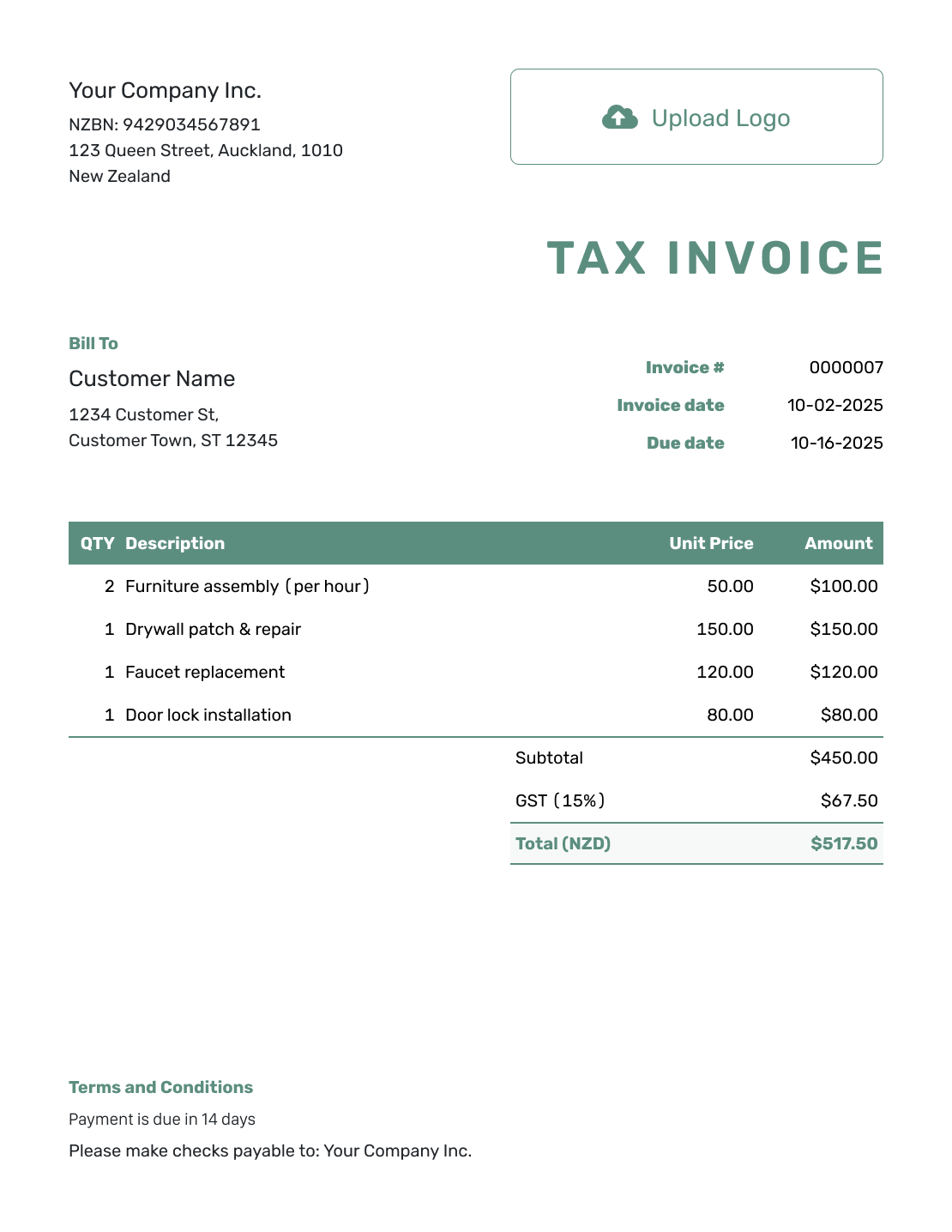

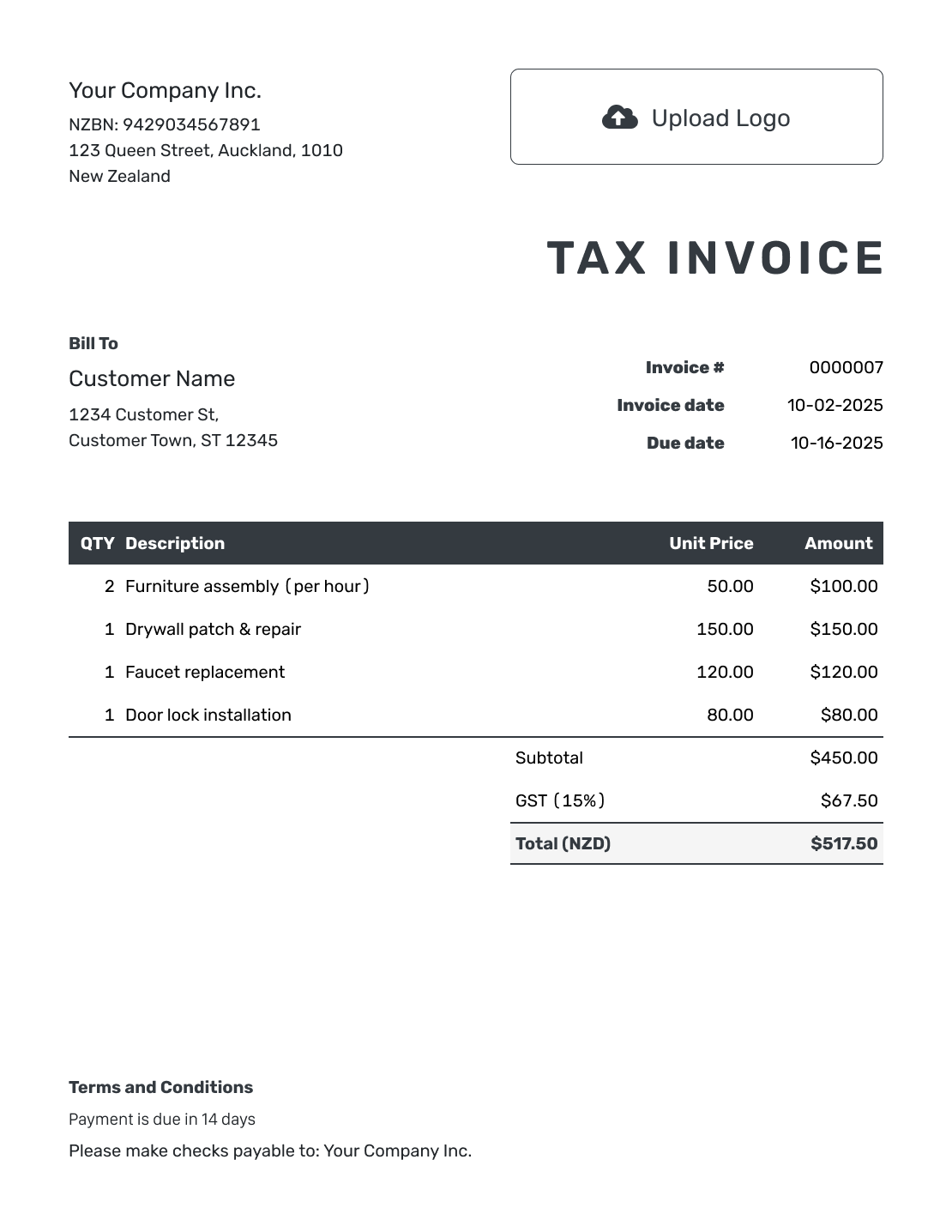

Free New Zealand Invoice Template

Whether you run a small business, work as a freelancer, or provide trade services, invoicing in New Zealand must be straightforward and compliant with tax regulations. A New Zealand Invoice Template helps you bill your customers efficiently while ensuring your invoices meet Inland Revenue Department (IRD) requirements.

