Est. reading time: 7 min

Working Capital is a financial metric that represents the operating liquidity available to a business, organization, or other entity. It is the difference between current assets and current liabilities. Understanding working capital is crucial for managing day-to-day operations and for planning future expenditures and investments efficiently.

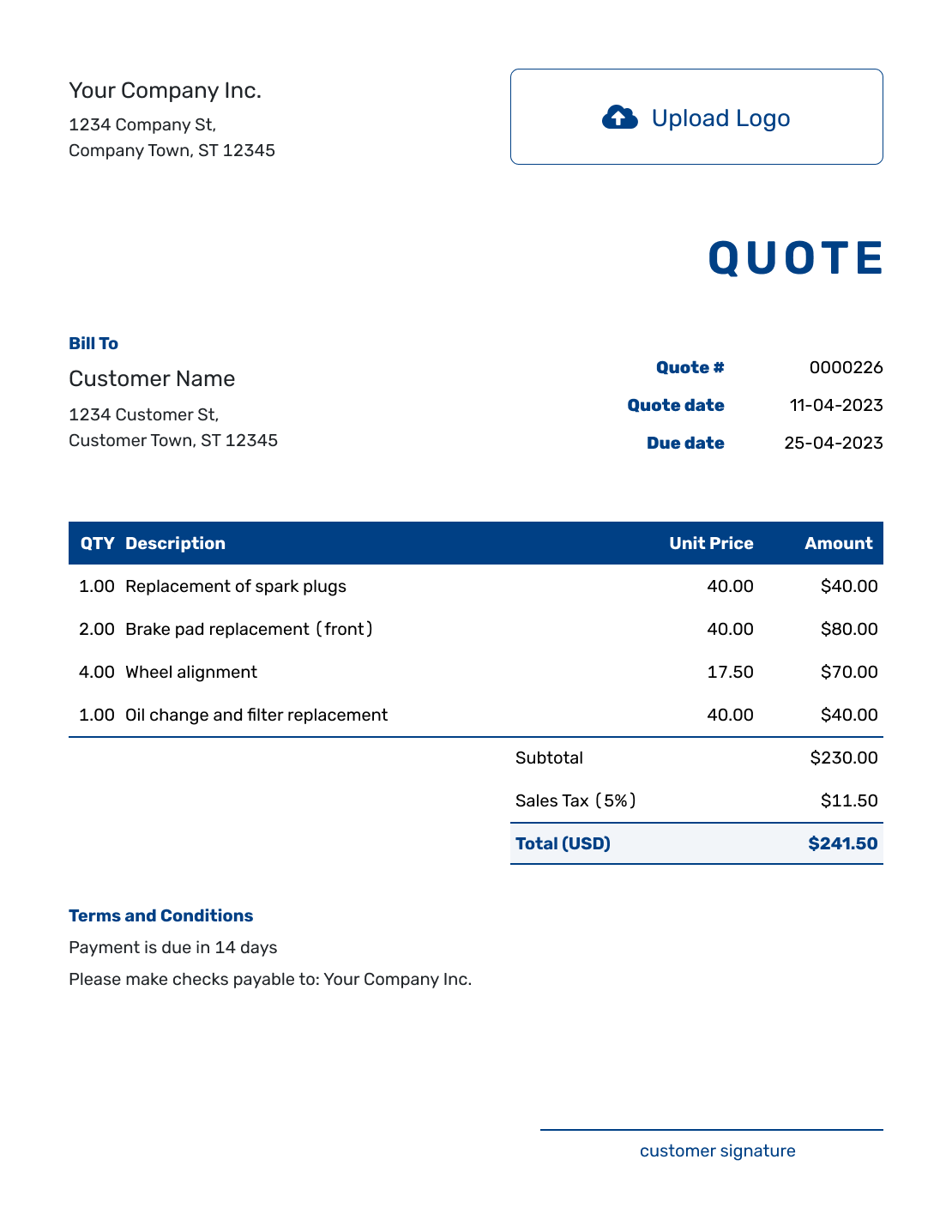

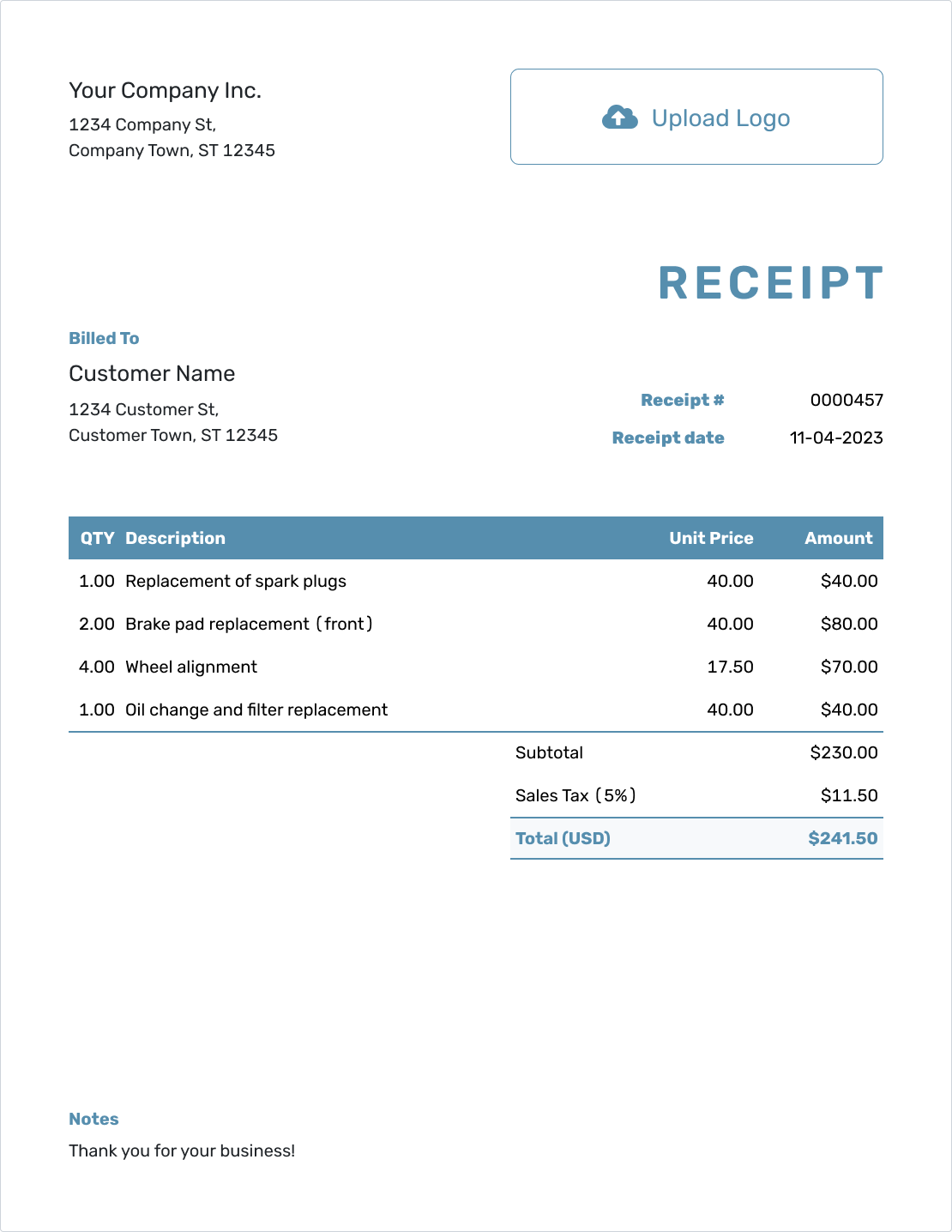

Also try:

