Est. reading time: 5 min

Return on Investment, commonly known as ROI, is a financial metric used widely across various sectors to evaluate the efficiency of an investment or compare the efficiency of multiple investments. It calculates the percentage return on a particular investment relative to its cost, providing a straightforward way to measure an investment's profitability.

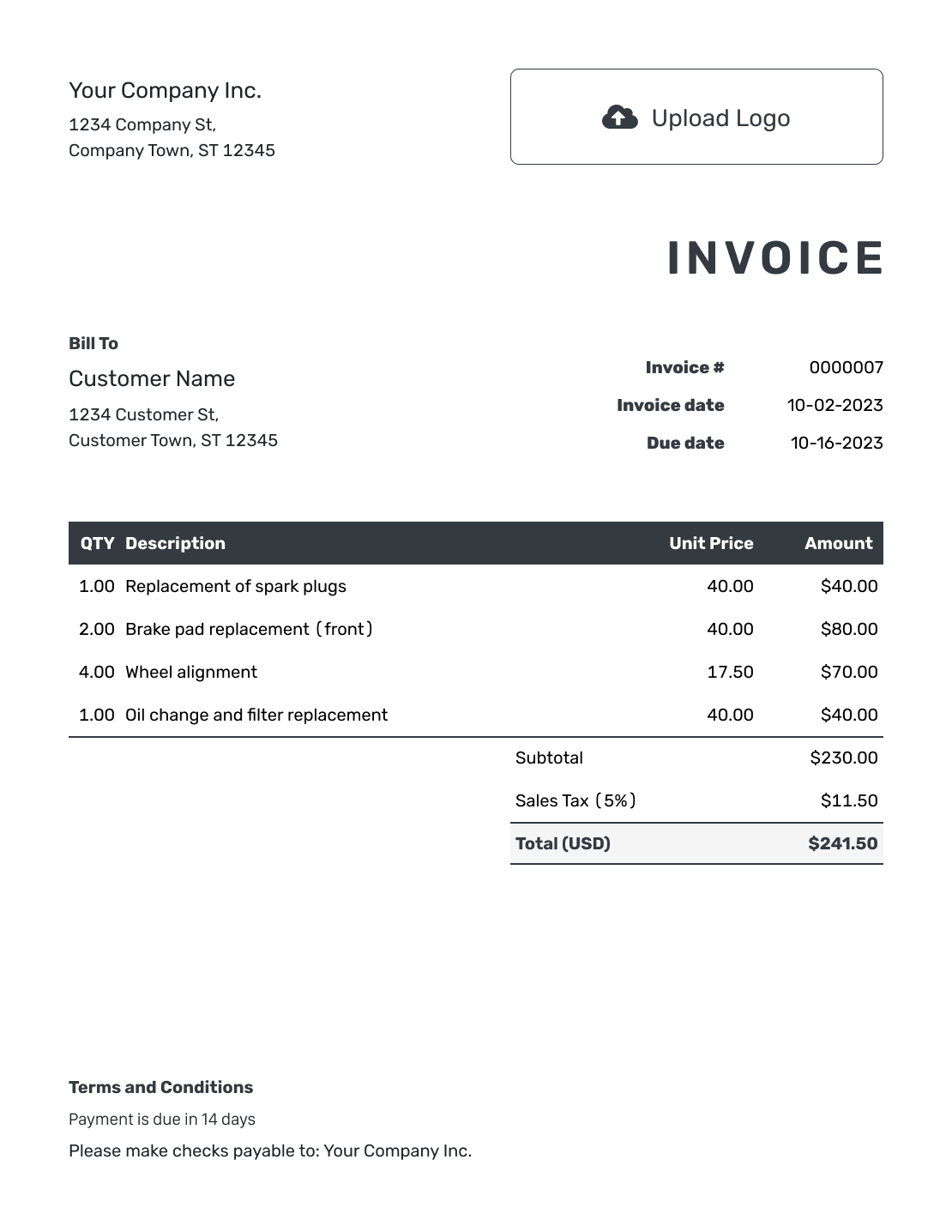

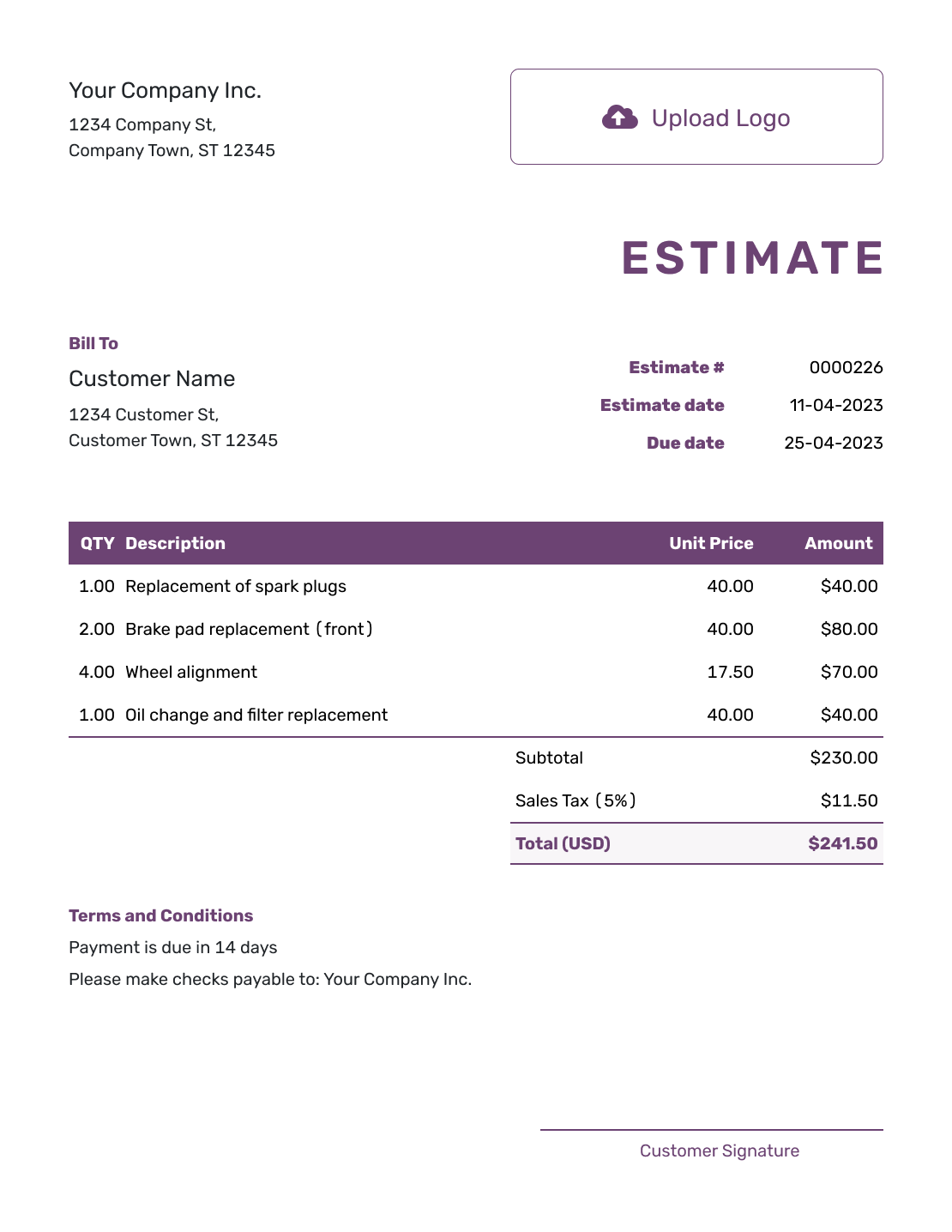

