Understanding

Profit Margin

Est. reading time: 7 min

Profit margin might sound like a technical term, but it’s really just a way to measure how much money your business makes after covering costs. Think of it as the piece of the pie you get to keep after paying for everything else. It’s a key number for understanding your business’s financial health.

What Is Profit Margin?

Profit margin shows the percentage of revenue your business keeps as profit. In other words, it tells you how much money is left over after subtracting all your expenses from your total income.

For example, if your business earns $1,000 from sales and your expenses are $700, your profit is $300. The profit margin tells you what portion of that $1,000 is profit.

How to Calculate Profit Margin

Calculating profit margin is simple. Here’s the formula:

| Profit Margin = | (Revenue - Expenses) |

| Revenue |

Multiply the result by 100 to get a percentage. For example:

If your revenue is $1,000 and your expenses are $700, your profit margin would be:

| Step 1: | ($1,000 - $700) ÷ $1,000 = 0.3 |

| Step 2: | 0.3 × 100 = 30% |

Your profit margin is 30%.

Why Profit Margin Matters

Knowing your profit margin is essential for understanding your business’s financial health. Here’s why:

- It helps you price better: If your profit margin is too low, you might need to adjust your prices or reduce costs.

- It shows efficiency: A higher profit margin means you’re keeping more of each dollar earned.

- It’s a key metric for growth: Tracking your margin over time helps you spot trends and plan for the future.

For small businesses, profit margin is especially important because it shows whether your efforts are paying off.