Table of Contents

- Word Definitions

- Calculating Working Capital

- Examples

- Working Capital Turnover Ratio

- Frequently Asked Questions

- Further Reading

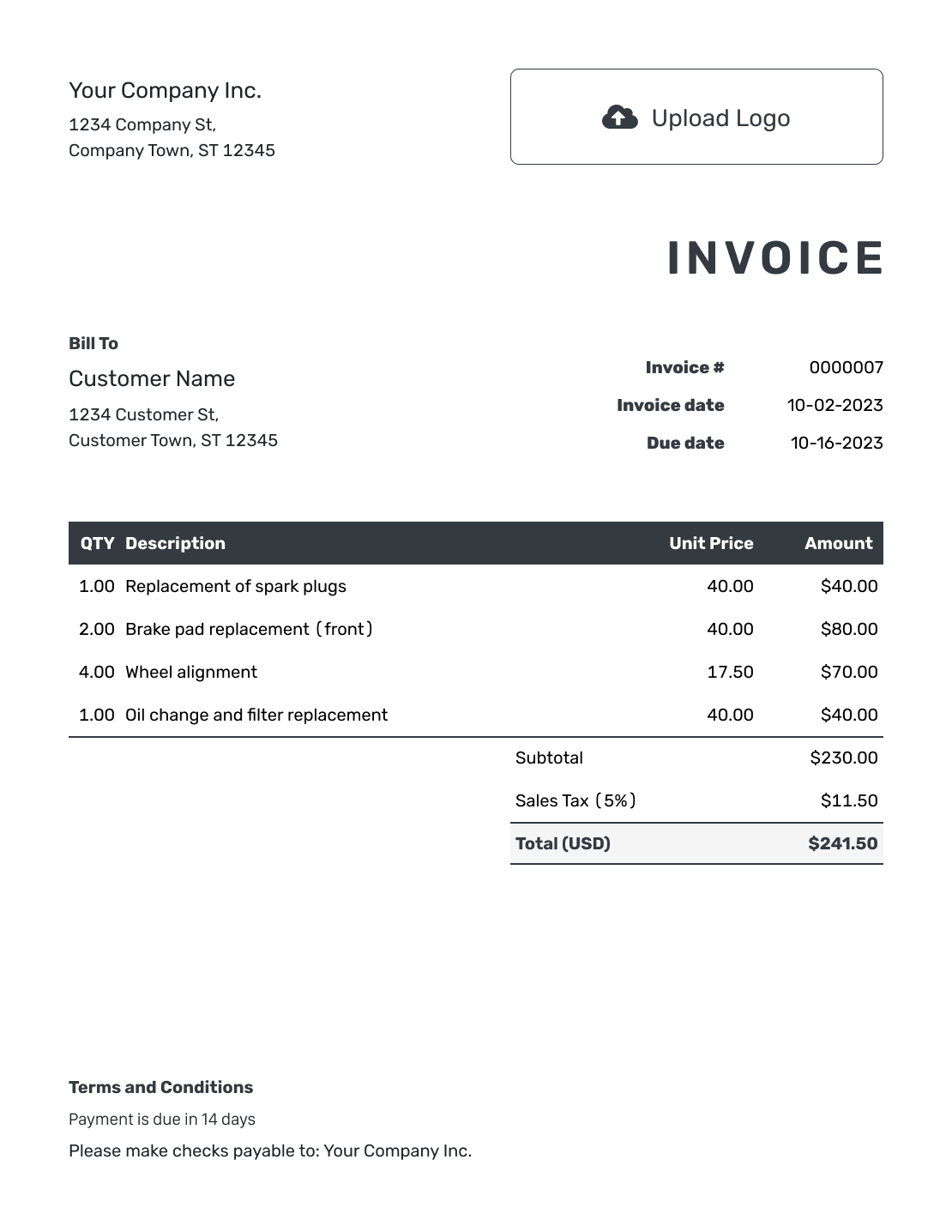

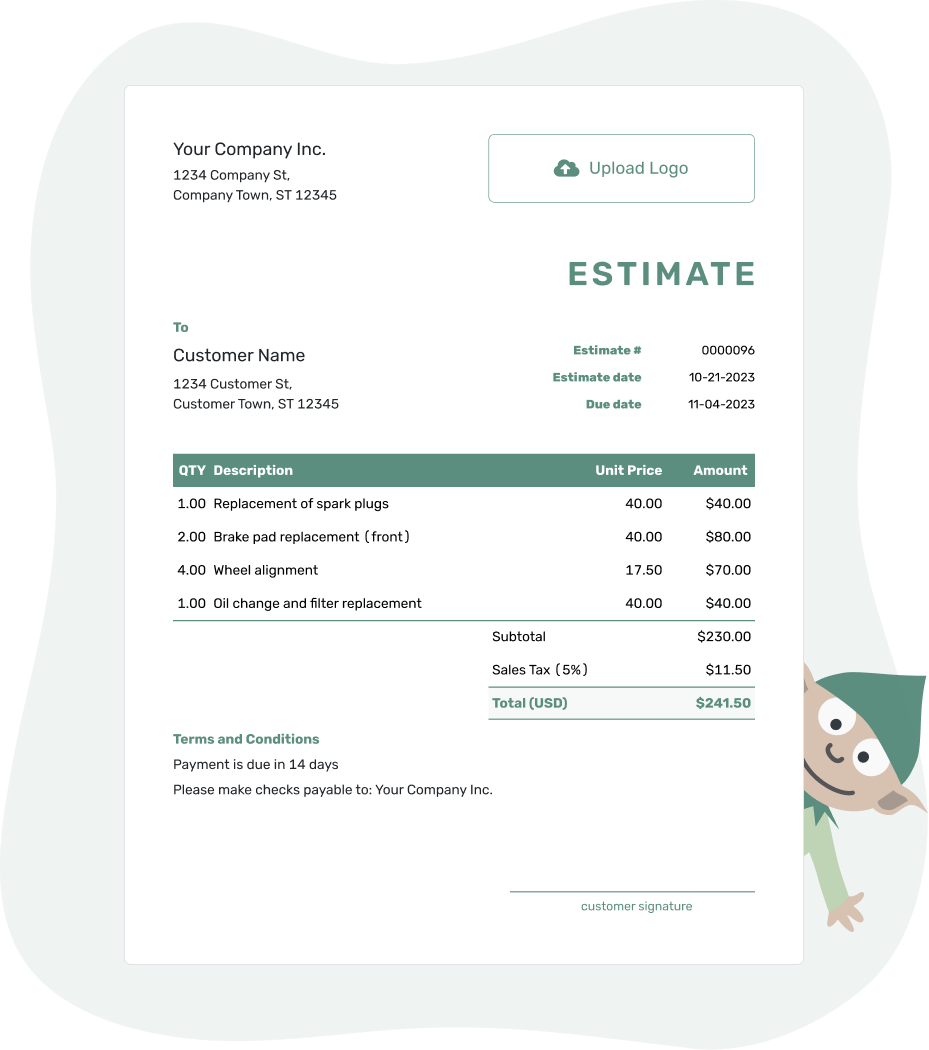

- PDF, Email or Print

- Convert to Invoice

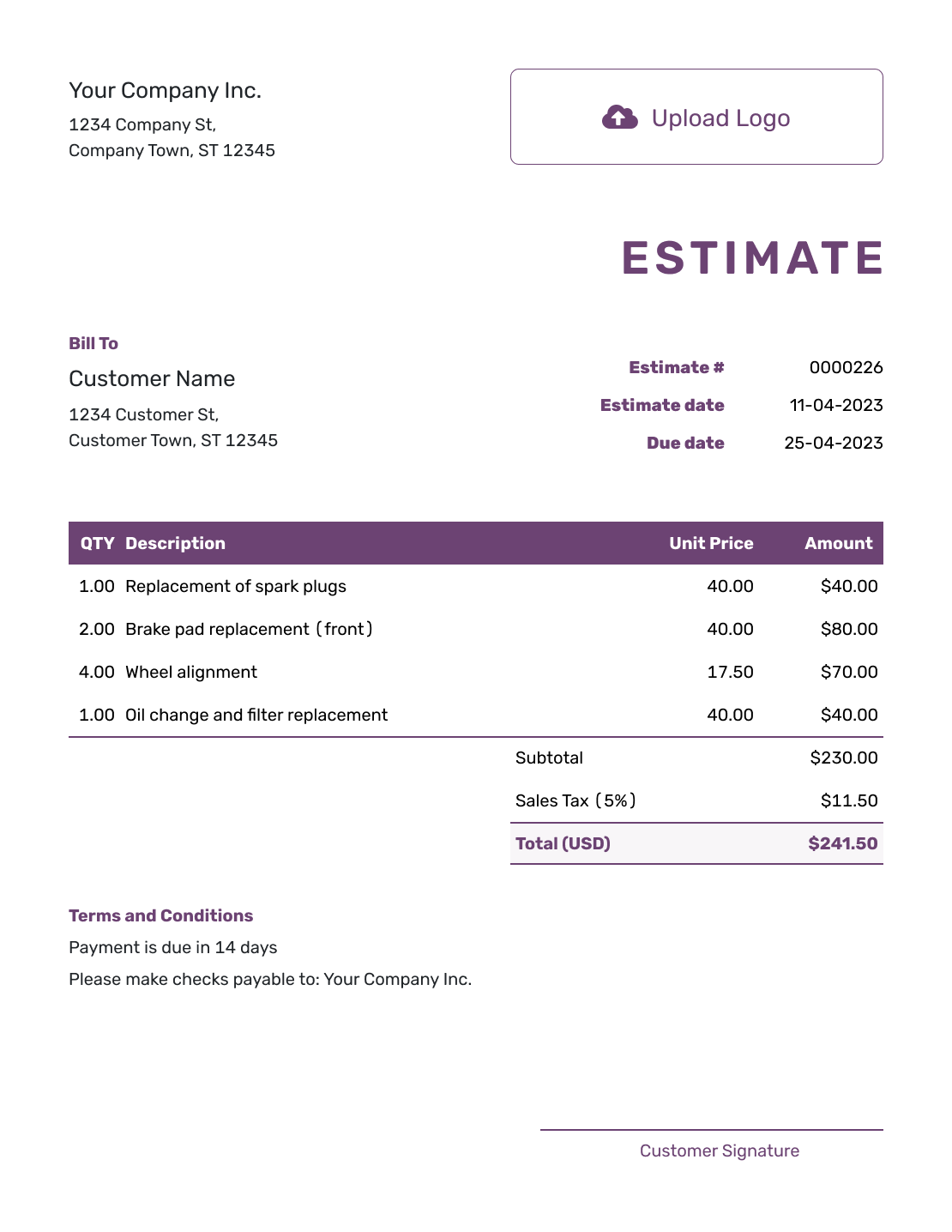

- See when your estimate has been opened

- Get notified when your estimate is accepted

Word Definitions

-

Working Capital (WC):

The difference between a company's current assets and current liabilities, indicating the amount of liquid assets available to run its day-to-day operations. -

Current Assets:

Assets that a company expects to convert into cash, sell, or consume either in one year or in the operating cycle of the business, whichever is longer. -

Current Liabilities:

Obligations or debts that a company needs to pay off within one year or within the business's operating cycle, whichever is longer. -

Net Working Capital (NWC):

Also known as Working Capital, it refers to the difference between current assets and current liabilities. It is used to measure a company's liquidity, operational efficiency, and short-term financial health. -

Working Capital Turnover Ratio:

A measure of efficiency that shows how effectively a company uses its working capital to generate sales revenue. It is calculated by dividing the revenue by the average working capital for a period. -

