Est. reading time: 6 min

Profit margin is used to evaluate the profitability of a business, product, or service. It is expressed as a percentage and indicates how much of each dollar in revenue is converted into profit after all expenses are paid. This measurement helps determine the financial health of a business, indicating how well it controls costs and manages pricing strategies.

Also try:

Table of Contents

- Word Definitions

- How to Calculate Profit Margin

- Examples of Profit Margin Calculation

- Understanding Gross Margin

- Understanding Markup

- Frequently Asked Questions

- Further Reading

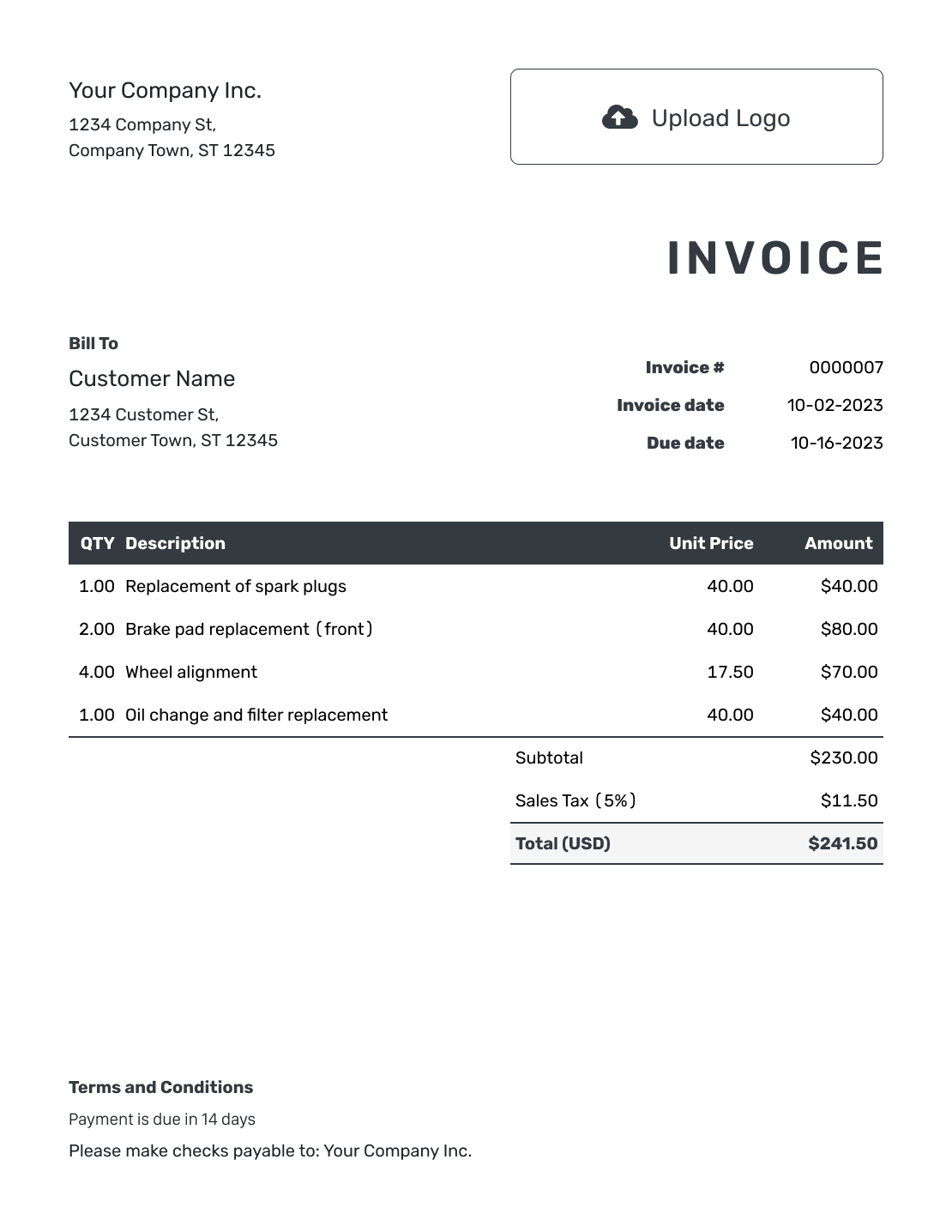

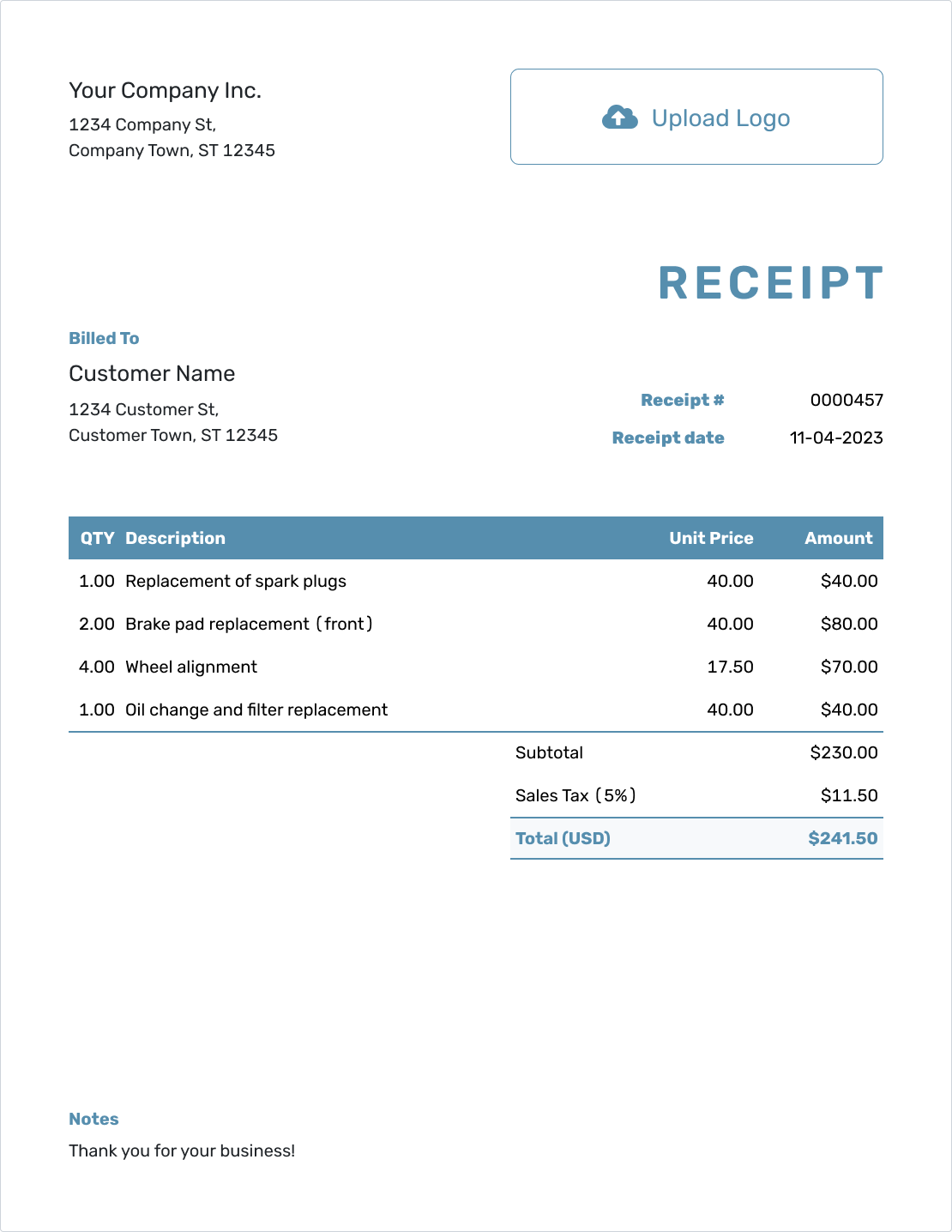

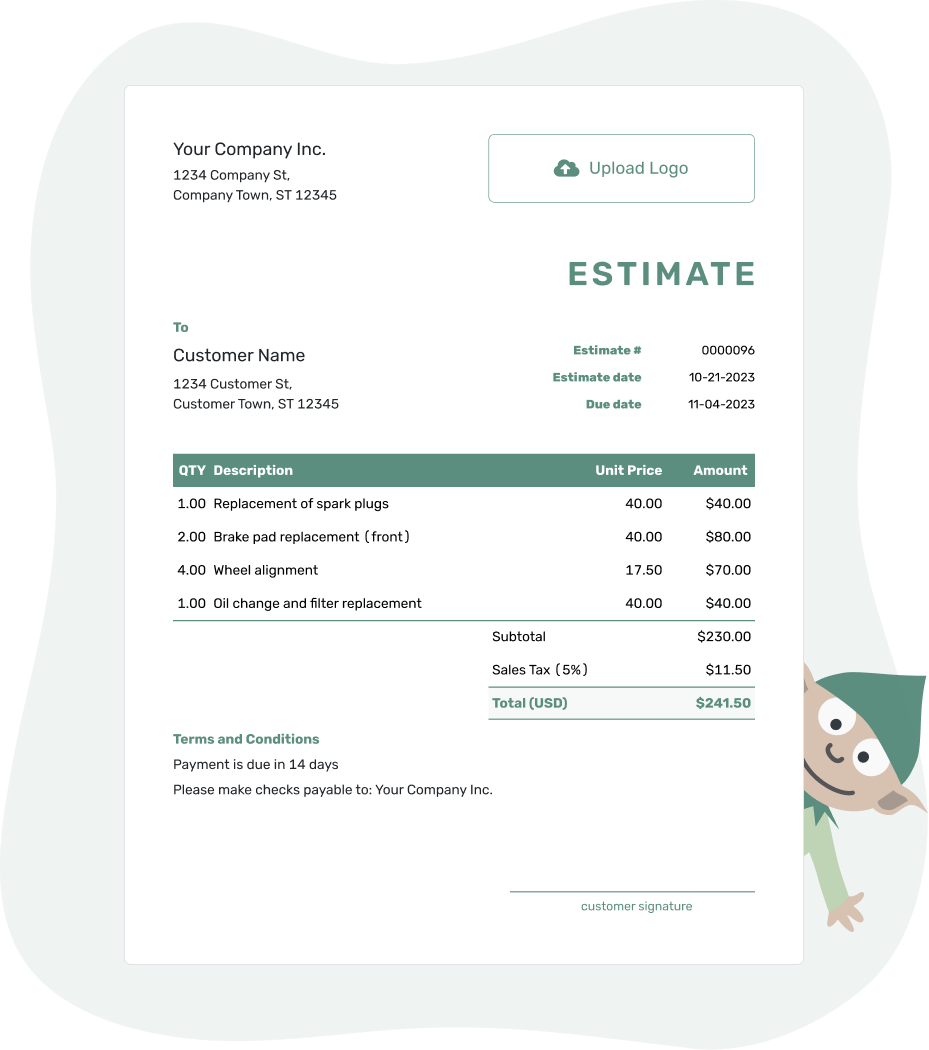

- PDF, Email or Print

- Convert to Invoice

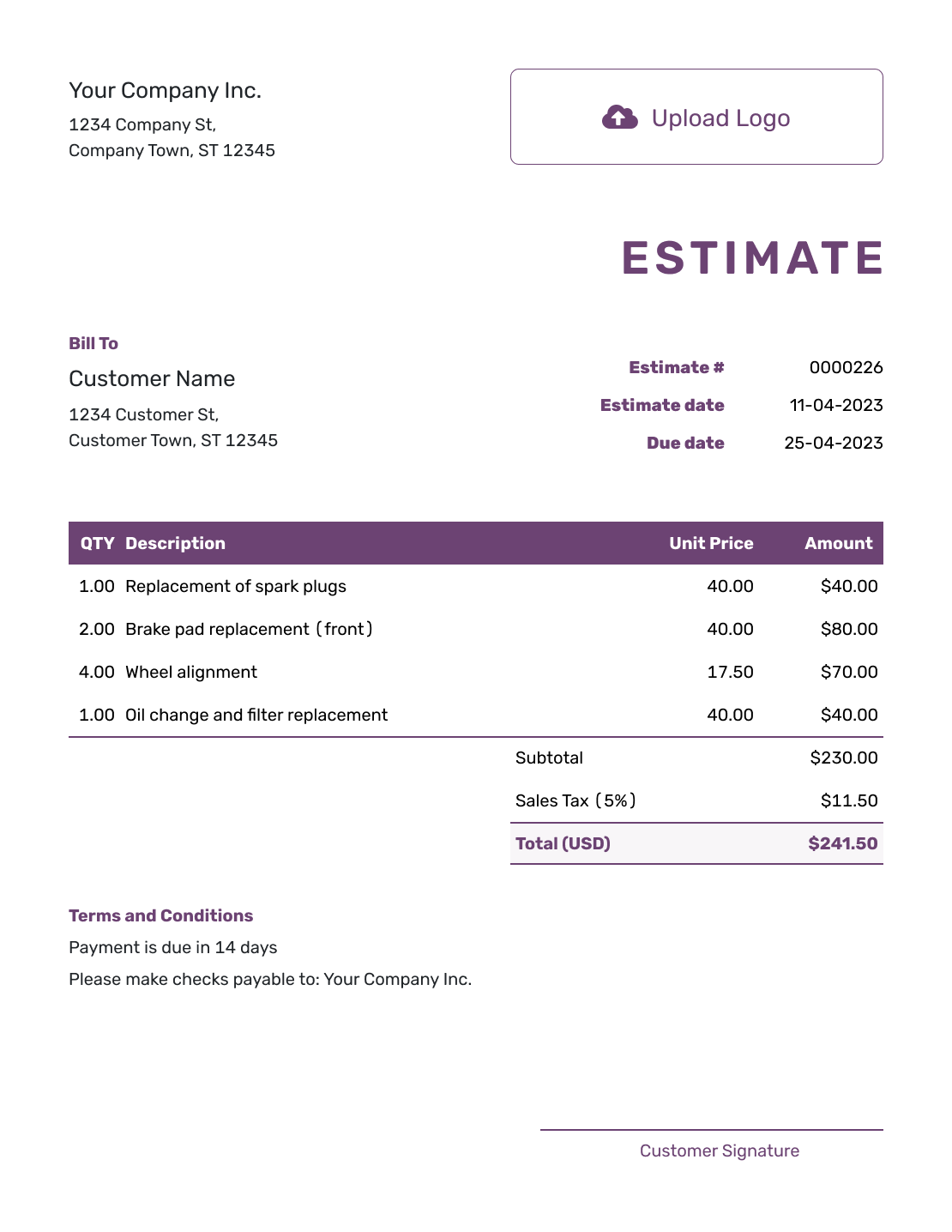

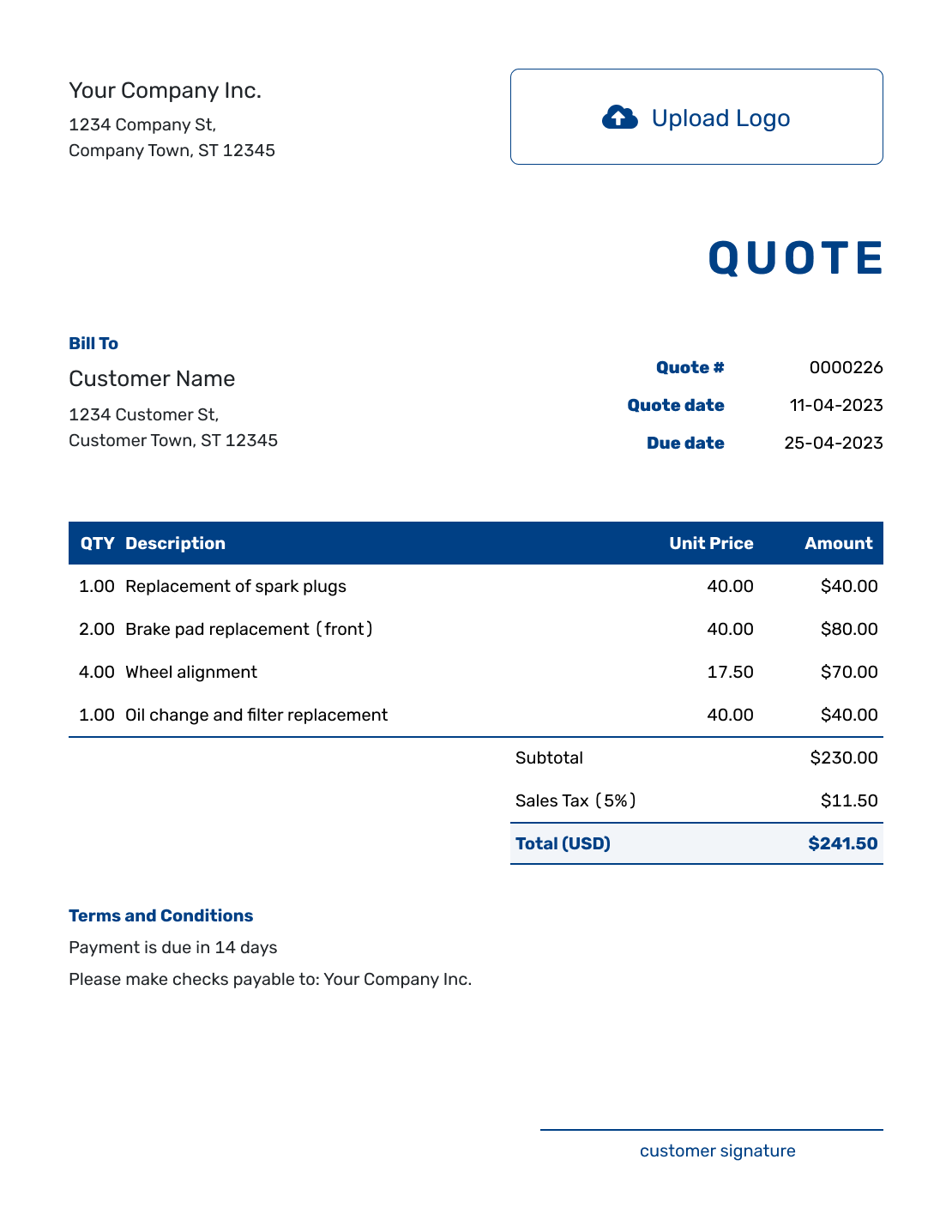