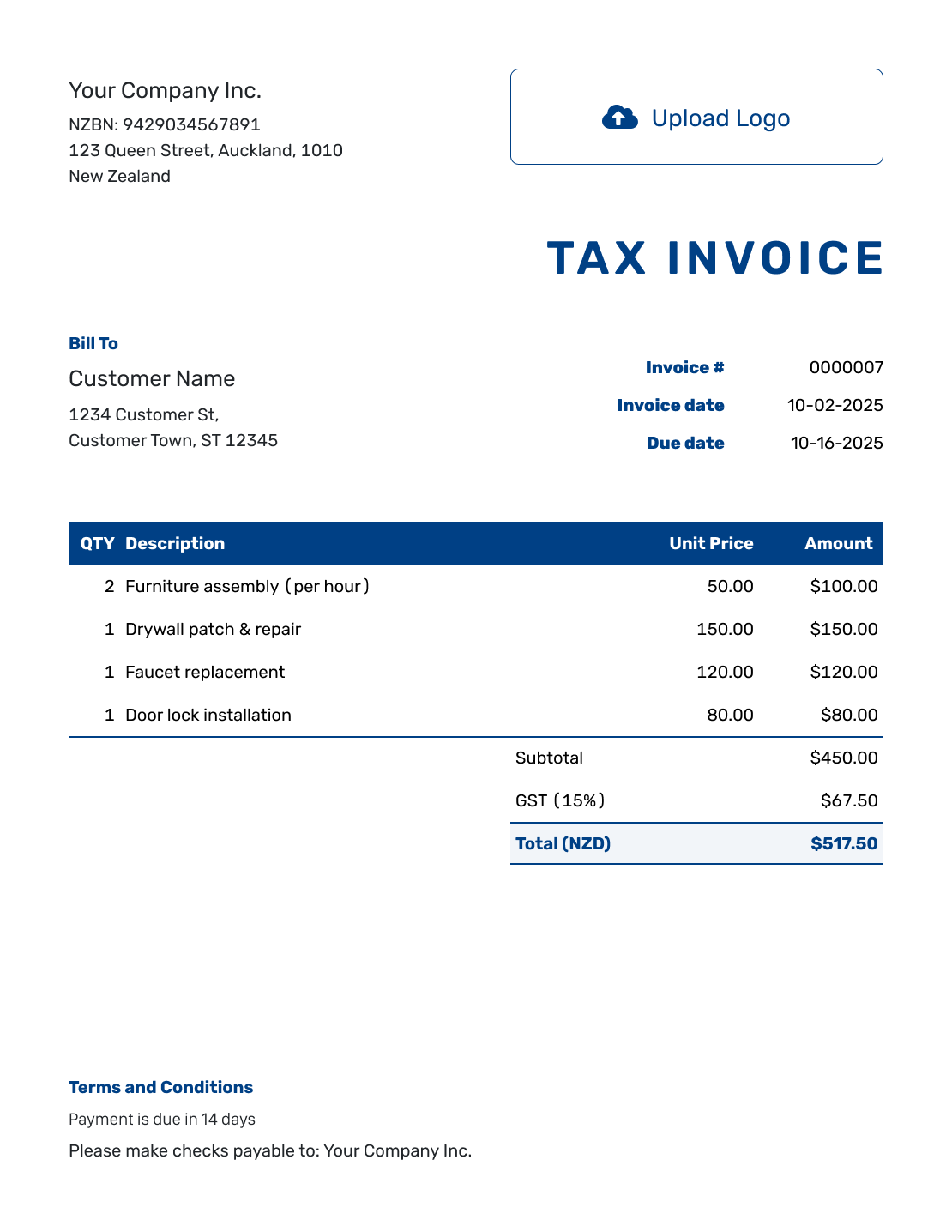

If your business has a New Zealand Business Number (NZBN), you can add it to your invoice in the company address field. If you are registered for Goods and Services Tax (GST), you may need to issue a tax invoice instead of a regular invoice. With Docelf, you can change the invoice title to "Tax Invoice" in the add-ons section, found in the side menu (bottom on mobile).

- PDF, Email or Print

- Convert to a Receipt

- See when your invoice has been opened

- Keep track of due dates and payments

New Zealand Invoice Templates by Docelf

Docelf’s New Zealand Invoice Templates are designed for businesses of all sizes, whether you charge hourly, per project, or sell goods. These templates include the necessary details such as NZBN, GST breakdown (if applicable), and clear payment terms. You can easily customize them to match your branding.

Other Invoice Template File Formats

Looking for an invoice template that fits your workflow? We offer options in Word, Google Docs, Excel, and Google Sheets to suit your needs.

Need a polished and professional layout? A Microsoft Word invoice template keeps formatting easy and flexible. If you prefer automated calculations and team collaboration, an Excel or Google Sheets invoice template is a great choice. For simple, cloud-based editing, a Google Docs invoice template ensures quick and accessible invoicing.

No matter your industry, these templates help you create invoices that are professional, clear, and easy to use.