Working Capital Ratio:

Also known as the Current Ratio, it compares a company's current assets to its current liabilities, providing insight into the company's ability to pay off its debts with its available assets.

How to Calculate Working Capital

To calculate working capital, subtract the total current liabilities from the total current assets:

| Working Capital = | Current Assets - Current Liabilities |

The Working Capital Ratio, also known as the Current Ratio, is calculated by dividing current assets by current liabilities:

| Working Capital Ratio = | Current Assets |

| Current Liabilities |

Examples of Working Capital Calculation

Below are examples that demonstrate how to calculate Working Capital (WC) and the Working Capital Ratio (WCR) for a better understanding of a company's financial health.

Example 1: Simple Working Capital Calculation

Consider Company XYZ, which has the following financial details:

- Current Assets: $150,000

- Current Liabilities: $100,000

To calculate the Working Capital:

| Working Capital = | Current Assets − Current Liabilities |

Working Capital = $150,000 - $100,000 = $50,000

Company XYZ has a Working Capital of $50,000, indicating it has sufficient liquid assets to cover its short-term liabilities. This positions the company well to manage its day-to-day operations without financial strain.

Example 2: Working Capital Ratio Calculation

Now, let's take a look at Company ABC with the same financial figures:

- Current Assets: $150,000

- Current Liabilities: $100,000

To calculate the Working Capital Ratio:

| Working Capital Ratio = | Current Assets |

| Current Liabilities |

Working Capital Ratio = $150,000 / $100,000 = 1.5

With a Working Capital Ratio of 1.5, Company ABC demonstrates good liquidity, indicating that it has 1.5 times more current assets than current liabilities. This is a healthy financial condition, suggesting that the company can easily meet its short-term obligations and may have excess assets to fund future growth or handle unexpected expenses.

Working Capital Turnover Ratio

The Working Capital Turnover Ratio is a key metric that measures the efficiency with which a company utilizes its working capital to generate sales. This ratio is particularly useful for assessing how effectively a company is managing its short-term assets and liabilities to support sales activities.

Understanding the Working Capital Turnover Ratio

This ratio provides insight into a company's operational efficiency by comparing its net sales (or revenues) to its working capital. A higher ratio indicates that the company is generating a higher amount of sales per dollar of working capital used, which can be a sign of operational efficiency and good short-term financial health.