- See when your estimate has been opened

- Get notified when your estimate is accepted

Word Definitions

-

Cost of Goods Sold (COGS):

The direct costs associated with the production of the goods sold by a company. This includes the cost of materials and labor directly used to create the product, but excludes indirect expenses such as distribution costs and sales force costs. -

Revenue:

The total amount of money received by the company for goods sold or services provided during a certain time period. It is often referred to as 'sales' and does not account for any costs or expenses. -

Gross Profit:

The profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services. Gross profit will appear on a company's income statement and can be calculated by subtracting COGS from revenue. -

Net Profit:

Also known as net income or net earnings, it is a measure of the profitability of a venture after accounting for all costs. Revenue minus COGS, expenses, interest, and taxes forms the net profit. -

Profit Margin:

A profitability ratio calculated by dividing net profit by revenue. It is often expressed as a percentage and indicates how many cents of profit has been generated for each dollar of sale. -

Markup:

The difference between the cost of a good or service and its selling price. It is expressed as a percentage over the cost. A markup is added onto the total cost incurred by the producer of a good or service in order to cover the costs of doing business and create a profit.

How to Calculate Profit Margin

The profit margin is the percentage of your revenue which is comprized of profit. To calculate the profit margin you need to first subtract the cost from your total revenue to find the profit

