Est. reading time: 6 min

Carrying costs, also known as holding costs, represent the total cost of holding inventory over a period of time. Calculating these costs accurately is crucial for effective inventory management and optimizing operational budgets. This article provides insights into how carrying costs are calculated and the factors that influence them.

Also try:

Table of Contents

- Word Definitions

- Calculating Carrying Costs

- Examples

- Inventory Optimization Tips

- Frequently Asked Questions

- Further Reading

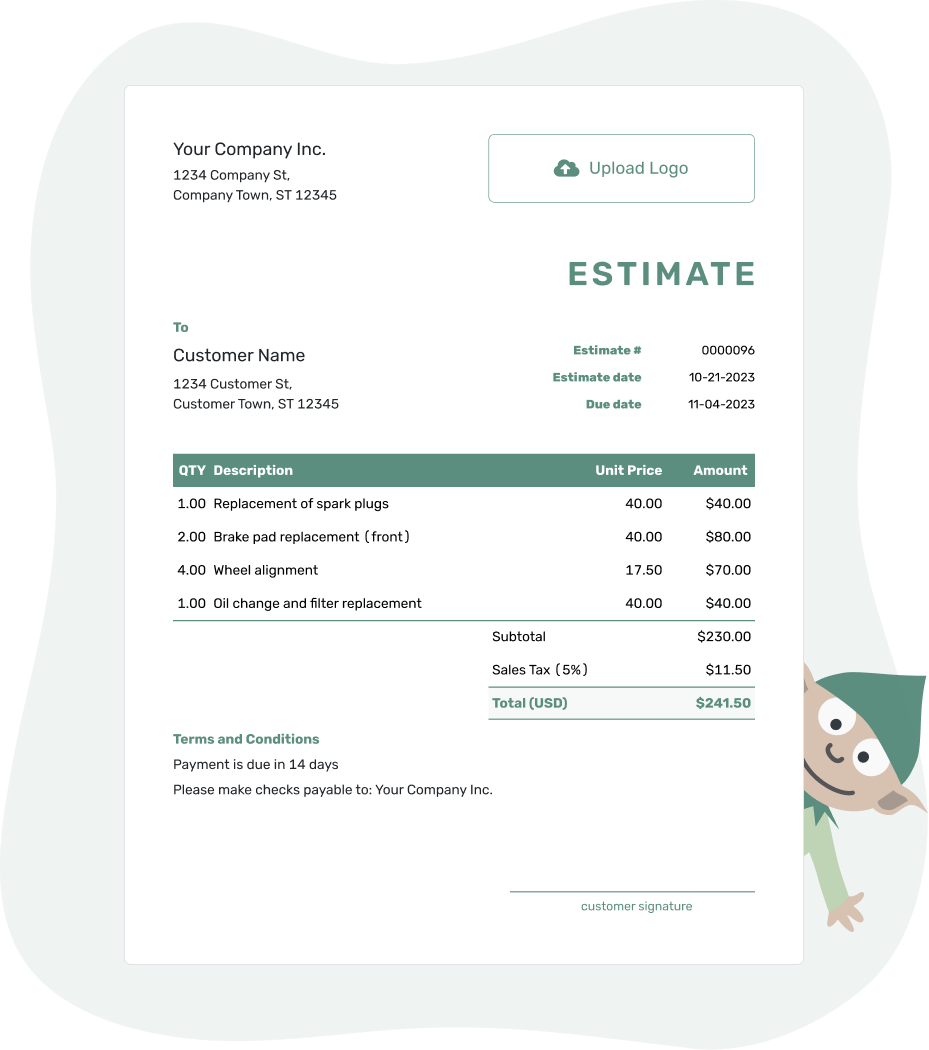

- PDF, Email or Print

- Convert to Invoice

- See when your estimate has been opened

- Get notified when your estimate is accepted

Word Definitions

-

Carrying Costs:

Expenses associated with maintaining and storing unsold goods. This includes warehousing, depreciation, insurance, taxes, and opportunity costs. -

Inventory:

The total quantity of goods or materials held in stock by a business, available for sale or production. -

Opportunity Costs:

The potential benefits that are foregone by choosing one alternative over another. In terms of inventory, it refers to the potential revenue from investing funds elsewhere. -

Capital Costs :

Expenses related to the purchase or finance of inventory. This includes the cost of the goods and any additional expenses like interest on loans used to purchase the inventory. -

Service Costs :

Costs incurred from services needed to maintain inventory quality and manage stock, such as insurance, taxes, and software used for inventory management. -

Risk Costs :

Costs related to the potential loss in value of inventory due to factors like obsolescence, shrinkage, or spoilage. -

Space Costs :

Costs for the physical space required to store inventory, including warehouse rent, utilities, and handling fees. -

Total Inventory Value :

The monetary value of all inventory items a company currently holds, calculated at either cost or market value, reflecting the total worth of the inventory on hand. -

Inventory Turnover Ratio :

A measure of how often inventory is sold and replaced over a period. It provides insights into sales effectiveness and inventory management efficiency.