How to Calculate the Working Capital Turnover Ratio

To calculate the Working Capital Turnover Ratio, you need two main pieces of financial information from a company's financial statements: the net sales (or revenues) and the average working capital for the period being analyzed.

The formula to calculate the Working Capital Turnover Ratio is as follows:

| Working Capital Turnover Ratio = | Net Sales / Average Working Capital |

Where:

- Net Sales: Total revenue generated from sales activities, excluding returns and discounts.

- Average Working Capital: The average of working capital at the beginning and end of the period. It can be calculated as:

Average Working Capital = (Beginning Working Capital + Ending Working Capital) / 2

A high turnover ratio might indicate that the company is using its working capital efficiently to support sales, whereas a low ratio might suggest inefficiencies in managing inventories or receivables, or that the company is undercapitalized.

Frequently Asked Questions

-

What is working capital?

Working capital is the difference between a company's current assets and current liabilities. It's an indicator of the operational efficiency and short-term financial health of a business, used to determine if a company can pay off its short-term liabilities with its short-term assets.

-

Why is working capital important?

Working capital is essential as it is needed to pay for regular operations and to meet short-term expenses and obligations. Having adequate working capital ensures that a business can remain solvent and can invest in growth opportunities.

-

How can a company improve its working capital?

Improving working capital involves managing receivables, payables, and inventory more effectively. Strategies include negotiating better terms with suppliers, improving inventory turnover, and optimizing the timing of accounts receivable and payable to maintain a healthy cash flow.

-

What does negative working capital indicate?

Negative working capital occurs when a company's current liabilities exceed its current assets. This situation might indicate potential liquidity problems, but it can also be common in industries where companies are able to turn over inventory quickly or receive payments before needing to settle liabilities.

-

Why is working capital important for day-to-day operations?

Working capital is crucial for daily operations as it funds the short-term operational needs of a company. Adequate working capital ensures a company can cover its current liabilities with its current assets, thus maintaining normal business operations without facing financial constraints.

-

What are common challenges in managing working capital?

Common challenges in managing working capital include maintaining liquidity, managing inventories efficiently, ensuring timely collection of receivables, and controlling payment terms with suppliers. These challenges require careful management to avoid impacting the company's financial health adversely.

-

What is a good working capital ratio?

A good working capital ratio, often called the current ratio, varies by industry, but generally, a ratio between 1.2 and 2.0 is considered healthy. A ratio above 1 indicates that the company has more current assets than current liabilities, which suggests it can cover its short-term obligations without needing to sell long-term assets or raise additional capital.

A ratio lower than 1 might indicate potential liquidity issues, suggesting that the company might not be able to cover its current liabilities in the short term. Conversely, a very high ratio, such as over 2, could indicate that the company is not effectively using its current assets or could be overcapitalized, which might not be an efficient use of resources.

Therefore, while evaluating a company's working capital ratio, it is crucial to consider the industry norms and the company's operational requirements. Some industries, like retail, typically have higher ratios due to the need to manage larger inventories, while others, such as construction, may operate effectively with lower ratios.

-

What is the Working Capital Turnover Ratio?

The Working Capital Turnover Ratio measures how effectively a company uses its working capital to generate revenue. A higher ratio indicates that the company is efficiently using its working capital to increase sales, signifying effective management of its current assets and liabilities.

-

How do you calculate the Working Capital Turnover Ratio?

The Working Capital Turnover Ratio is calculated by dividing the company's annual net sales by its average working capital. Average working capital is typically calculated by taking the average of the working capital at the beginning and end of the fiscal year.

-

Why is the Working Capital Turnover Ratio important?

This ratio is important as it helps investors and analysts understand how efficiently a company is using its working capital to generate sales. A higher ratio typically indicates that a company is efficient in managing its working capital, while a lower ratio could suggest inefficiencies or potential financial stress.

-

What is an ideal Working Capital Turnover Ratio?

There isn't a one-size-fits-all answer for an ideal Working Capital Turnover Ratio as it can vary significantly between industries. Generally, a higher ratio indicates efficient use of working capital, but extremely high ratios may indicate a company is not investing enough in inventory or is stretching its payables too thin, which could harm long-term sustainability.

Further Reading

To deepen your understanding of working capital and its management, explore the following resources:

- Investopedia's Article on Working Capital - Provides a detailed explanation of working capital, including how to calculate and manage it effectively.

- How to Determine Your Working Capital Needs - Offers insights into various aspects of working capital and its significance for business sustainability and growth.