Understanding

Revenue Recognition

Est. reading time: 6 min

Revenue recognition might sound complicated, but it's really about one thing: when your business gets to count money earned as revenue. It ensures your income is recorded at the right time, making your financial records accurate and clear. Whether you’re selling products, providing services, or a mix of both, understanding this concept helps you stay on top of your finances.

Understanding Revenue Recognition

Imagine you run a bakery. If a customer orders a wedding cake for next month and pays in advance, you don’t count that money as revenue until you deliver the cake. That’s the essence of revenue recognition—it matches income to the work completed.

Why Revenue Recognition Matters

Accurate revenue recognition helps you:

- Understand your financial health: Know what money you’ve actually earned, not just what’s been paid.

- Build trust with investors and lenders: Clear financial records show your business is reliable.

- Comply with financial rules: In the US, guidelines like Generally Accepted Accounting Principles (GAAP) outline when to record revenue.

When Revenue Is Recognized

There are two main methods to recognize revenue:

-

At the time of delivery (or completion): This is the most common method. You record revenue when the product or service is delivered.

- For example, a plumber fixes a customer’s sink on Monday. The invoice is sent the same day, so revenue is recorded immediately.

-

Over time: For ongoing projects, you record revenue as work is completed.

- Think of a contractor building a custom home. If half the work is done, they may record 50% of the revenue for the project.

The Five Steps of Revenue Recognition

The Financial Accounting Standards Board (FASB) provides a five-step process to guide businesses:

- Identify the contract: A contract is any agreement between your business and a customer.

- Identify performance obligations: These are the services or products you’ve promised to provide.

- Determine the transaction price: This is how much the customer will pay.

- Allocate the price to obligations: If you’re providing multiple items, like a bundle deal, divide the price across those items.

- Recognize revenue: Count the revenue when (or as) you fulfill the obligation.