- Word Invoice Template

- Google Docs Invoice Template

- Excel Invoice Template

- Google Sheets Invoice Template

- PDF, Email or Print

- Convert to a Receipt

- See when your invoice has been opened

- Keep track of due dates and payments

How to Write a New Zealand Invoice

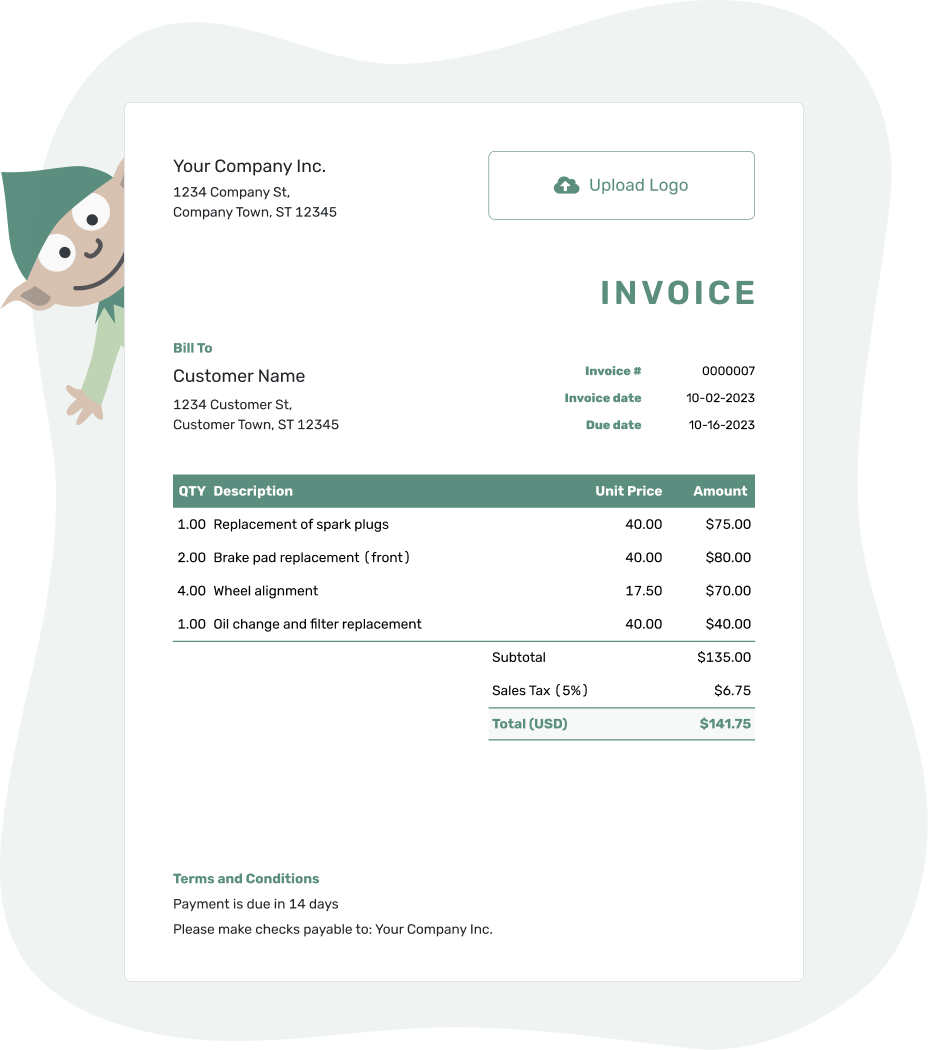

A well-structured invoice ensures you get paid on time while keeping records clear for tax purposes. In New Zealand, invoices should include essential details like your business name, NZBN, customer details, a breakdown of goods or services provided, pricing, and payment terms.

If your business is registered for GST, you must include a GST breakdown and label the document as a "Tax Invoice." You can easily change the invoice title to "Tax Invoice" using the add-ons section in the side menu (bottom on mobile). This ensures compliance with New Zealand tax laws.

Creating a professional invoice with Docelf is easy — just follow these 10 steps:

- Add Your Business Details: Enter your company name, address, phone number, and email.

- Upload Your Logo: Add your logo for a polished, branded look.

- Enter Customer Details: Fill in the customer's name, company (if applicable), address, and contact details.

- Assign an Invoice Number and Dates: Choose a unique invoice number, add the invoice date and due date.

