Understanding

Fixed vs. Variable Costs

Est. reading time: 6 min

When you run a business, it's important to know where your money is going. Two key types of expenses you'll often hear about are fixed costs and variable costs. But what do these really mean? Simply put, fixed costs are expenses that stay the same no matter what, like rent. Variable costs, on the other hand, change depending on how much you sell or produce, like raw materials.

What Are Fixed and Variable Costs?

Fixed Costs

Fixed costs are expenses that do not change, no matter how much your business is producing or selling. These costs are the same each month or year, making them predictable and easy to budget for. Think of things like your office rent, insurance, and salaries for staff who earn the same amount each month. Whether you sell one product or a thousand, your fixed costs remain unchanged.

Examples of Fixed Costs:

- Office Rent

- Insurance Premiums

- Monthly Salaries

Variable Costs

Variable costs are expenses that change depending on how much you produce or sell. When your sales go up, these costs usually go up too. If your sales go down, your variable costs drop as well. An example would be the cost of raw materials. If you run a bakery, the more cakes you make, the more flour and sugar you need—making these costs variable.

Examples of Variable Costs:

- Raw Materials

- Packaging Costs

- Commissions for Sales Staff

Key Differences

| Aspect | Fixed Costs | Variable Costs |

|---|---|---|

| Definition | Costs that do not change regardless of production level. | Costs that vary depending on production or sales volume. |

| Examples | Rent, insurance, fixed salaries. | Raw materials, packaging, commissions. |

| Impact on Business | Helps in budgeting due to predictability. | Can be flexible, changing as your business grows or shrinks. |

Why It Matters for Your Business

Understanding the difference between fixed and variable costs can help you plan better for your business. Fixed costs are important because they are predictable. You know you will have to pay them each month, no matter what. This makes it easier to plan your budget and understand your break-even point, which is the point where your total sales cover all your costs.

Variable costs, on the other hand, give you some flexibility. If business is slow, these costs might drop because you are buying fewer materials or selling fewer products. However, if you are doing well, variable costs will go up, but they also mean you are generating more income. Keeping a balance between these two types of costs helps your business stay financially healthy and adaptable.

The Docelf Advantage

Docelf makes managing your business finances easier by providing simple tools for creating and tracking your financial documents. With Docelf, you can:

