Understanding

Working Capital

Est. reading time: 6 min

Working capital might sound like a complicated finance term, but it’s really just a simple way to describe the money your business has on hand to keep running day-to-day. It’s the difference between what your business owns (like cash and unpaid customer invoices) and what it owes (like bills and loans due soon).

What Is Working Capital?

Working capital is the money your business uses to pay for its short-term needs, like buying supplies or paying employees. It’s a quick snapshot of your company’s financial health.

The formula for working capital is straightforward:

| Working Capital = | Current Assets − Current Liabilities |

Why Does Working Capital Matter?

Working capital is important because it helps you manage your cash flow and avoid financial stress. Here’s why it matters:

- Keeps Operations Running: It ensures you have enough money to pay for everyday expenses.

- Builds Financial Stability: A positive working capital means your business can handle unexpected costs or slow periods.

- Shows Business Health: Lenders and investors often look at working capital to assess your business’s financial health.

How to Calculate Working Capital

Calculating working capital is easy. Start with your current assets—things your business owns that can be turned into cash within a year, like cash, accounts receivable, and inventory. Then subtract your current liabilities—bills and other payments due within a year.

Here’s an example:

| Current Assets = | $50,000 |

| Current Liabilities = | $30,000 |

| Working Capital = | $50,000 − $30,000 = $20,000 |

In this example, the business has $20,000 in working capital. That means it has enough funds to cover short-term bills and some extra cushion for surprises.