The Docelf Advantage

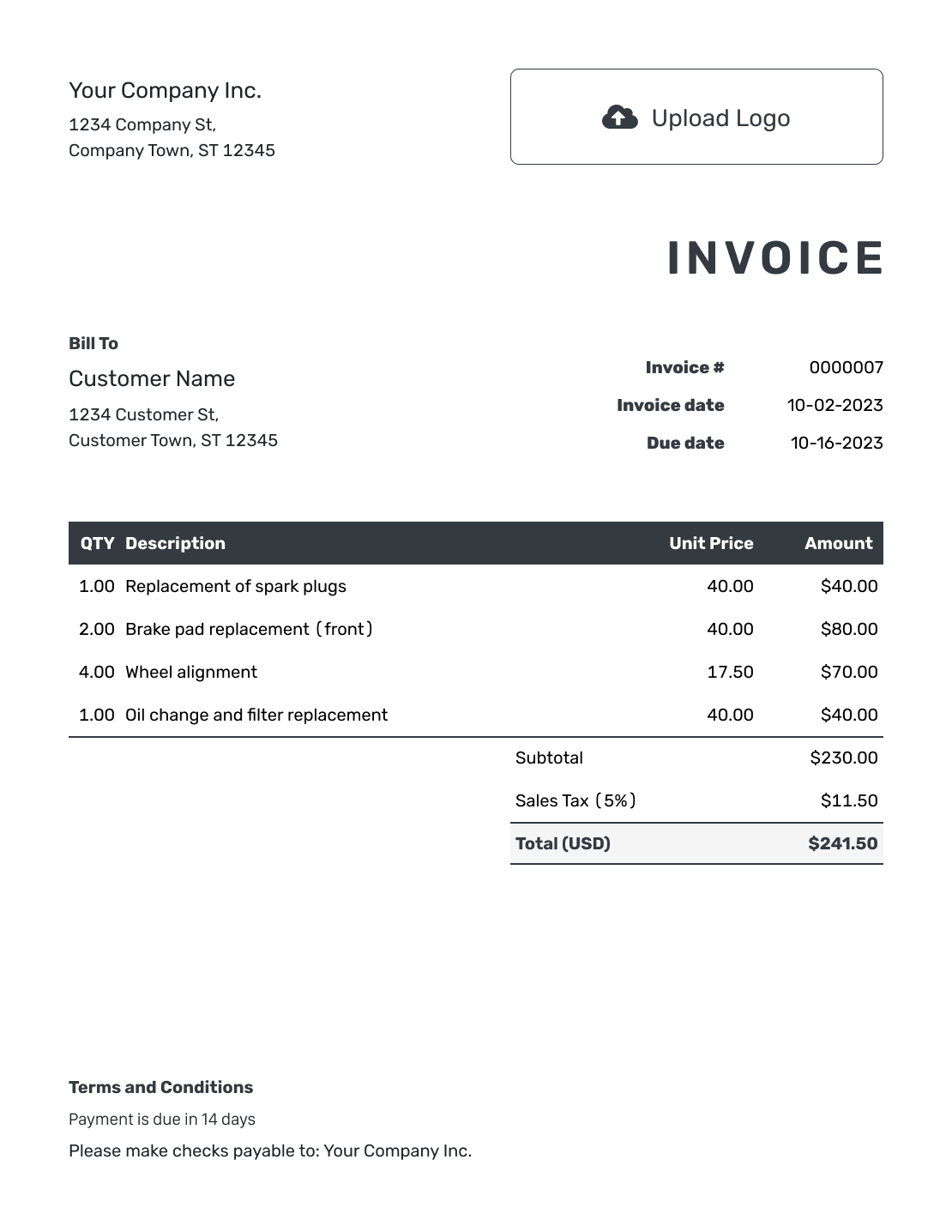

Tracking your profit margin starts with keeping clear records of your income and expenses. Docelf makes this easy with tools for invoicing, quotes, and estimates. Here’s how we can help:

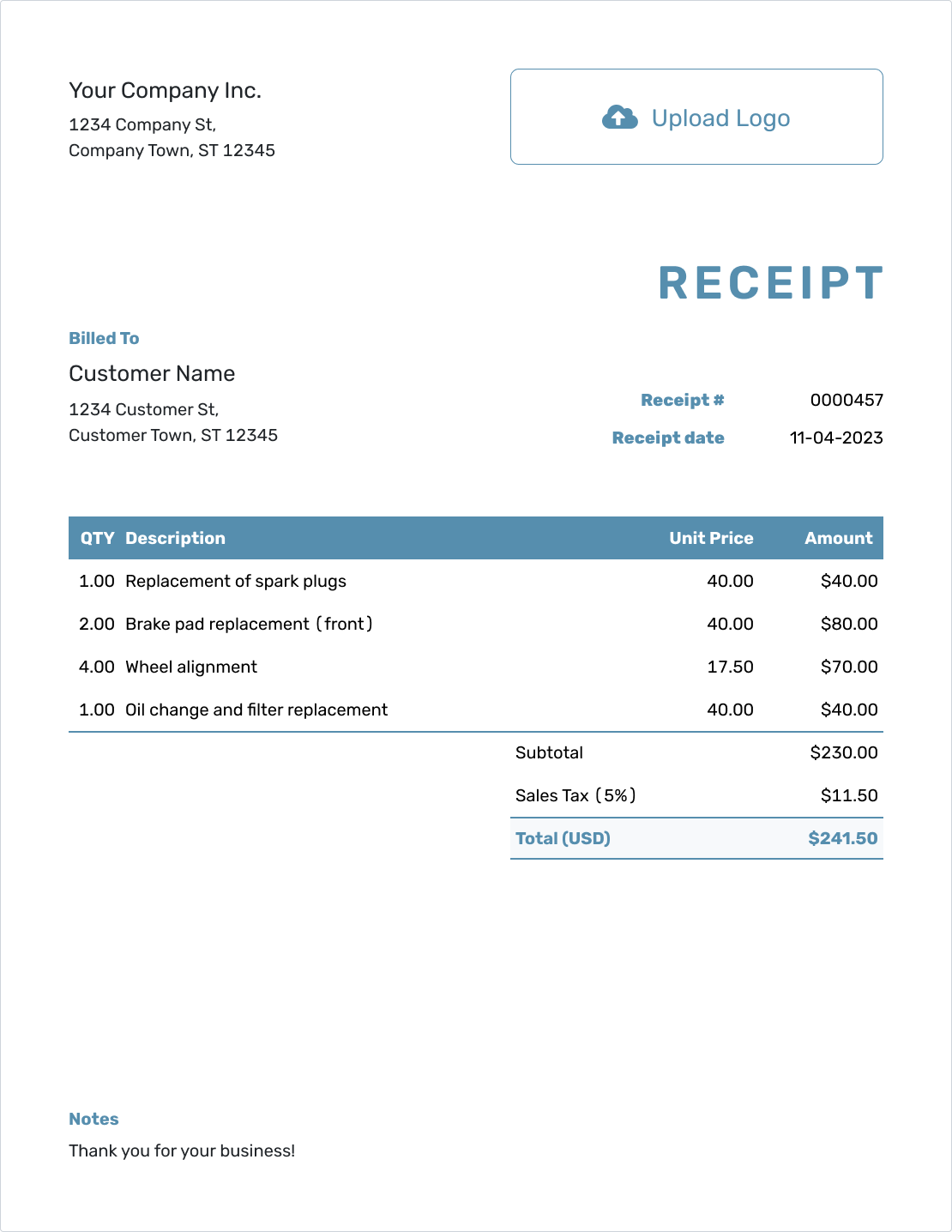

- Clear invoicing: Create professional invoices that reflect your brand and help you get paid faster.

- Track income: Organize your payments to see how much your business is earning over time.