The Docelf Advantage

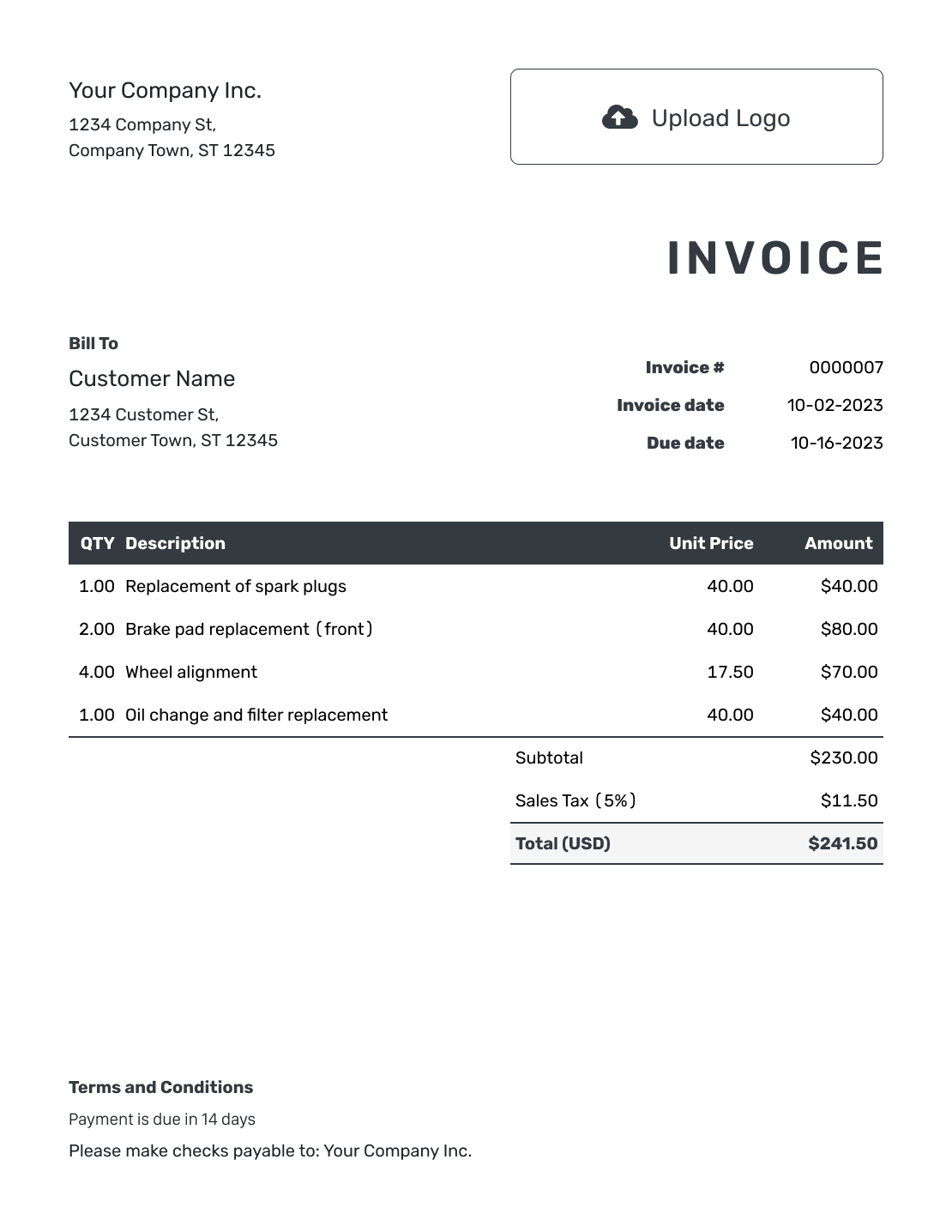

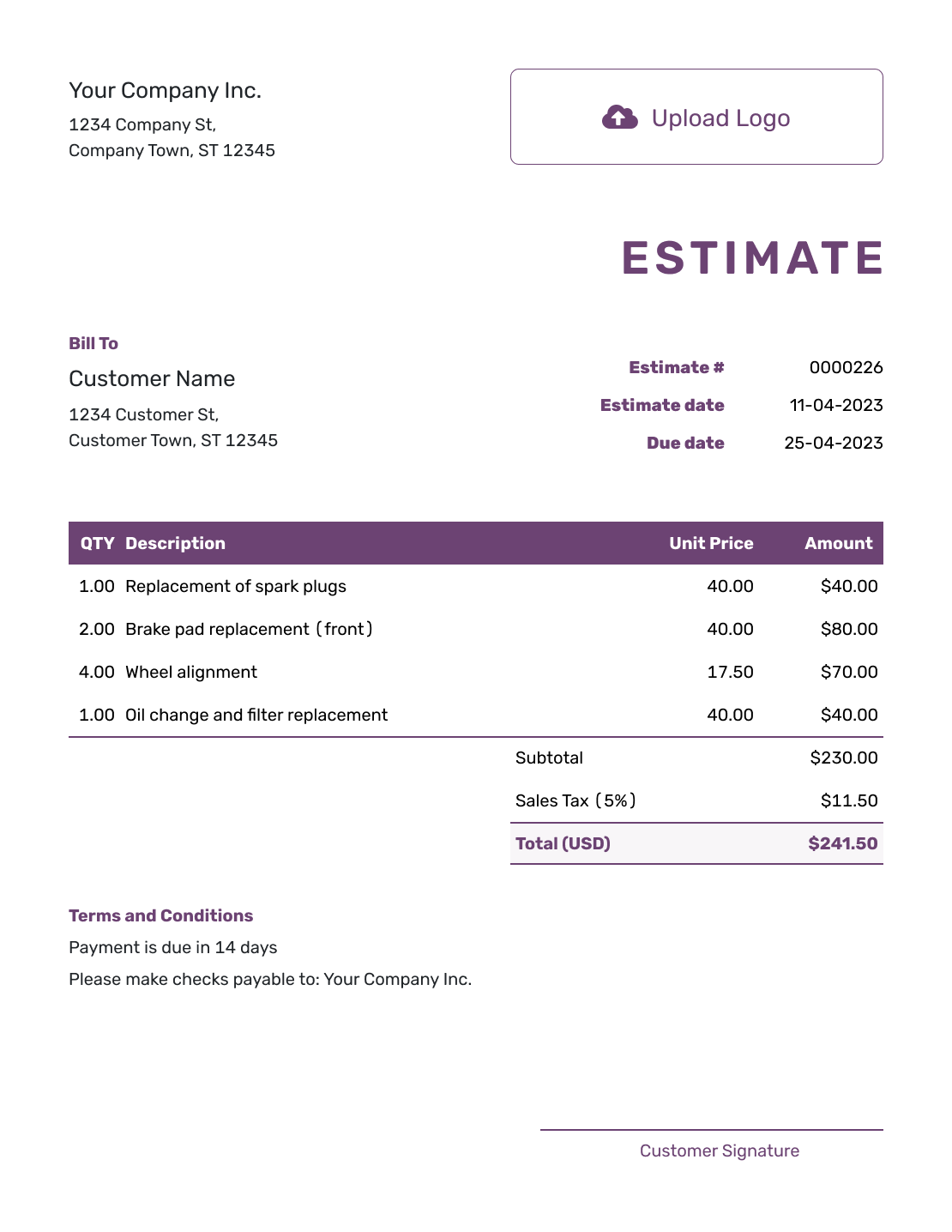

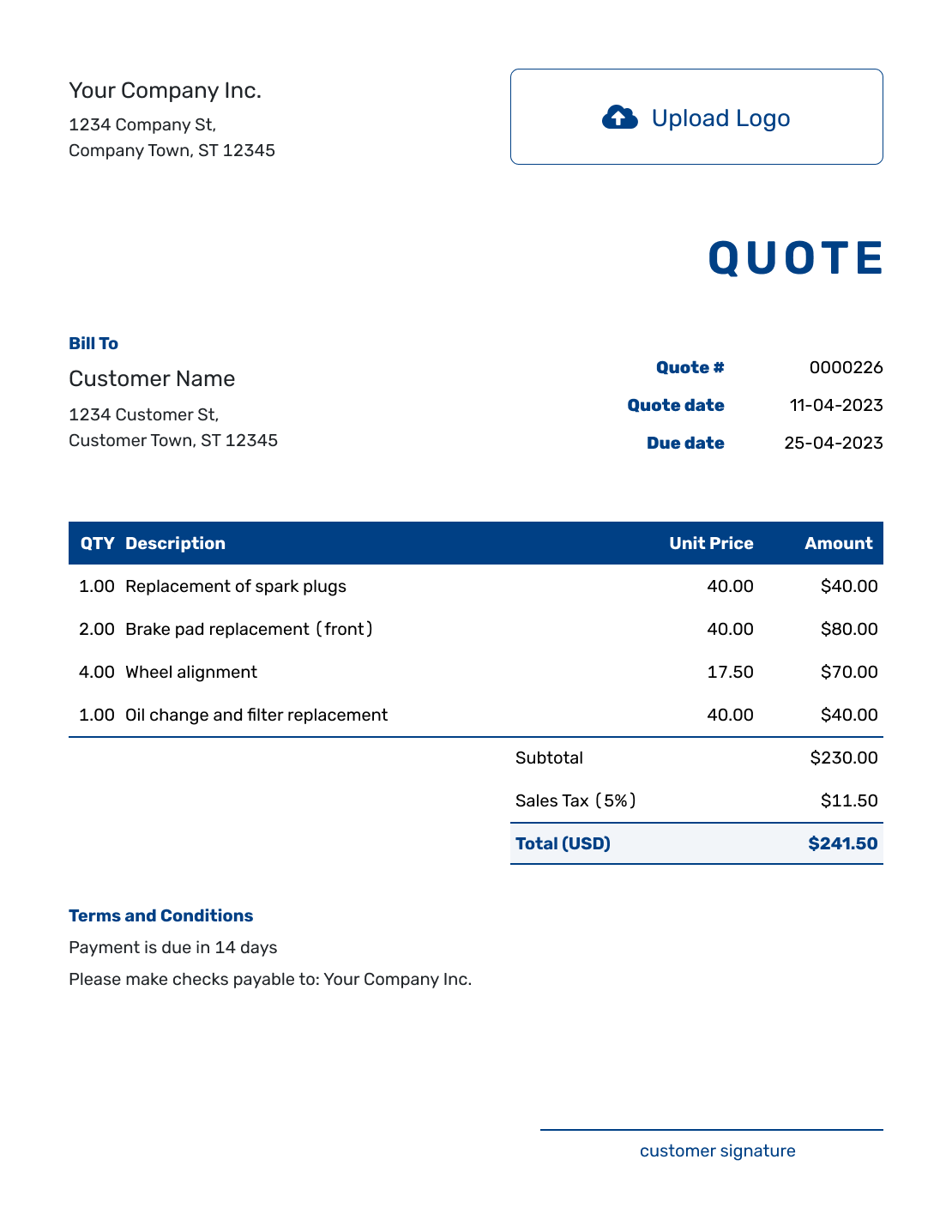

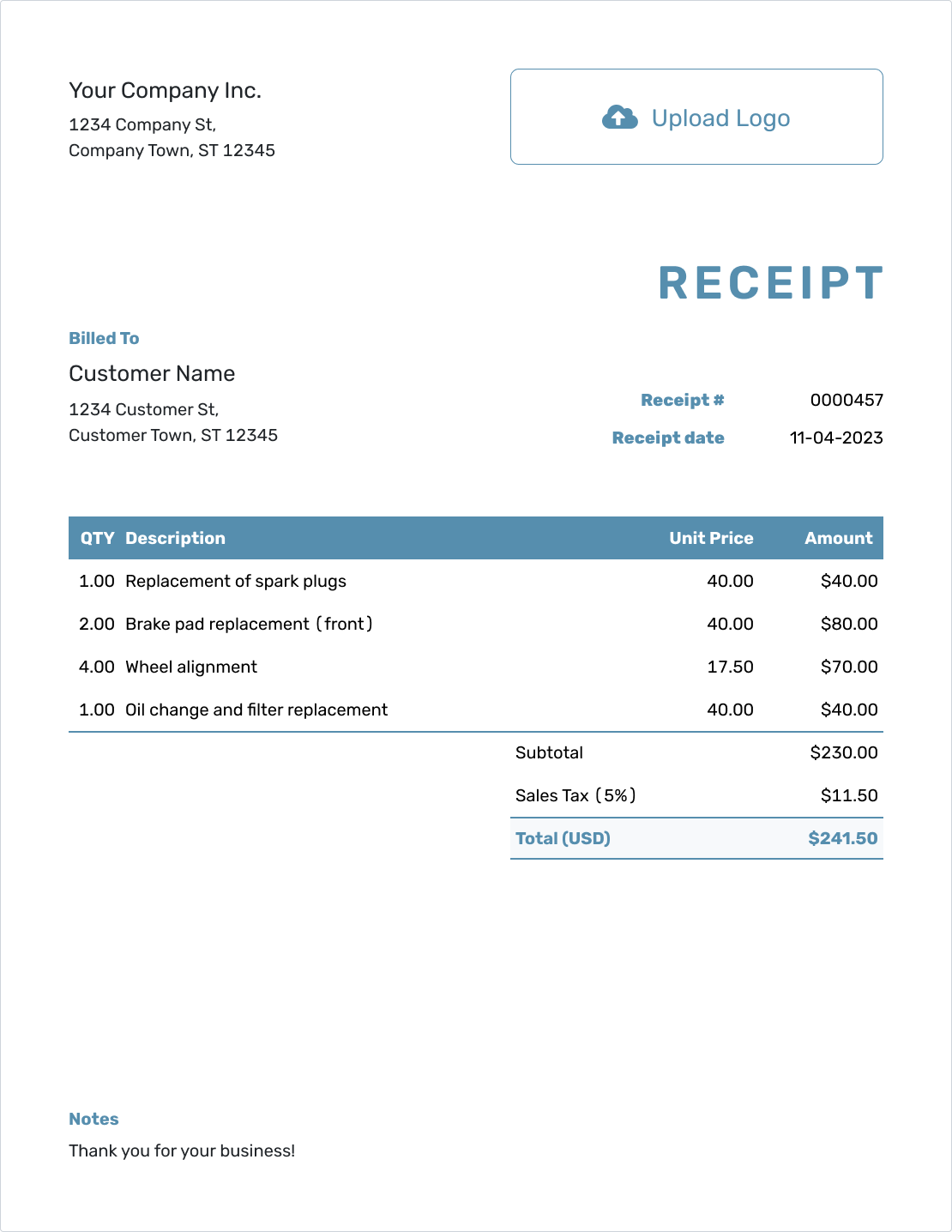

Docelf makes invoicing for recognized revenue easy:

- Customize invoices: Highlight details of the transaction, ensuring customers see what they’re paying for.

- Track payments: Know when a customer has paid, so you can match revenue to the right moment.

- Stay organized: Store all quotes, estimates, and invoices in one place for easy access.

Ready to simplify your revenue process? Try Docelf for free today!