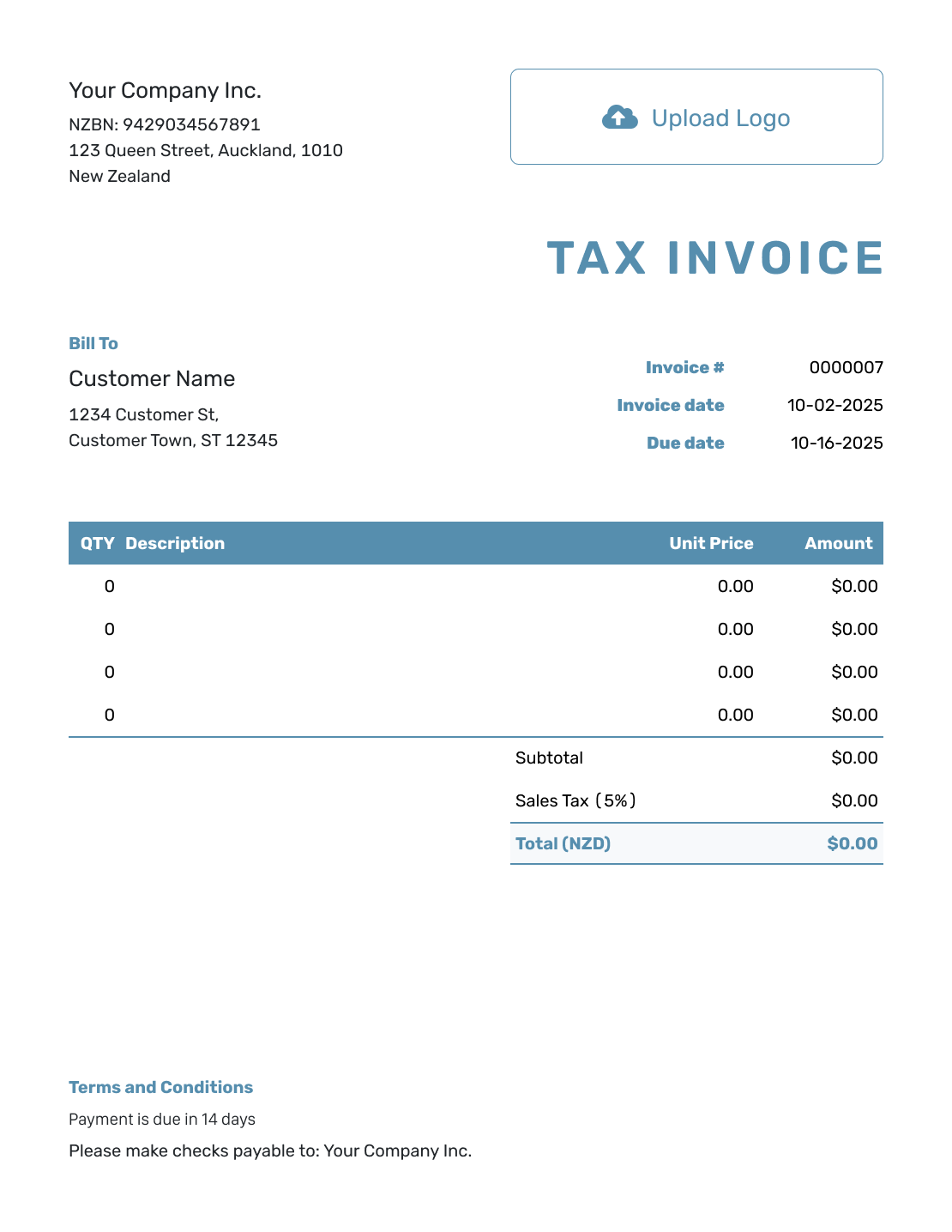

- List Products or Services: Itemize what you provided, including description, quantity, and unit price.

- Include Taxes and Discounts: Add applicable taxes and discounts — Docelf updates the total automatically.

- Check the Total: Review the final amount before sending to ensure accuracy.

- Add Payment Instructions: Specify accepted payment methods, bank details, or any special instructions.

- Set Your Terms and Conditions: Include payment terms (e.g., "Net 30 days"), late fees, or refund policies.

- Send, Download, or Print:

- Email: Send directly from Docelf and track when it’s opened.

- Download: Save a PDF for easy sharing.

- Print: Keep a hard copy if needed.

That’s it! A professional invoice in minutes — clear, simple, and hassle-free.