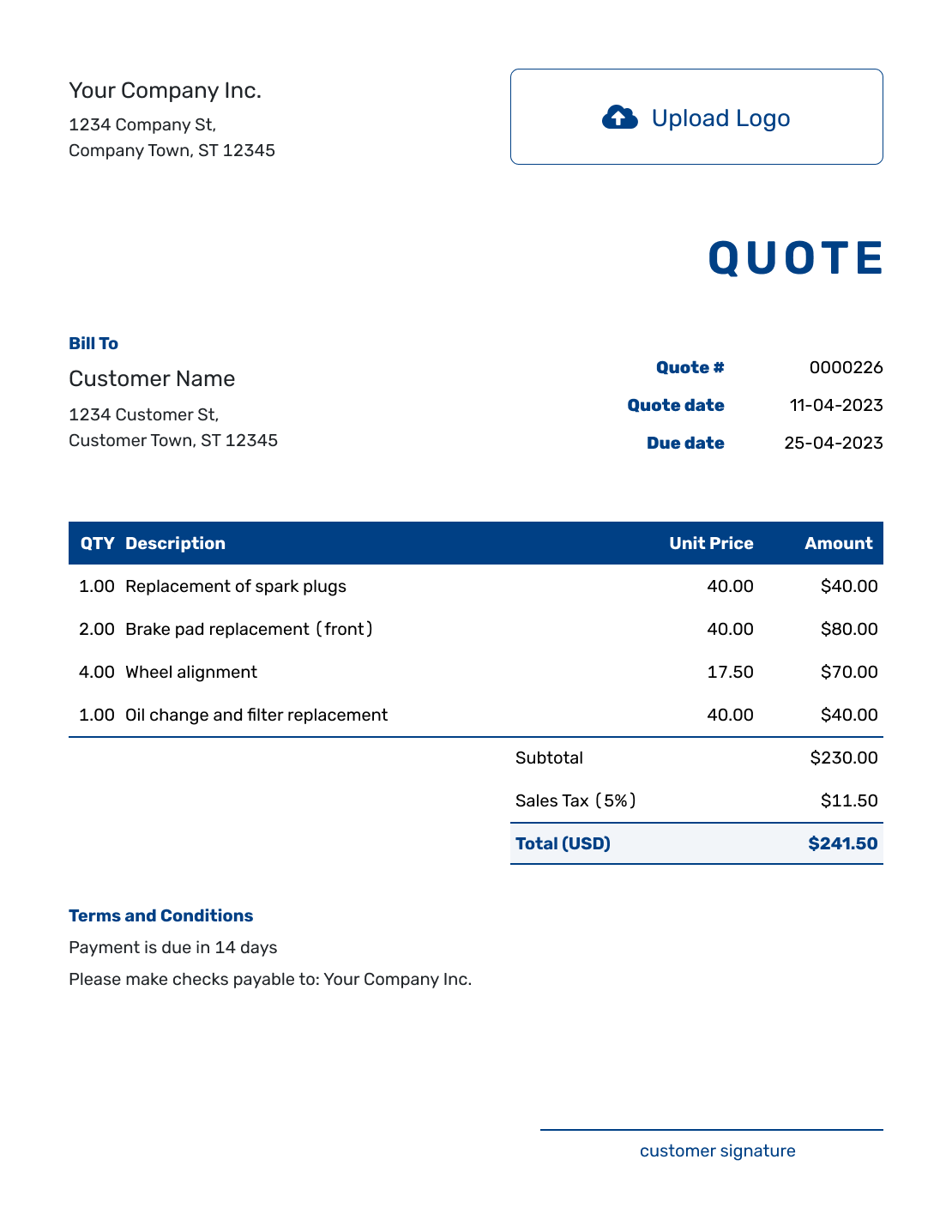

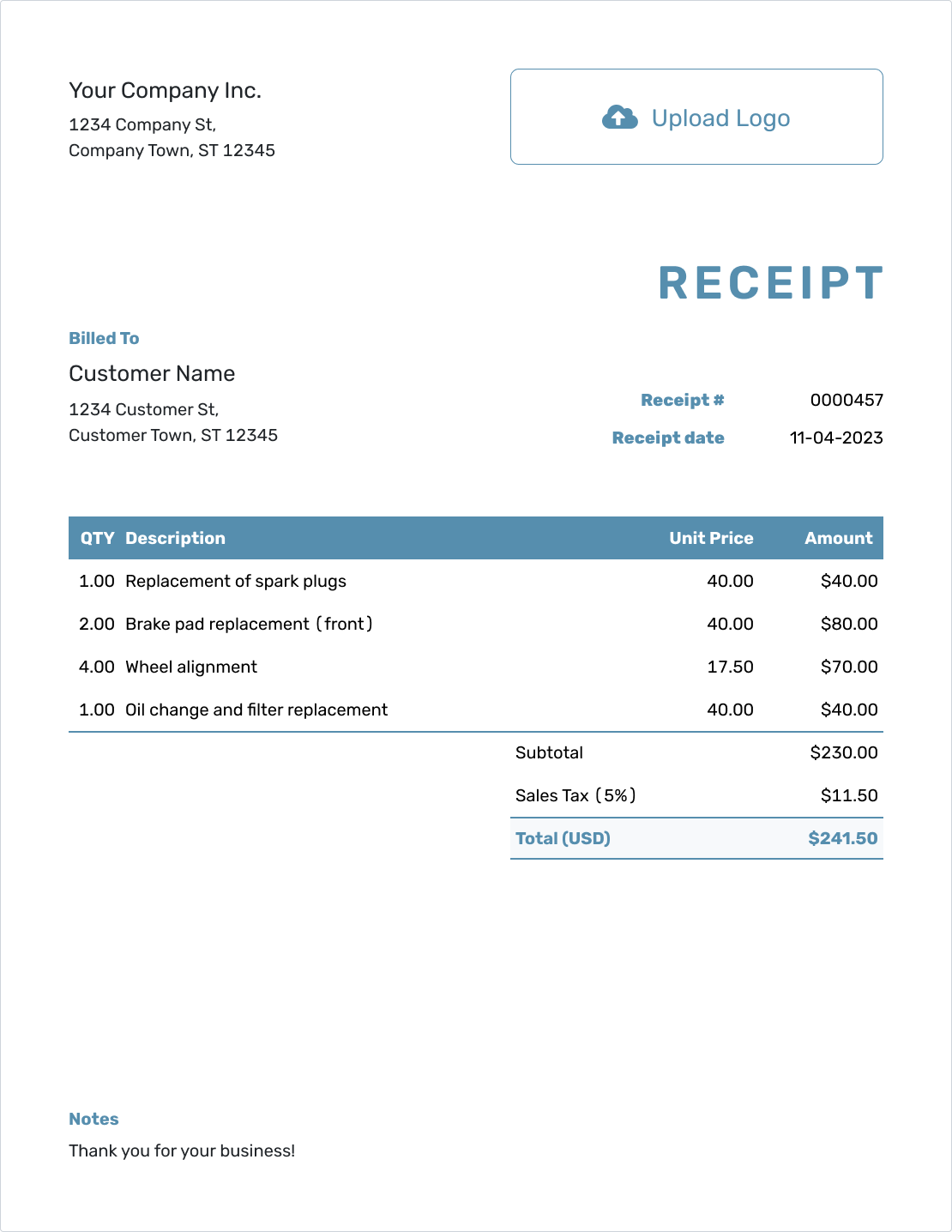

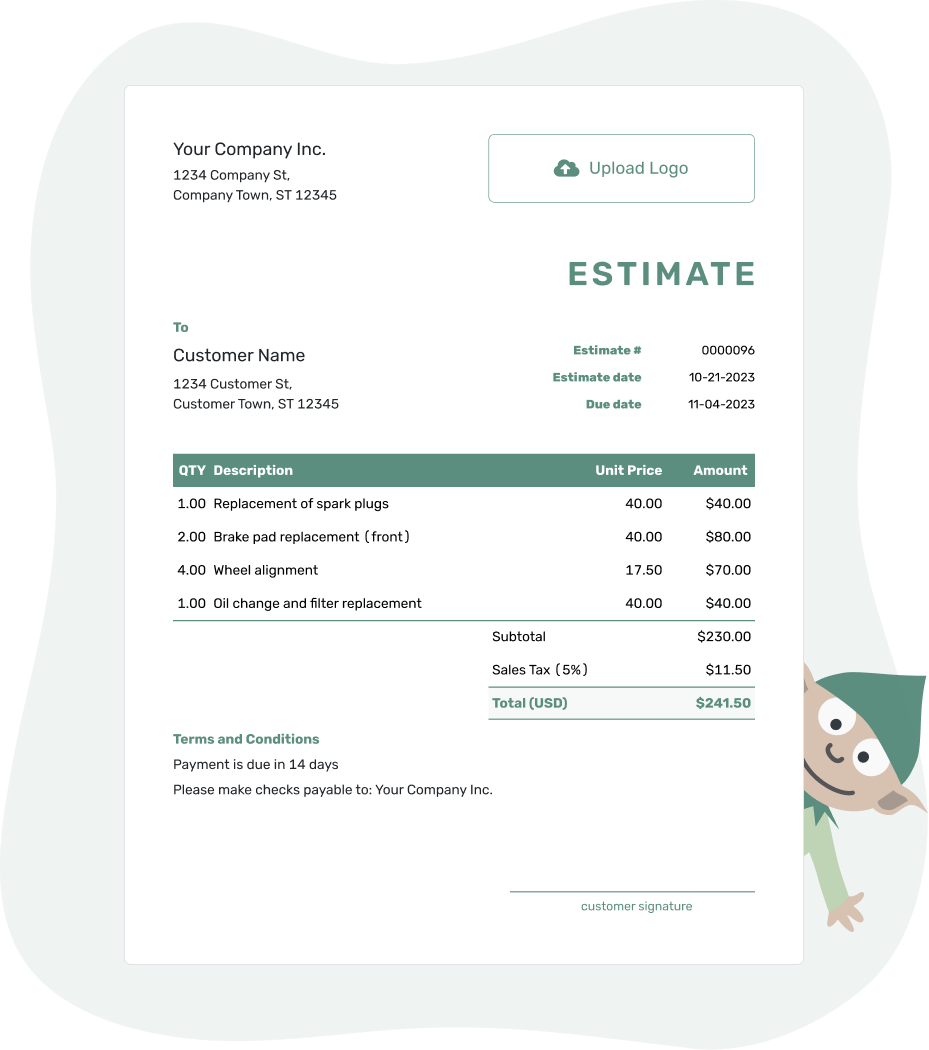

Also try:

Table of Contents

- PDF, Email or Print

- Convert to Invoice

- See when your estimate has been opened

- Get notified when your estimate is accepted

Word Definitions

-

Years:

The time frame over which the ROI is calculated. This can range from a single year to several decades. -

Rate of Return:

The expected annual gain from an investment. This can vary based on the investment type. -

Initial Investment:

The starting amount invested. -

Additional Investments:

Any extra money added to the investment over time. -

Frequency of Contributions:

How often more funds are added to the investment. -

Inflation Rate:

The expected average rate at which the general level of prices for goods and services rises, thereby eroding purchasing power. -

Tax Rate:

The percentage of the investment return that must be paid as taxes. -

Inflation Adjustment:

An option to increase future investment amounts to counteract inflation. -

Compound Interest:

The interest earned on the initial principal and the accumulated interest from previous periods. -

Simple Interest:

Interest calculated only on the principal amount. -

Final Value:

The total value of the investment at the end of the investment period, including the initial capital, additional investments, and the accumulated interest or dividends over the period. -

Annualized ROI:

A rate of return that standardizes the ROI to a yearly basis, allowing for comparison between investments of different lengths. It takes into account the effect of compounding over the entire investment period. -

Length of Investment:

The total duration for which the investment is held before being liquidated. It's crucial for calculating the annualized ROI and assessing the investment's performance over time.

How to Calculate ROI

Calculating ROI is straightforward: First, calculate the net profit by substracting the initial investment from the final value:

| Net Profit = | Final Value - Initial Investment |

To calculate the ROI, divide the net profit by the initial cost of the investment, then multiply by 100 to get a percentage.

| ROI = | Net Profit | x 100% |

| Initial Investment |

Examples of ROI Calculation

Let's look at some practical examples to understand how ROI is calculated:

Example 1: Business Venture

For a young entrepreneur who starts with a $30,000 investment in a small business and earns a profit of $36,000 by the end of the first year:

| ROI = | $36,000 - $30,000 | x 100% |

| $30,000 |

The ROI is 20%.

Example 2: Real Estate Investment

A woman invests $135,000 into an apartment and sells it for $180,000:

| ROI = | $180,000 - $135,000 | x 100% |

| $135,000 |

The ROI is 33%.

Frequently Asked Questions

-

What exactly is ROI?

ROI, or Return on Investment, measures the gain or loss generated on an investment relative to the amount of money invested. It is usually expressed as a percentage and is used for personal financial decisions, to compare a company's profitability or to compare the efficiency of different investments.

-

How do you calculate ROI?

To calculate ROI, divide the net profit of the investment by the initial cost of the investment. The result is then multiplied by 100 to get a percentage. The formula is:

ROI = Net Profit x 100% Initial Investment -

What factors can affect ROI?

Several factors can affect ROI, including investment fees, taxes, market volatility, and inflation rates. Additionally, the period of investment and the method of calculating returns (e.g., simple vs. compound interest) can significantly impact the ROI.

-

What is the difference between ROI and profit?

Profit is the absolute amount earned from an investment after subtracting the costs. In contrast, ROI measures the efficiency or profitability of an investment as a percentage. This allows for the comparison of the profitability of different investments, regardless of their absolute profit amounts.

-

Can ROI be negative?

Yes, ROI can be negative, which indicates that the investment resulted in a loss rather than a profit. A negative ROI means that the net profit is less than zero, or the total costs of the investment are greater than the total returns.

-

How can I improve my investment's ROI?

Improving an investment's ROI can involve several strategies, such as reducing costs, choosing investments with a higher potential return, diversifying investment portfolios to mitigate risk, and investing over a longer period to take advantage of compound interest.

-

What is annualized ROI and how is it calculated?

Annualized ROI calculates the yearly return of an investment, allowing for the comparison of returns over different periods. It's calculated by taking the nth root of the total ROI + 1 (where n is the number of years the investment is held), subtracting 1, and then multiplying by 100 to get a percentage.

Annualized ROI = [(Final Value / Initial Investment)1/n - 1] × 100%

Further Reading

To delve deeper into ROI and other financial metrics, consider exploring these resources:

- Investopedia's Guide to ROI - A comprehensive overview of ROI, including its calculation and implications for investors.

- Calculating the Value of Impact Investing - An article from Harvard Business Review discussing ROI in the context of impact investments.

- Return On Investment (ROI) - A Forbes advisor article that explains the significance of ROI for individual investors and businesses.