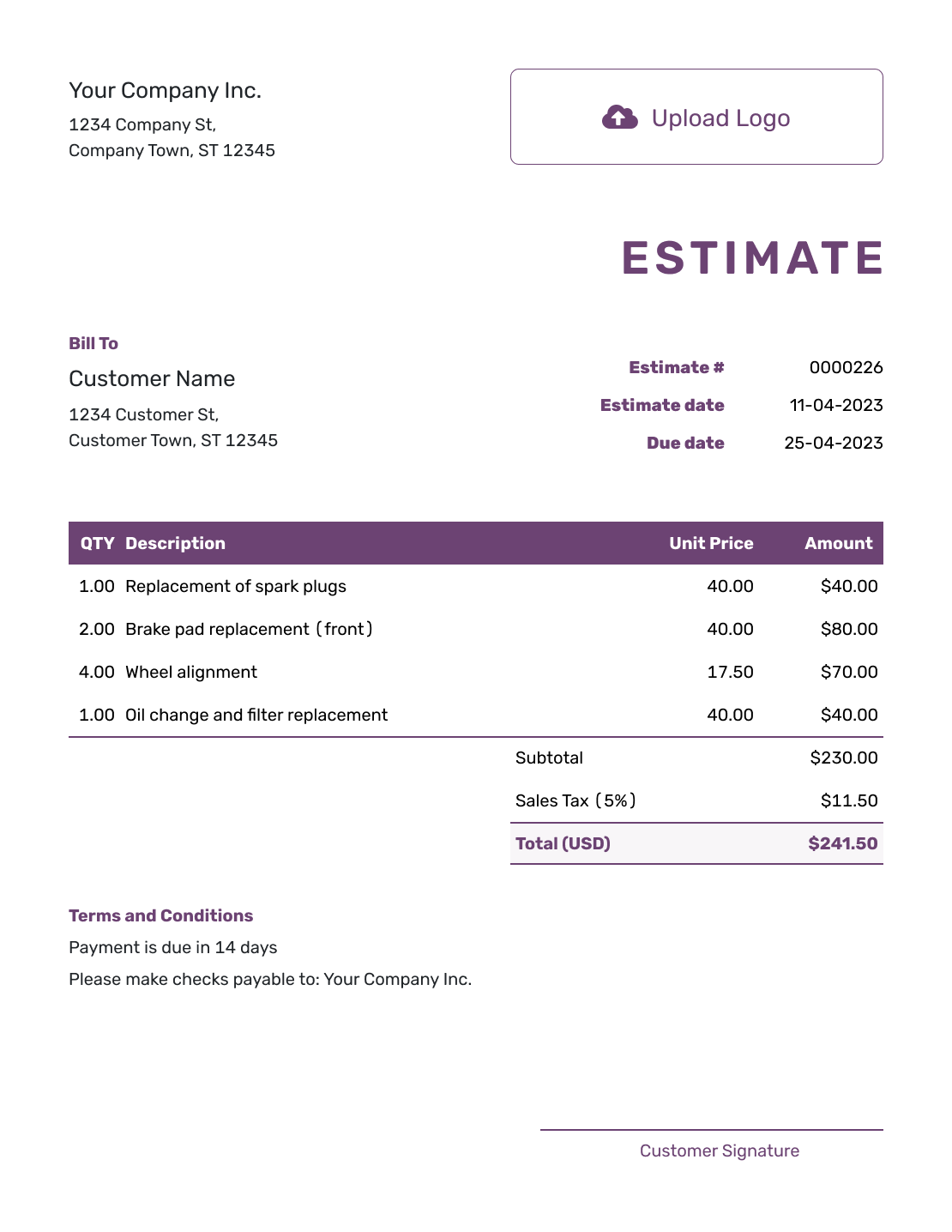

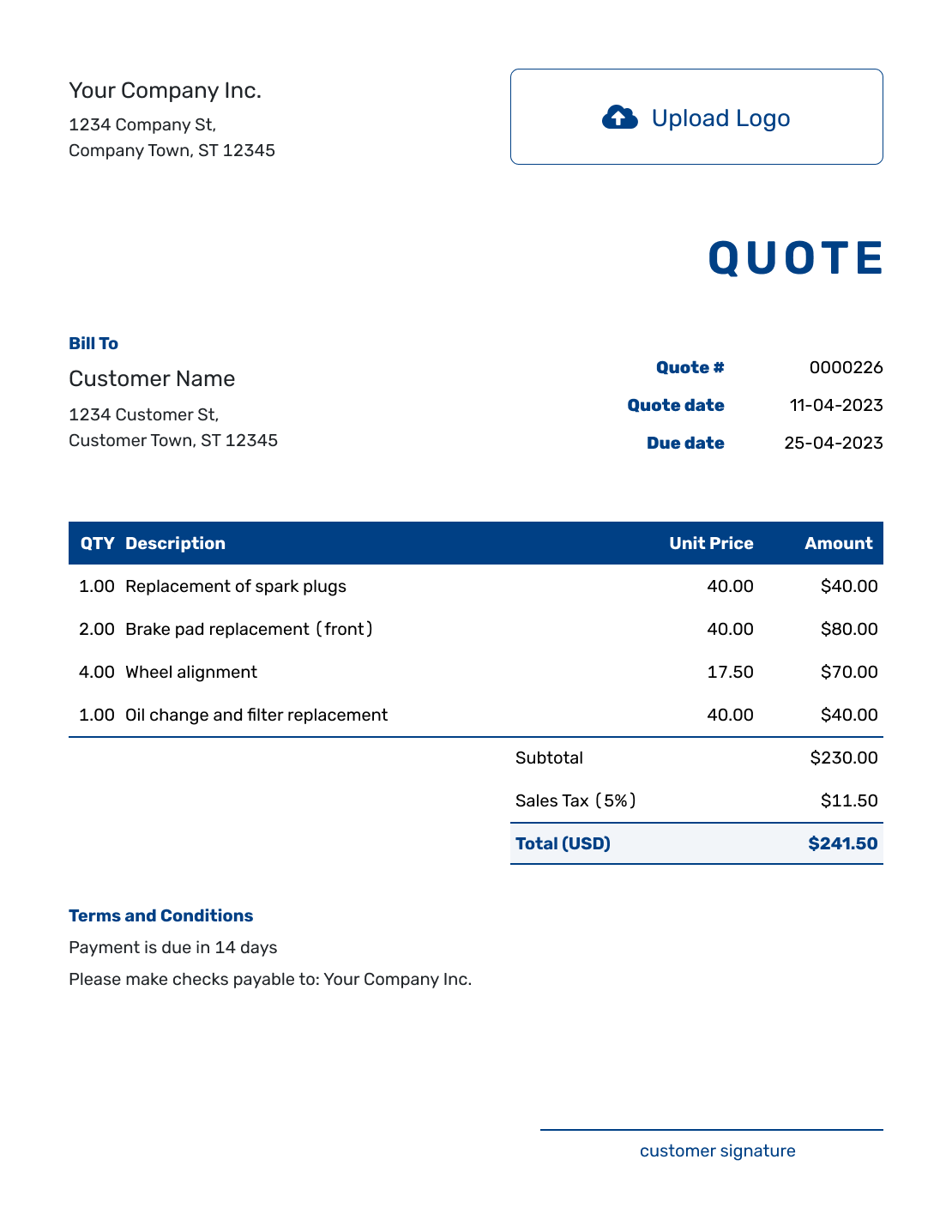

- Plan for success: Use estimates and quotes to set clear expectations with clients, ensuring your projects stay profitable.

Ready to simplify your business finances? Try Docelf today and take the stress out of managing your income and expenses.