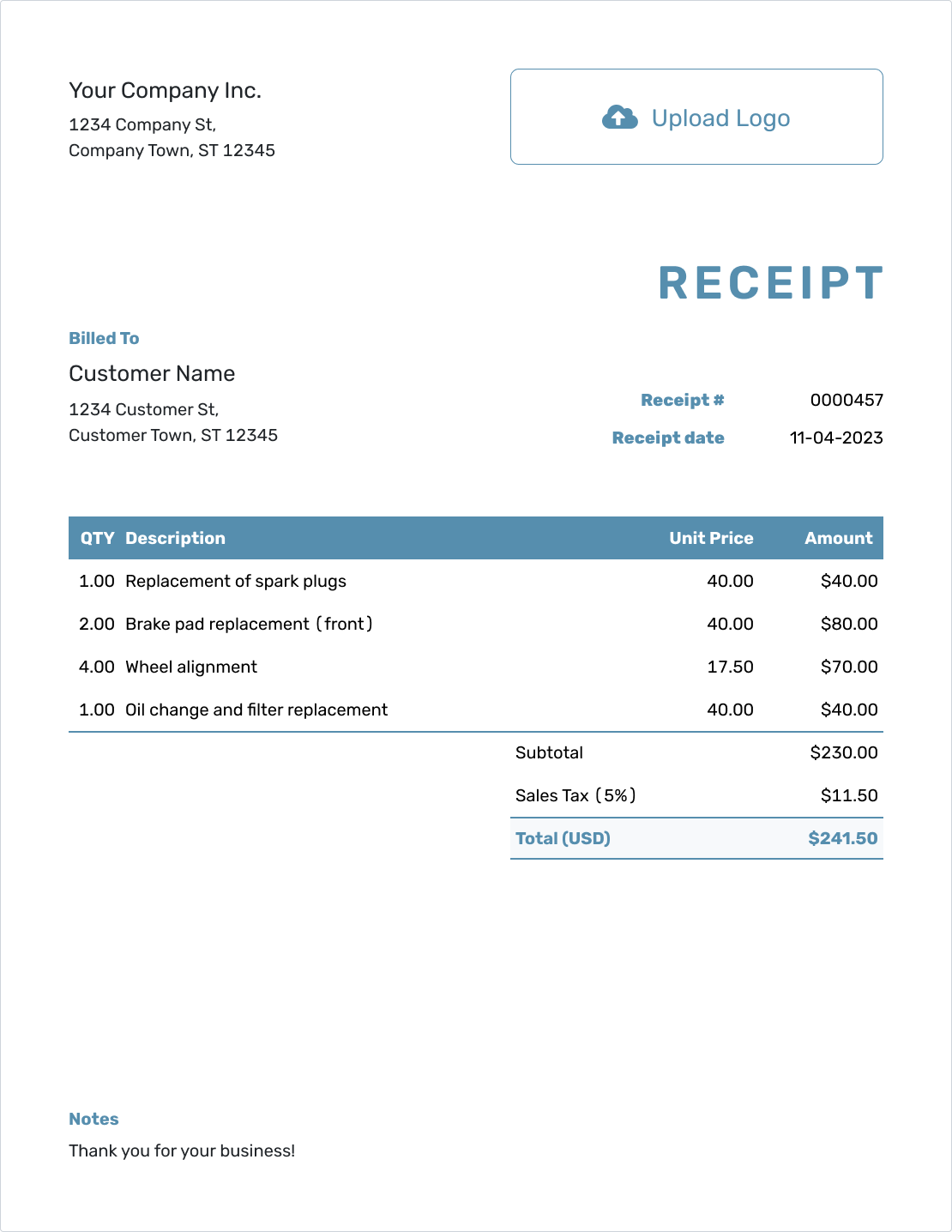

Keeping your invoices and payments organized makes bank reconciliation easier. With Docelf, you can:

- Track payments: Record invoices as paid to keep your financial data accurate.

- Stay organized: Access all your invoicing and payment history in one place.

- Customize invoices: Use your own branding, colors, and logo to create professional documents.

Ready to simplify your invoicing process and maintain accurate financial records? Try Docelf today and stay in control of your business's cash flow.