Understanding

Break-Even Analysis

Est. reading time: 7 min

Break-even analysis might sound technical, but it's simply figuring out when your business makes enough money to cover its costs. Think of it as the point where you're not losing money but not yet making a profit either. Knowing this number helps you set smarter prices and understand your costs better.

What Is Break-Even Analysis?

A break-even analysis helps you determine the amount of sales you need to cover all your expenses. At the break-even point, your business isn't making a profit, but it isn't losing money either. Every sale after this point contributes to profit.

Key Concepts in Break-Even Analysis:

- Fixed Costs: Expenses that stay the same no matter how much you sell (e.g., rent, salaries).

- Variable Costs: Expenses that increase with each sale (e.g., materials, shipping).

- Sales Price: The amount you charge customers per unit of your product or service.

Why Does It Matter?

Understanding your break-even point can help you make better decisions, such as:

- Setting Prices: Know how low you can go without losing money.

- Planning Growth: Understand how much you need to sell to afford new expenses.

- Managing Costs: Identify where you might cut costs or improve efficiency.

Simply put, break-even analysis gives you a clear picture of what it takes to keep your business afloat and when you’ll start turning a profit.

How to Calculate It

The formula for finding your break-even point is straightforward:

| Break-Even Point (units) = | Fixed Costs |

| Sales Price per Unit - Variable Cost per Unit |

Example:

Let's say your fixed costs are $1,000, your sales price per unit is $50, and your variable cost per unit is $30. Plugging these into the formula:

| Break-Even Point (units) = | 1,000 |

| 50 - 30 |

This means you need to sell 50 units to break even.

Practical Tips

Break-even analysis can be even more helpful when paired with these tips:

- Review Regularly: Costs and prices change, so update your analysis to stay accurate.

- Test Scenarios: Use the formula to explore what happens if your costs or prices change.

- Think in Units and Revenue: Knowing the sales volume and total dollars required gives you a fuller picture.