| Profit = | Revenue - Costs |

| Profit Margin (%) = | Profit | × 100% |

| Revenue |

Examples of Profit Margin Calculation

To solidify your understanding of how to calculate profit margins, let's go through a couple of practical examples using the formulas described above.

Example 1: Manufacturing Company

Imagine a manufacturing company that produces consumer electronics. Let's say the total revenue generated from sales this year was $500,000 and the costs associated were $300,000. Here's how you would calculate the profit and profit margin:

Profit Calculation:

| Profit = | $500,000 - $300,000 = $200,000 |

Profit Margin Calculation:

| Profit Margin (%) = | $200,000 | × 100% = 40% |

| $500,000 |

This calculation shows that the manufacturing company has a profit margin of 40%, meaning 40% of the total revenue is profit after covering all the costs.

Example 2: Retail Business

Consider a retail business that sells clothing. Suppose the business earned $150,000 in total revenue last quarter and the costs were $90,000. Let's calculate the profit and profit margin:

Profit Calculation:

| Profit = | $150,000 - $90,000 = $60,000 |

Profit Margin Calculation:

| Profit Margin (%) = | $60,000 | × 100% = 40% |

| $150,000 |

This example shows that the retail business has a profit margin of 40%, indicating that the business retains $0.40 from each dollar of sales as profit.

Understanding Gross Margin

Gross margin is the percentage of revenue that exceeds the cost of goods sold (COGS). It measures how efficiently a company uses labor and supplies in the production process and reflects the financial health in terms of production efficiency.

