Est. reading time: 7 min

Calculating the margin with discounts involves understanding how your profitability is affected when you apply reductions to your selling prices. This process is crucial for effectively managing promotions and ensuring your business remains profitable even when offering discounts.

Also try:

Table of Contents

- Word Definitions

- How to Calculate Margin with Discount

- Examples

- Understanding Markup with Discounts

- Frequently Asked Questions

- Further Reading

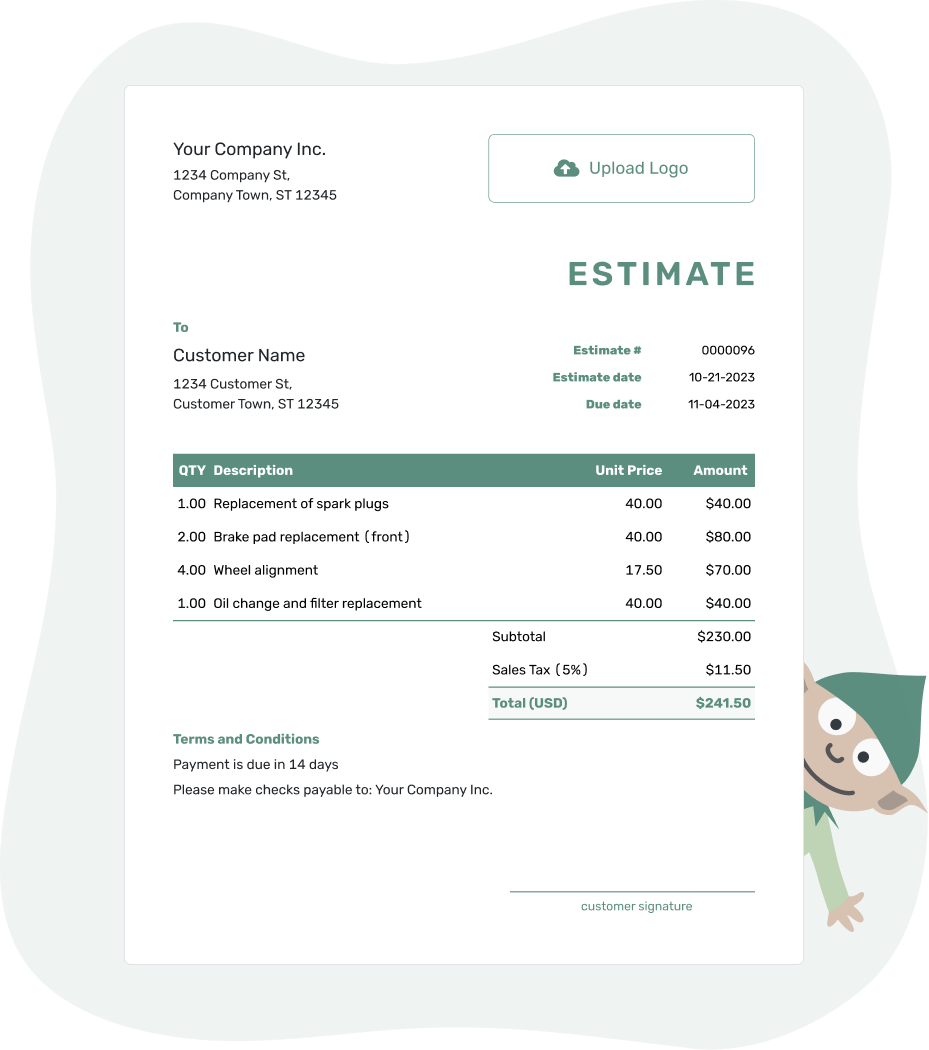

- PDF, Email or Print

- Convert to Invoice

- See when your estimate has been opened

- Get notified when your estimate is accepted

Word Definitions

-

Cost of Goods:

The total cost incurred to produce or purchase the product. -

Selling Price Before Discount:

The price at which the product is intended to be sold before any discounts are applied. -

Discount:

The reduction from the original selling price expressed as a percentage. -

Price After Discount:

The new selling price after the discount has been applied. -

Margin Before Discount:

The profit margin calculated before any discounts are applied. -

Margin After Discount:

The profit margin calculated after applying the discount.