- PDF, Email or Print

- Convert to a Receipt

- See when your invoice has been opened

- Keep track of due dates and payments

Customize the New Zealand Invoice

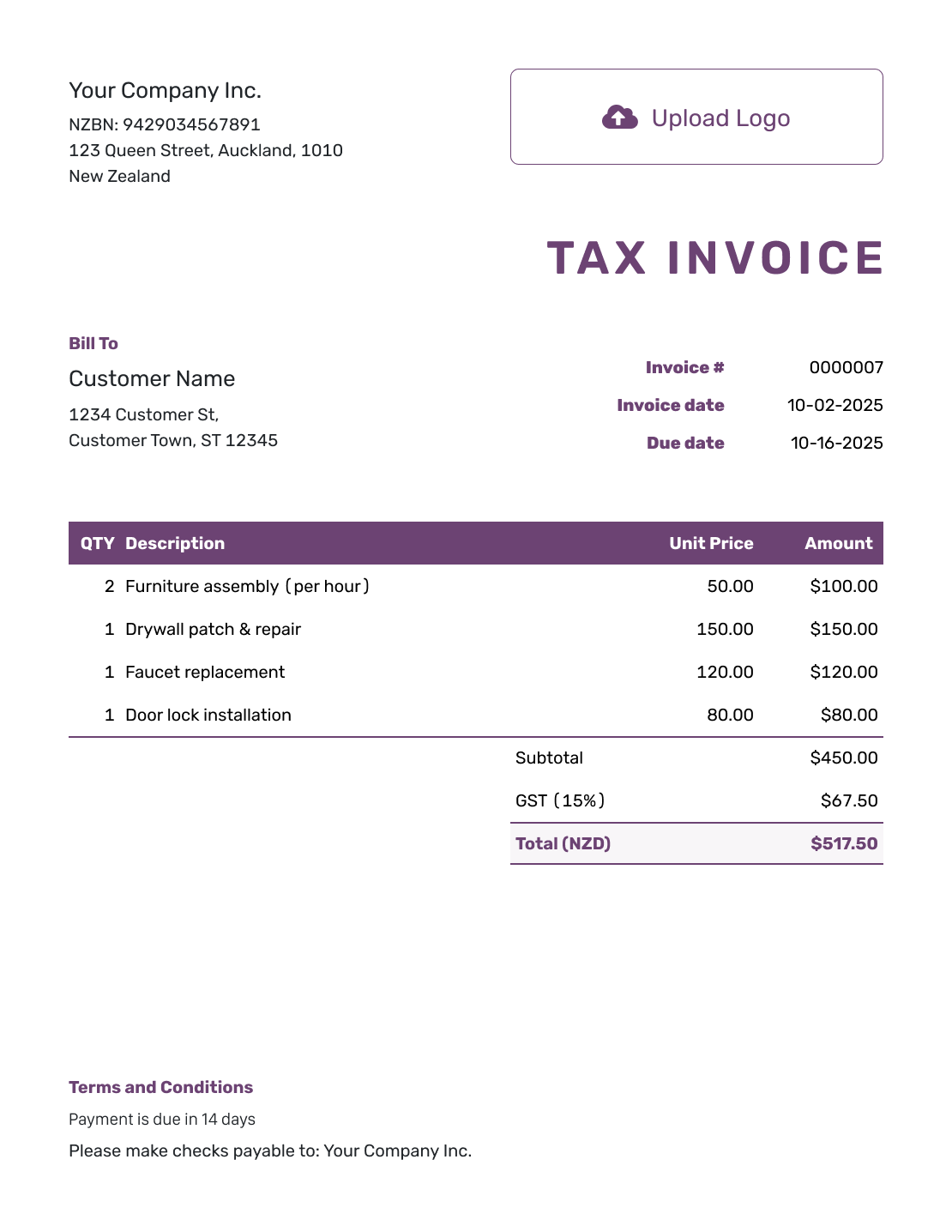

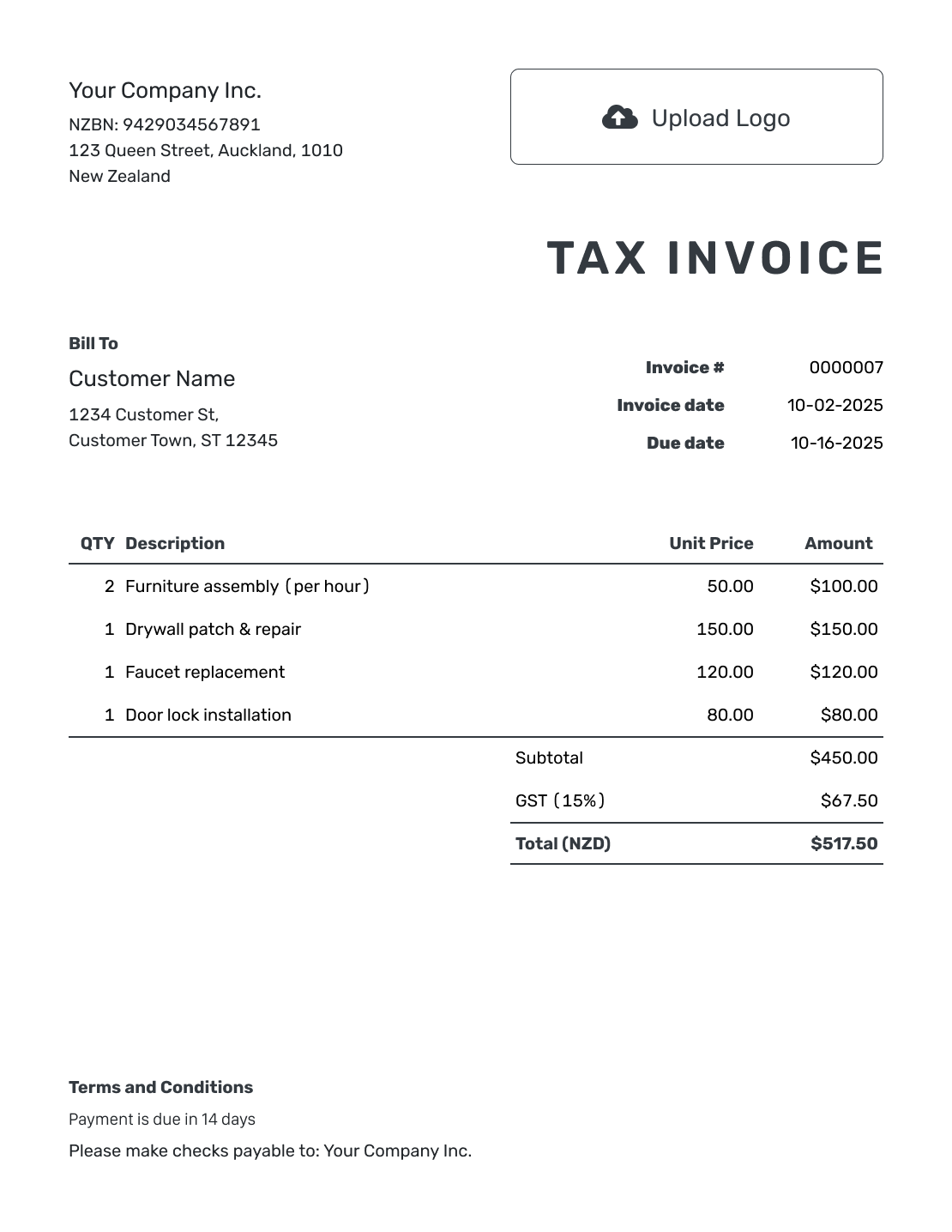

Your invoice should be professional and reflect your business identity. With Docelf, you can personalize your New Zealand Invoice Template by adding your logo, adjusting colors, and choosing fonts that match your brand.

If you need to include your NZBN, simply add it in the company address field. If you charge GST, ensure your invoice is labeled as a "Tax Invoice" and clearly states the GST amount. Docelf makes it easy to adjust these settings in the invoice editor.

Your invoice isn’t just a bill — it’s part of your brand. Customize it with these simple options to make every invoice look professional and uniquely yours.

- Add Your Logo: Build trust and make your invoices instantly recognizable.

- Pick Your Fonts and Colors: Choose a font and color that reflect your business style.

- Choose Your Currency: Select from USD, AUD, CAD, GBP, and EUR for international invoicing.

- Customize Your Invoice Name: Rename your invoice to match your business needs, whether you're a contractor, freelancer, or service provider.

- Personalize Your Footer: Add key details like your email, phone number, or website to keep communication easy.

- Attach Supporting Documents: Include contracts, breakdowns, or reference images to provide extra clarity.

With these options, your invoices will look as polished and professional as your business. Happy invoicing!

- PDF, Email or Print

- Convert to a Receipt

- See when your invoice has been opened

- Keep track of due dates and payments