How Gross Margin Differs from Profit Margin

While both gross margin and profit margin are measures of profitability, they highlight different aspects of financial performance. Gross margin focuses solely on the relationship between revenue and the cost of goods sold, not including other operating expenses like administration, marketing, or taxes. It essentially measures the efficiency of production and how much a company earns from each dollar of sales after covering the costs directly related to production.

Profit margin, on the other hand, takes into account all expenses, including operating expenses, interest, and taxes. It provides a more comprehensive view of a company's overall profitability and its ability to manage all costs associated with its operations and not just the direct costs of producing goods.

How to Calculate Gross Margin

Calculating gross margin is straightforward. You subtract the cost of goods sold from the revenue and then divide that number by the revenue. The result is then multiplied by 100 to express it as a percentage. This formula gives you the gross margin percentage, indicating how much of each dollar of revenue is retained as gross profit.

Here's the formula expressed mathematically:

| Gross Margin (%) = | Revenue - COGS | × 100% |

| Revenue |

For example, if a company generates $100,000 in sales and the cost of goods sold is $60,000, the gross margin would be calculated as follows:

| Gross Margin (%) = | $100,000 - $60,000 | × 100% |

| $100,000 |

Which is equal to 40%. This means that the company retains $0.40 from each dollar of sales as gross profit, before any other expenses are considered.

Understanding Markup

Markup refers to the difference between the selling price of a product or service and its cost, expressed as a percentage of the cost. It is essentially the amount by which the cost of a product is increased to arrive at the selling price.

How Markup Differs from Profit Margin

Although both markup and profit margin measure how much more a company charges over its costs, they do so in different ways and are not calculated in the same manner. Markup is applied to the cost of a product to determine the selling price. It is a measure of how much the cost is marked up to arrive at the sales price.

Profit margin, on the other hand, is calculated based on the selling price. It represents the percentage of the total sales price that is profit after all expenses have been paid. In other words, while markup looks at profit relative to the cost, profit margin looks at profit relative to the selling price.

How to Calculate Markup

Calculating markup involves determining the difference between the selling price and the cost price, then dividing that difference by the cost price, and finally, multiplying by 100% to convert it to a percentage.

Here's the formula expressed mathematically:

| Markup (%) = | Selling Price - Cost Price | × 100% |

| Cost Price |

For example, if a product costs $50 to produce and is sold for $75, the markup would be calculated as follows:

| Markup (%) = | $75 - $50 | × 100% |

| $50 |

This means that the cost price is marked up by 50% to arrive at the selling price.

Frequently Asked Questions

-

What is a profit margin?

Profit margin is a financial metric used to evaluate the profitability of a business by dividing net profit by revenue and expressing the result as a percentage. It reflects the percentage of revenue that constitutes profit.

-

How can I increase my profit margin?

Increasing profit margins can be achieved by reducing costs, increasing prices, improving product quality, or optimizing marketing strategies to attract higher-value customers.

-

What is the difference between margin and markup?

Margin is a profitability ratio calculated from the selling price (profit/revenue), whereas markup is calculated from the cost price (profit/cost). Essentially, margin is based on sales price, and markup is based on cost.

-

What factors can affect a company's profit margin?

Several factors can influence a company's profit margin, including pricing strategy, production costs, industry competition, regulation, and overall economic conditions. Efficient management and cost control are also crucial for maintaining a healthy profit margin.

-

Why is it important to monitor profit margins?

Monitoring profit margins helps businesses understand their financial health, make informed decisions about pricing, cost management, and investment, and assess the effectiveness of their business strategies over time.

-

How does profit margin impact business growth?

A higher profit margin indicates that a business is doing well financially and has more capital to invest in growth initiatives such as expanding its operations, entering new markets, or innovating new products and services. It also provides a buffer against economic downturns.

Further Reading

To deepen your understanding of financial metrics like profit margin and markup, and to explore advanced concepts related to financial management and business operations, consider the following resources:

- Investopedia - Detailed articles on Profit Margin and other financial metrics - Offers comprehensive explanations and examples, making complex financial terms easy to understand for both beginners and experienced professionals.

- Entrepreneur's Encyclopedia - Provides insights on a broad range of business topics, including financial management, strategy, and operational tactics.

- Khan Academy Finance Courses - Free courses that cover a range of topics including the basics of finance, accounting principles, and advanced financial analysis.

- Forbes Finance Section - Provides current news and in-depth articles on the financial industry, market trends, and investment strategies.

These resources can provide valuable insights and guidance that can help both individuals and businesses better understand and manage their financial health.