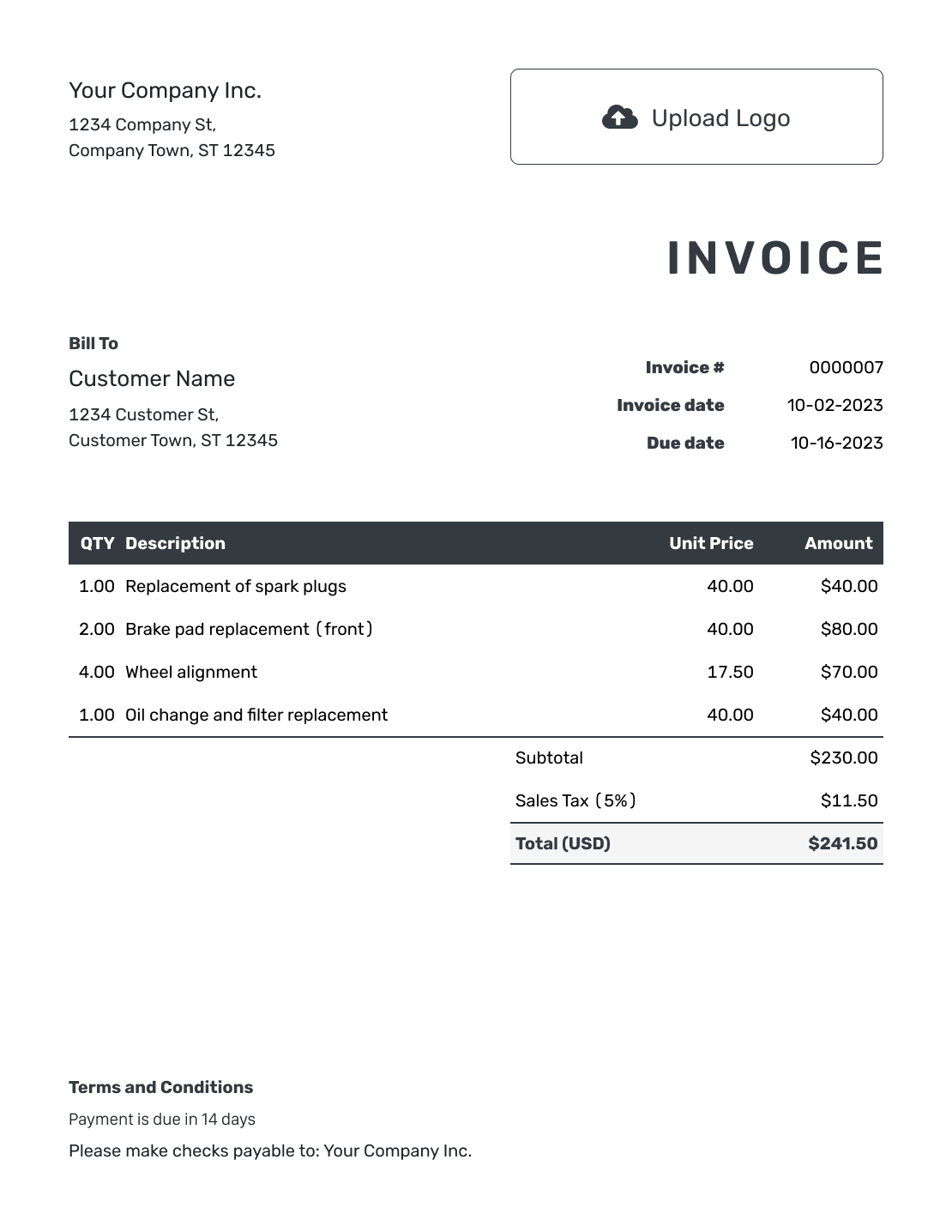

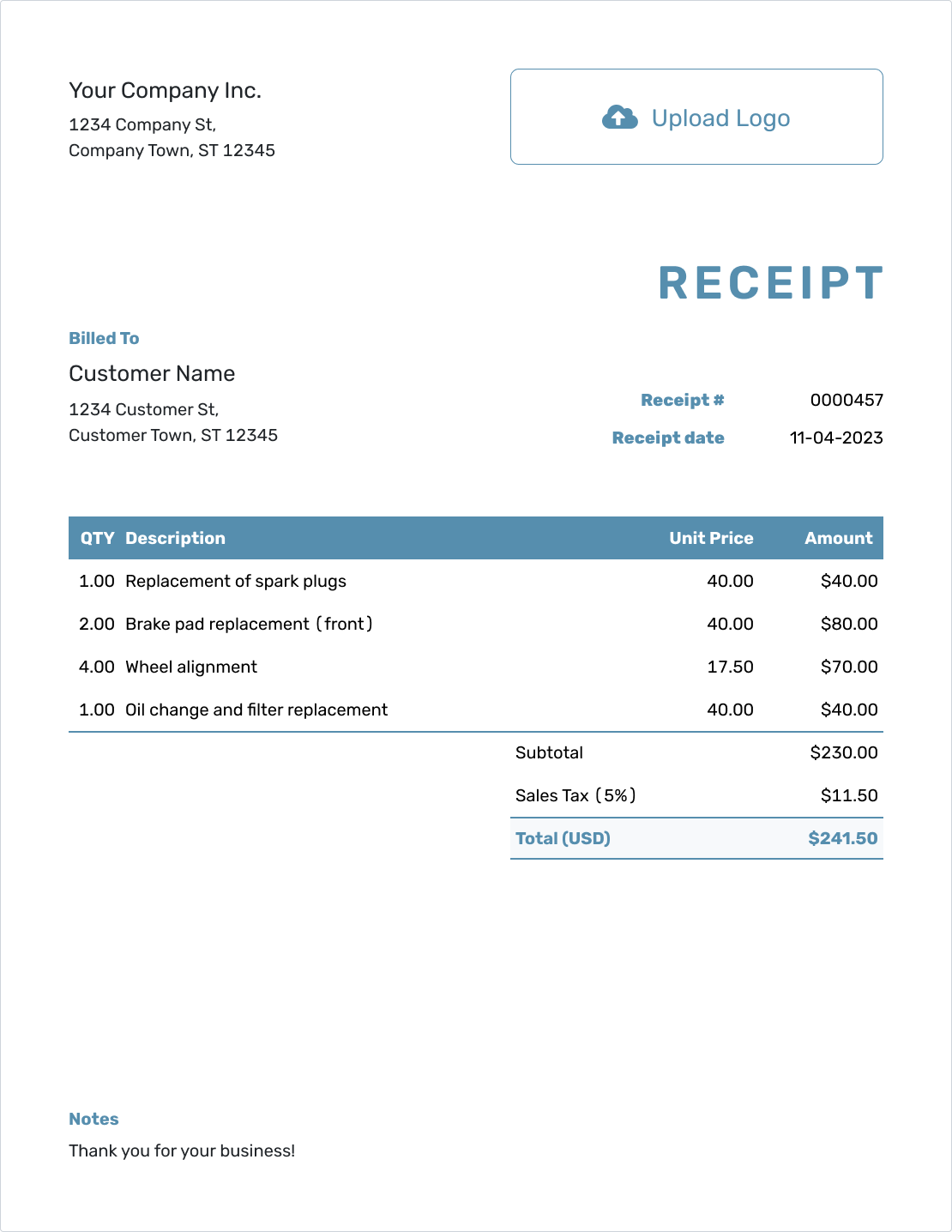

- Create Professional Invoices: Quickly generate invoices that look great and get you paid faster.