How to Calculate Margin with Discount

To calculate margin after a discount, you need to adjust both the selling price and understand the impact on profitability. Below are the steps and formulas you can use:

First, calculate the price after the discount:

| Price After Discount = | Selling Price Before Discount × (1 - Discount) |

Calculate the margin before the discount using the formula below:

| Margin Before Discount = | Selling Price Before Discount - Cost of Goods | × 100% |

| Selling Price Before Discount |

Use the price after discount and the cost of goods to calculate the marging after discount. It will always be smaller than the margin before discount.

| Margin After Discount = | Price After Discount - Cost of Goods | × 100% |

| Price After Discount |

These calculations will provide you with a clear understanding of how discounts affect your margins and help you make informed pricing decisions.

Examples of Margin Calculation

Let's look at practical examples to illustrate how to apply these formulas:

Example 1: Simple Discount on Electronics

If you purchase electronics at a cost of $200 and sell them for $300 with a 10% discount:

| Price After Discount = | $300 × (1 - 0.10) |

Price After Discount = $270.

| Margin After Discount = | $270 - $200 | × 100% |

| $270 |

Margin After Discount = 25.93%. This shows a margin decrease due to the discount applied.

Example 2: Higher Discount on Clothing

For clothing with a cost of $50 sold for $100 with a 20% discount:

| Price After Discount = | $100 × (1 - 0.20) |

Price After Discount = $80

| Margin After Discount = | $80 - $50 | × 100% |

| $80 |

Margin After Discount = 37.5%. Despite a higher discount, this calculation helps understand the new profit percentage.

Understanding Markup with Discounts

Markup is similarly affected by discounts. Here's how to calculate markup before and after a discount:

| Markup Before Discount = | Selling Price Before Discount - Cost of Goods | × 100% |

| Cost of Goods |

| Markup After Discount = | Price After Discount - Cost of Goods | × 100% |

| Cost of Goods |

Adjusting markup calculations for discounts can provide a clearer picture of profit expectations and product pricing strategies.

Frequently Asked Questions

-

How does a discount affect the margin and markup?

Discounts decrease both margin and markup because they reduce the selling price, which lowers the difference between the cost and the selling price. This reduction impacts the percentage profit made on each sale.

-

What is the ideal discount rate to ensure profitability?

The ideal discount rate depends on multiple factors including the initial markup, product demand, competition, and overall business strategy. Generally, a discount rate that allows the business to cover costs and maintain a reasonable profit margin is considered ideal. Analyzing past sales data and market trends can help determine the most effective discount rate.

-

How can businesses determine the impact of a discount on overall revenue?

Businesses can determine the impact of a discount on overall revenue by tracking sales volume before and after the discount is applied. Additionally, financial models that project revenue based on different discount rates can provide insights into how discounts might affect total sales and profitability.

-

Can offering discounts increase customer loyalty?

Yes, offering discounts can increase customer loyalty if done strategically. Discounts that reward repeat customers or are part of a loyalty program can enhance customer relationships and encourage repeat business. However, it's crucial to balance discounts with the perceived value of the product to avoid diminishing the brand's value.

-

How are discounts, margins, and profits connected?

Discounts, margins, and profits are interconnected in the pricing strategy of a business. Discounts directly reduce the selling price of goods, which can lower the margin – the difference between the cost and the selling price. While discounts can decrease individual product margins, they can potentially lead to increased volume of sales, which might compensate for the lower margin per unit and positively impact overall profits. However, if not managed carefully, excessive discounting can erode profits and negatively affect the financial health of a business. Therefore, it's crucial to balance discounts with desired profit margins to ensure long-term profitability.

Further Reading

To deepen your understanding of pricing strategies and their impact on profitability, explore the following resources:

- Harvard Business Review on Pricing Articles - Access a selection of in-depth articles discussing various aspects of pricing strategy.

- "Confessions of the Pricing Man: How Price Affects Everything" by Hermann Simon - Explore the psychology behind pricing and its significant effect on buying behavior.

- "The Strategy and Tactics of Pricing: A Guide to Growing More Profitably" by Thomas Nagle, John Hogan, and Joseph Zale - Provides a detailed framework for understanding and implementing effective pricing strategies.

- Competitive Pricing: Definition, Examples, and Loss Leaders - Offers a comprehensive overview of pricing strategies and their practical applications in business.

These resources provide valuable insights and guidance that can help both individuals and businesses better understand and manage pricing strategies effectively.