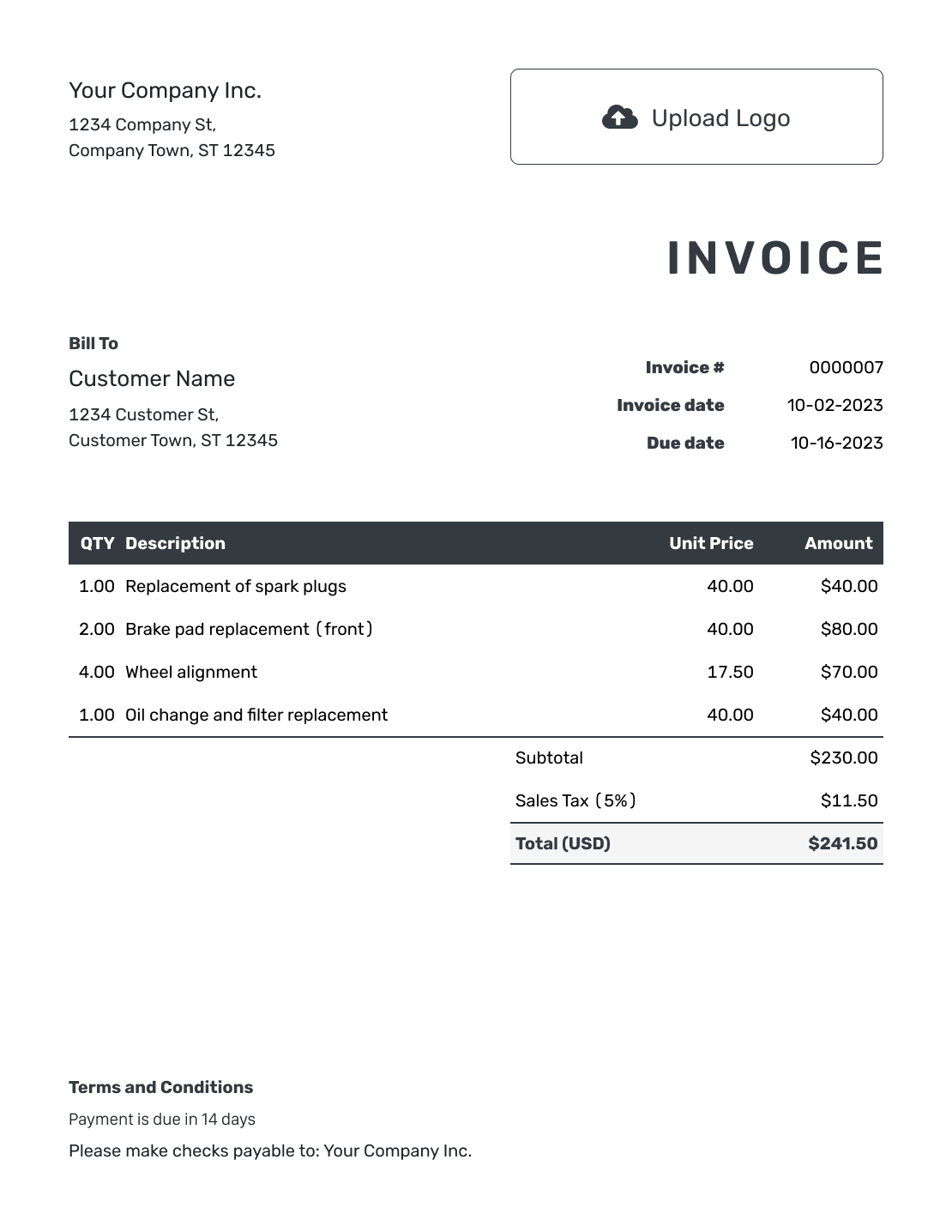

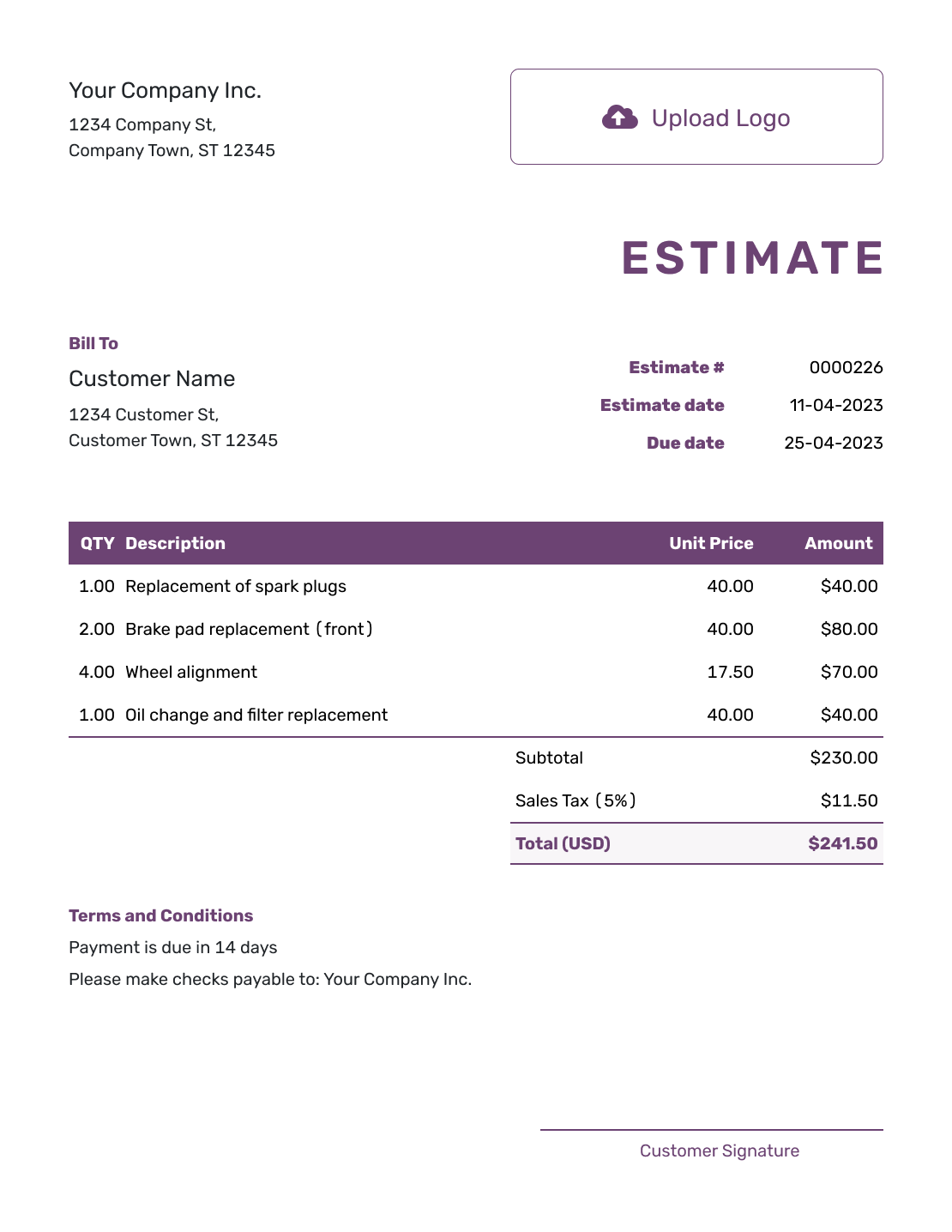

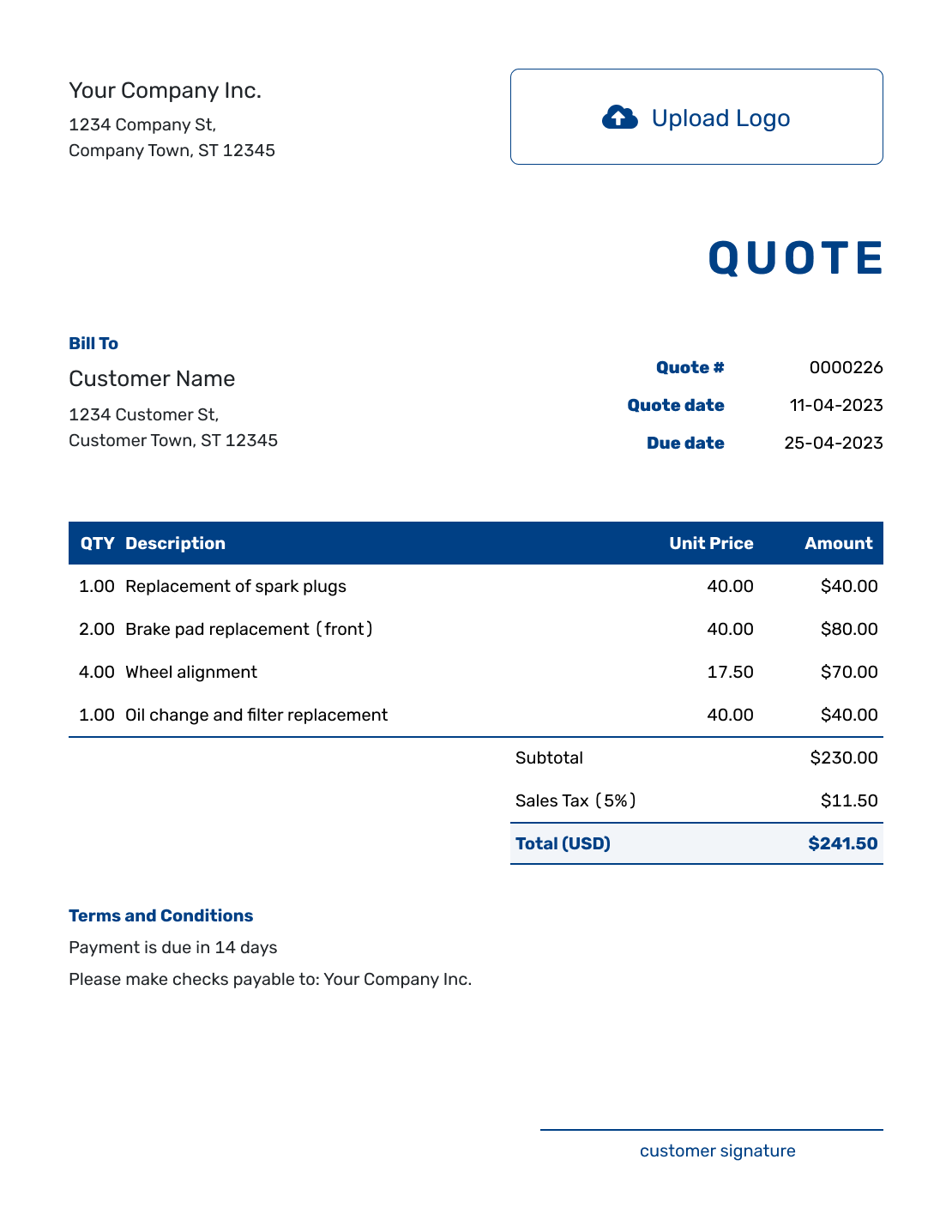

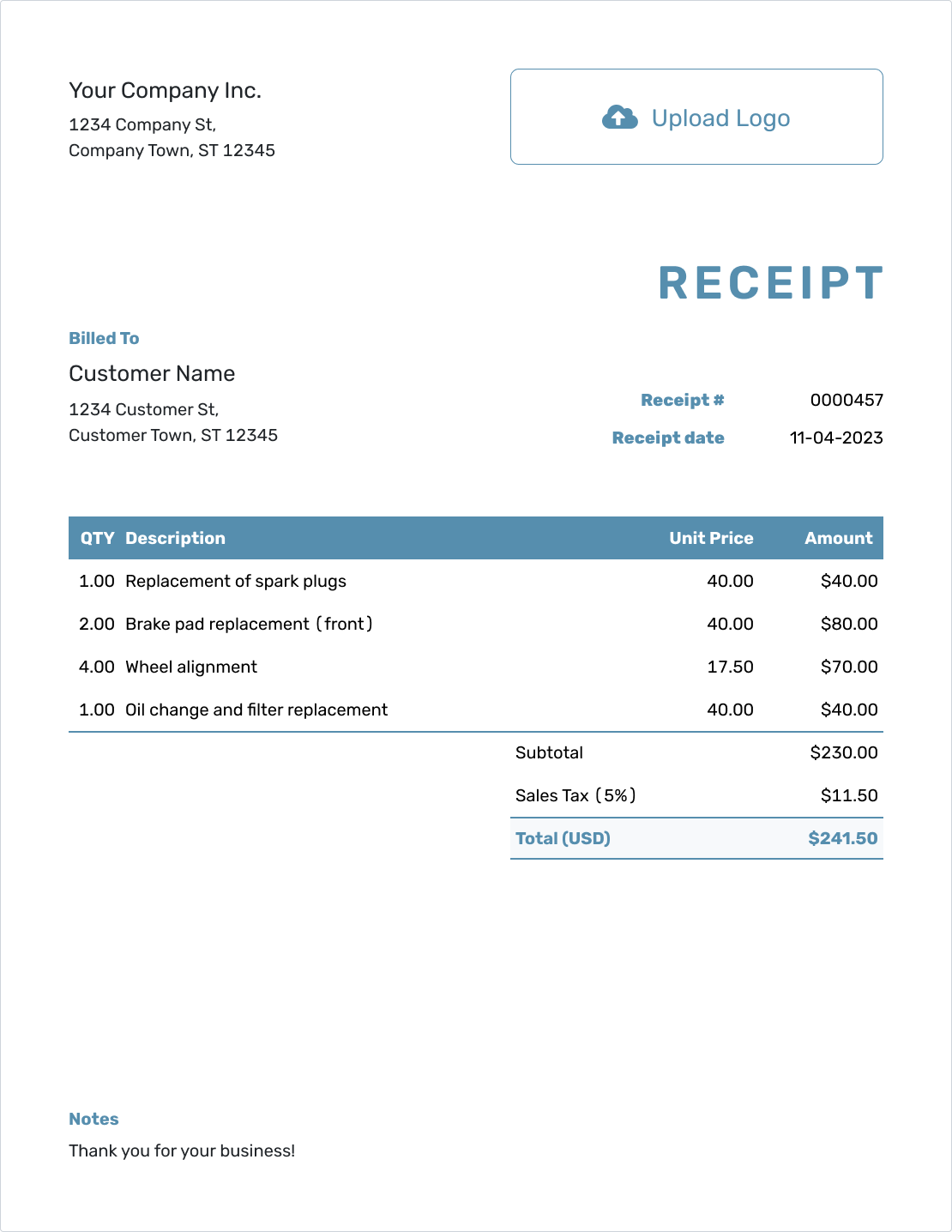

The Docelf Advantage

Docelf makes it easy to track your sales and costs through our professional invoicing tools. With Docelf, you can:

- Keep Costs Transparent: Show detailed cost breakdowns in your invoices and estimates.

- Track Payments: Know when invoices are paid so you can match them against your costs.

- Save Time: Focus on analyzing your numbers, not chasing paperwork.

Ready to get started? Try Docelf today and take control of your business finances!