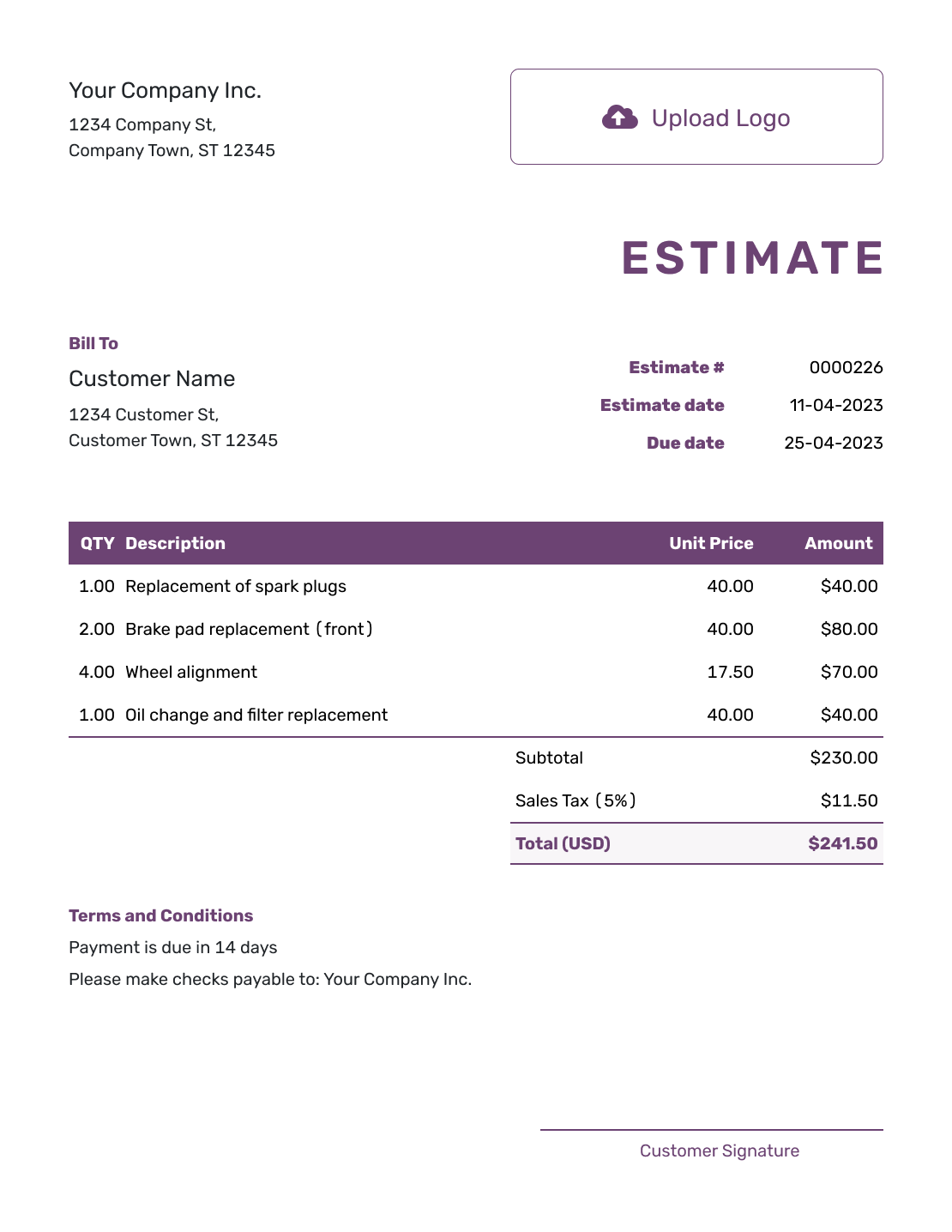

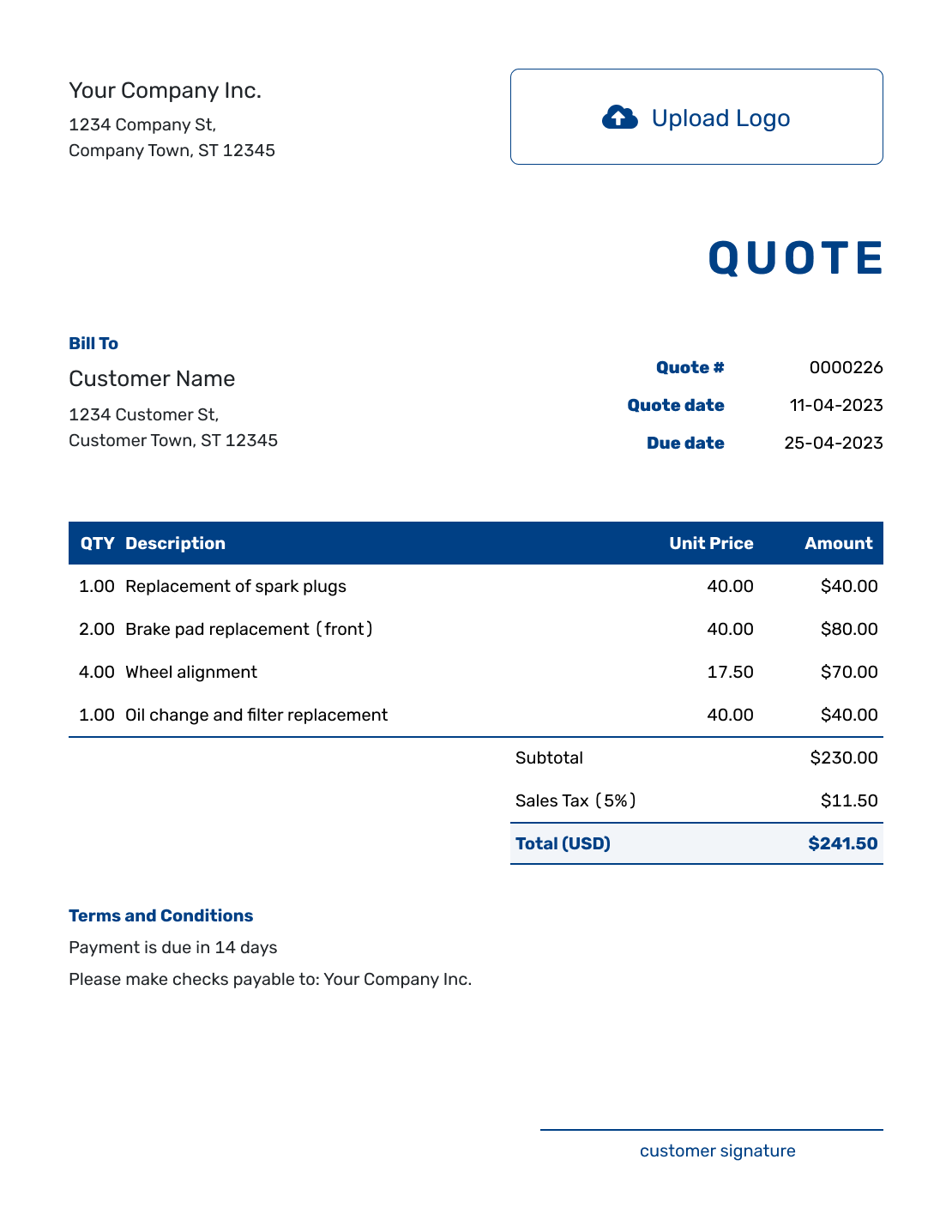

- Prepare Quotes and Estimates: Send clear, detailed quotes to your clients to secure new business.

- Stay Organized: Keep track of your invoices, quotes, and estimates all in one place to better manage your fixed and variable costs.

Ready to streamline your business finances? Try Docelf today and see how easy it is to manage costs and keep your business growing.