The Docelf Advantage

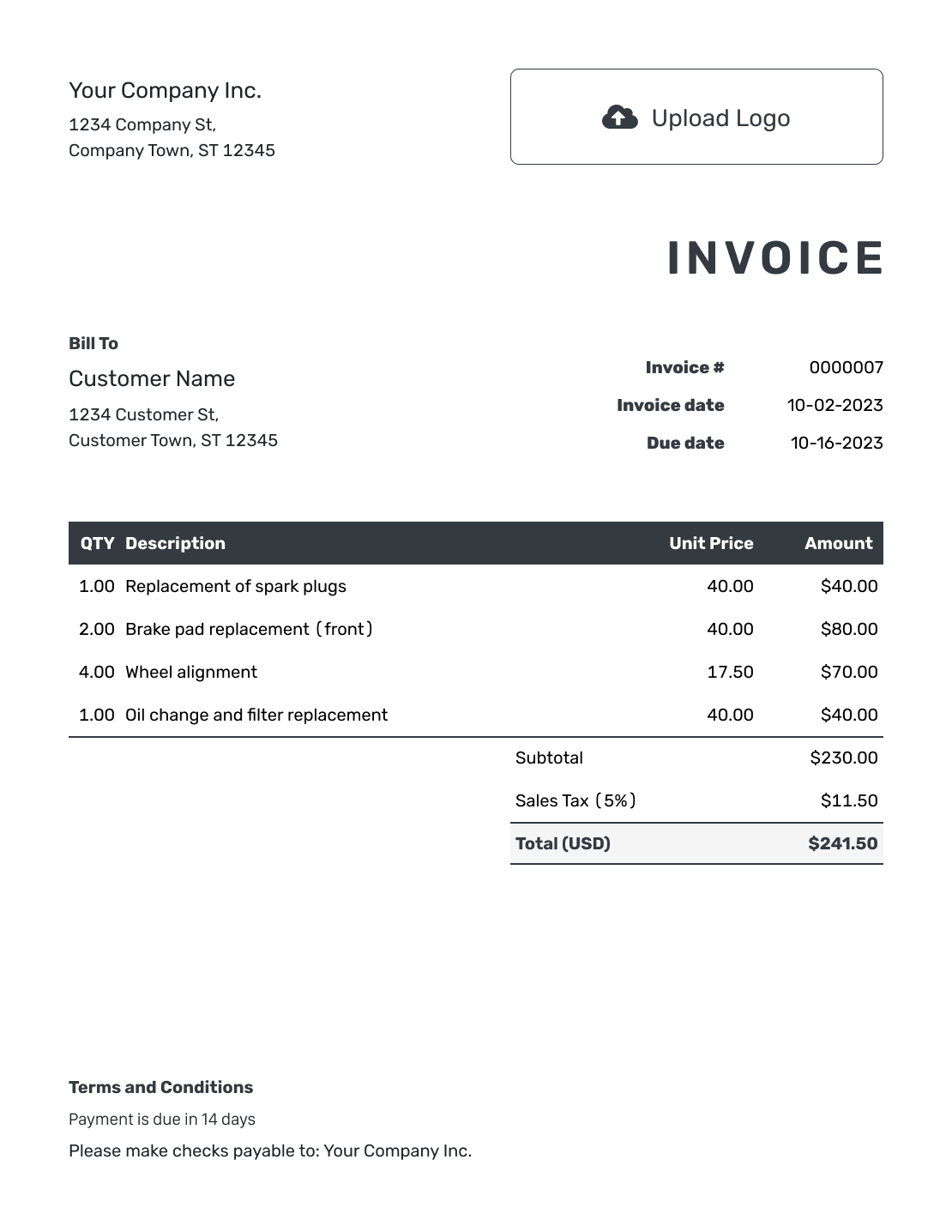

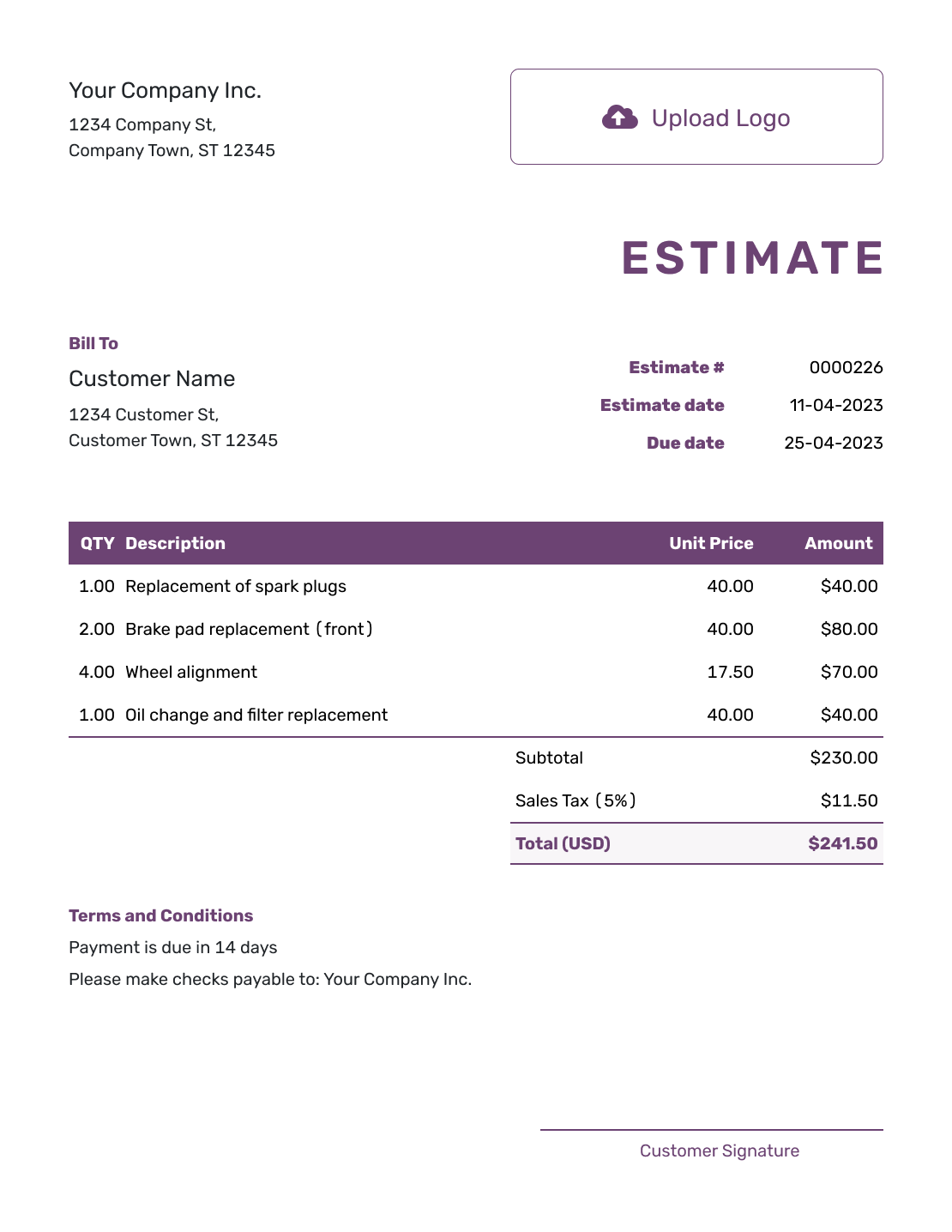

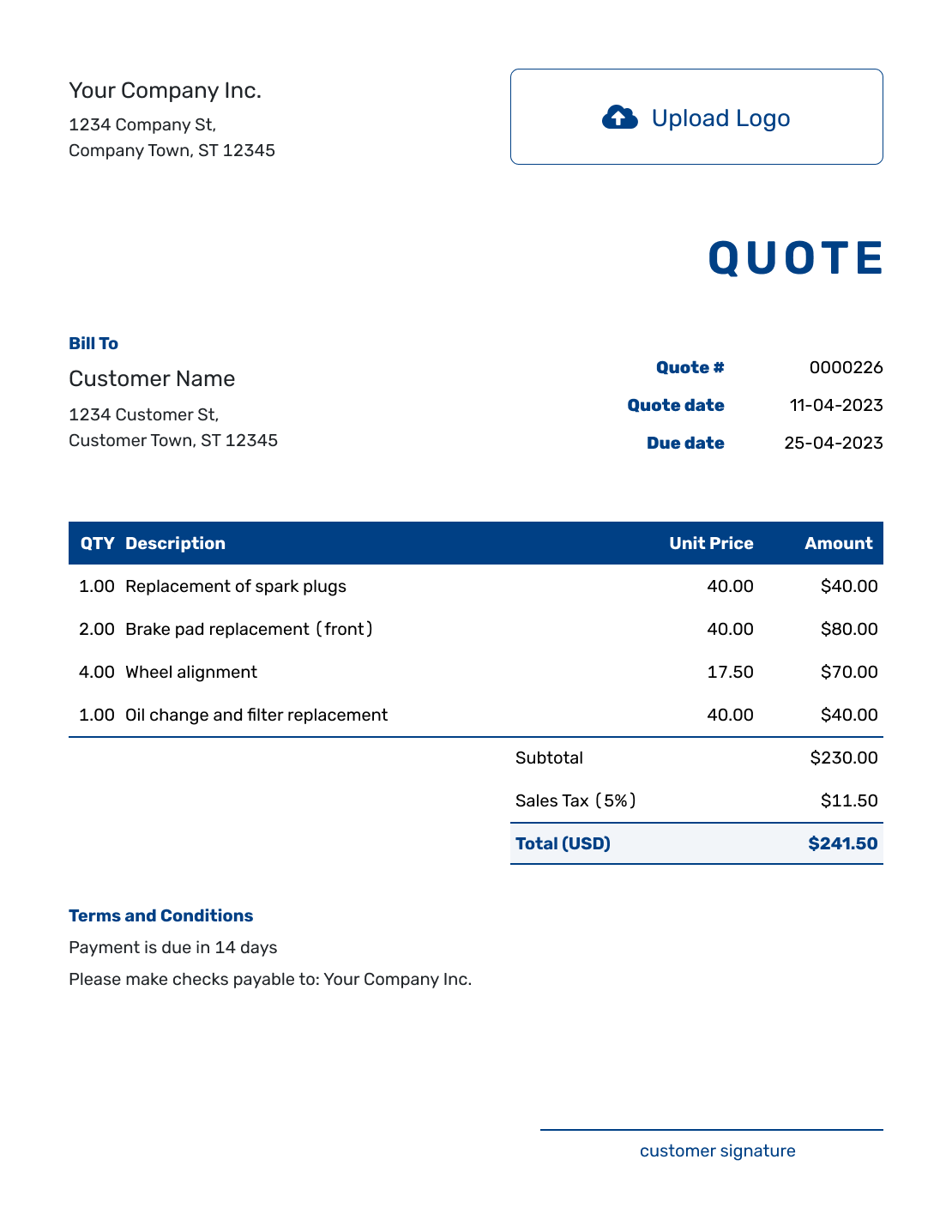

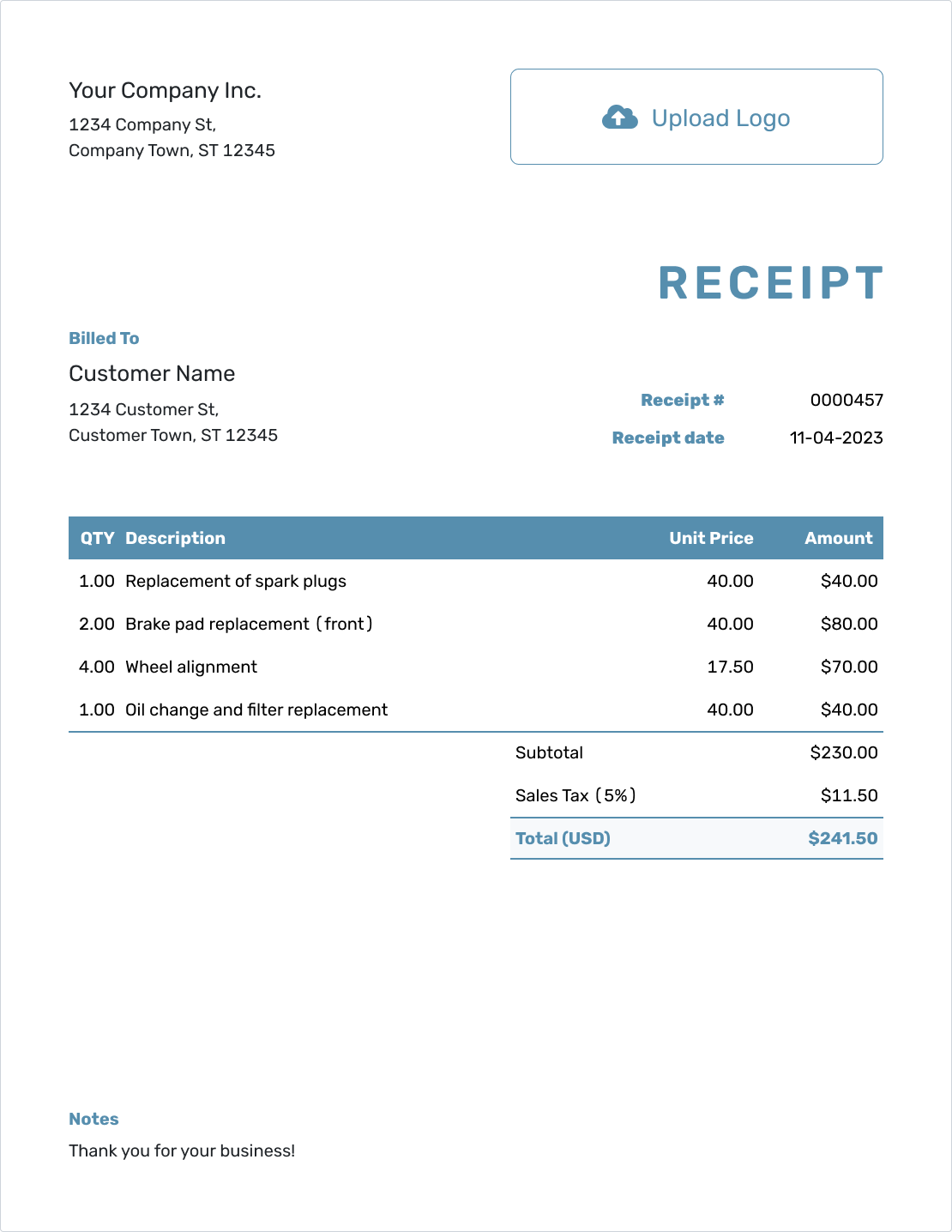

Managing your finances is easier when you stay organized. Docelf helps small businesses like yours streamline invoicing, estimates, and quotes. Here’s how we can help:

- Customize Your Documents: Tailor invoices and estimates with your branding for a professional touch.

- Track Payments: Stay on top of what’s owed and see when invoices are opened or paid.

- Save Time: Keep everything in one place, making it easier to stay organized.

Ready to make managing your business finances simpler? Try Docelf for free today!