How to Calculate Carrying Cost

Understanding how to calculate carrying costs is essential for effective inventory management and financial planning. The total carrying cost of inventory includes various components, each contributing to the total expense of holding inventory over time.

To calculate the carrying cost, sum up the following components:

| Inventory Carrying Cost = | Capital Costs + Service Costs + Risk Costs + Space Costs |

Components of Carrying Cost

- Capital Costs: These costs include the value of the inventory itself, along with associated expenses such as financing and loans. Capital costs generally comprise the largest portion of carrying costs.

- Service Costs: Costs incurred to maintain the inventory's condition and readiness for sale, including insurance, taxes, and inventory management software.

- Risk Costs: Costs associated with the risks of inventory becoming obsolete, depreciating in value, or losses due to theft or damage.

- Space Costs: Expenses related to the physical storage of inventory, such as rent, utilities, and warehouse management. These costs can vary significantly depending on whether you own the storage space or use third-party logistics.

To determine your inventory carrying cost as a percentage of the total inventory value:

| Carrying Cost Percentage = | Inventory Carrying Cost | × 100% |

| Total Inventory Value |

Examples of Calculating Carrying Cost

Below are two examples that demonstrate how to calculate the Inventory Carrying Cost and the Carrying Cost Percentage, providing a clearer understanding of how these costs impact overall financial planning and inventory management.

Example 1: Standard Retail Business

Imagine a retail business with the following annual costs related to its inventory:

- Capital Costs: $50,000

- Service Costs: $5,000

- Risk Costs: $2,000

- Space Costs: $8,000

- Total Inventory Value: $100,000

To calculate the Inventory Carrying Cost:

| Inventory Carrying Cost = $50,000 + $5,000 + $2,000 + $8,000 = $65,000 |

To determine the Carrying Cost Percentage:

| Carrying Cost Percentage = | $65,000 | × 100% |

| $100,000 |

Carrying Cost Percentage = 65%

This percentage indicates that the business incurs a carrying cost that is 65% of the total value of its inventory, which might suggest a need for better inventory efficiency or cost reduction strategies.

Example 2: E-commerce Store

Consider an e-commerce store with the following annual inventory-related costs:

- Capital Costs: $120,000

- Service Costs: $10,000

- Risk Costs: $3,000

- Space Costs: $15,000

- Total Inventory Value: $200,000

To calculate the Inventory Carrying Cost:

| Inventory Carrying Cost = $120,000 + $10,000 + $3,000 + $15,000 = $148,000 |

To determine the Carrying Cost Percentage:

| Carrying Cost Percentage = | $148,000 | × 100% |

| $200,000 |

Carrying Cost Percentage = 74%

A carrying cost percentage of 74% is quite high, indicating significant room for improvement in inventory management and cost control to enhance profitability.

Frequently Asked Questions

-

What exactly is a carrying cost?

Carrying cost is the total cost of holding inventory. This includes several expenses such as storage costs, insurance, and opportunity costs related to the capital tied up in inventory.

-

How can I reduce carrying costs?

To reduce carrying costs, focus on improving inventory accuracy, optimize storage and handling processes, negotiate better terms with suppliers for faster inventory turnover, and use just-in-time inventory methods when applicable.

-

What is the impact of high carrying costs on a business?

High carrying costs can strain a business's finances, reduce profit margins, and lead to excessive inventory levels that may not turn over quickly. This can result in cash flow problems and limit the company's ability to invest in other areas such as development or marketing efforts.

-

What is an optimal carrying cost percentage?

The optimal carrying cost percentage varies by industry, but typically, it should be low enough to ensure profitability while sustaining efficient inventory levels. Generally, a lower carrying cost percentage is preferred as it indicates a more efficient use of resources.

-

What techniques can be used to measure carrying costs effectively?

Effective measurement of carrying costs involves tracking inventory levels, calculating storage costs, assessing insurance and tax expenses, and analyzing opportunity costs. Tools like inventory management software can automate these calculations to provide more accurate and real-time data.

-

What are common mistakes in carrying cost calculation?

Common mistakes include underestimating the costs of storage and insurance, neglecting to factor in depreciation and obsolescence, and failing to account for all capital costs. These errors can lead to a significant underestimation of true carrying costs, impacting financial planning and decision-making.

Further Reading

To deepen your understanding of carrying costs and their management, explore the following resources:

- Investopedia's Article on Carrying Costs - Provides a detailed explanation of carrying costs, including how they are calculated and strategies to manage them effectively.

- Entrepreneur's Guide on How to Manage Inventory Carrying Costs - Offers practical advice and strategies for minimizing carrying costs and optimizing inventory management.

- Harvard Business Review on Managing Inventory as Demand Changes - Discusses approaches to adjusting inventory practices in response to fluctuating market conditions, focusing on carrying cost implications.