Est. reading time: 5 min

The Cost Price Calculator is an essential tool for businesses to determine the cost price of their products or services by including all costs associated with production and delivery. Understanding the cost price is crucial for setting retail prices, calculating profit margins, and effective financial planning.

Also try:

Table of Contents

- Word Definitions

- How to Calculate Cost Price

- Examples

- Determining Costs and Overheads

- Connections Between Selling Price, Cost Price, Margin, Revenue, and Profit

- Frequently Asked Questions

- Further Reading

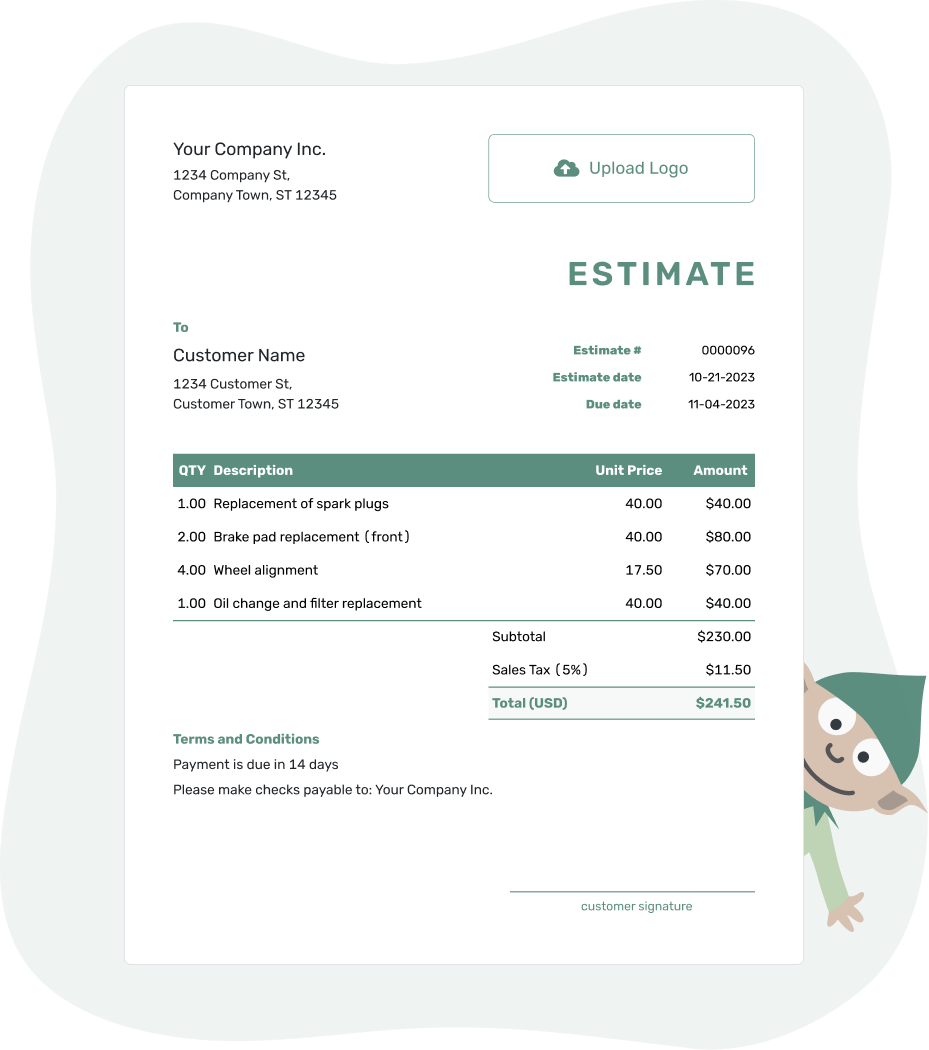

- PDF, Email or Print

- Convert to Invoice

- See when your estimate has been opened

- Get notified when your estimate is accepted

Word Definitions

-

Cost Price:

The total cost incurred to manufacture, acquire, or deliver a product or service, including raw materials, labor, and overhead expenses. -

Direct Costs:

Costs that can be directly attributed to the production of a product or service, such as raw materials and labor. -

Indirect Costs:

Costs not directly linked to production but necessary for operations, such as rent, utilities, and administrative expenses. -

Overhead:

All ongoing business expenses not directly attributed to creating a product or service.

How to Calculate Cost Price

Calculating the cost price involves summing all the direct costs, indirect costs, and overheads associated with the production of a good or service:

| Cost Price = | Direct Costs + Indirect Costs + Overhead |

Examples of Cost Price Calculation

Below are examples that demonstrate how to calculate Cost Price (CP) for a better understanding of determining the selling price by accounting for all expenses.

Example 1: Simple Cost Price Calculation

Consider a company, HomeTech Manufacturing, which produces kitchen appliances. Here are the financial details for producing one microwave:

- Materials: $50

- Labor: $30

- Overheads (calculated per unit): $20

To calculate the Cost Price:

| Cost Price = | Materials + Labor + Overheads |

Cost Price = $50 + $30 + $20 = $100

HomeTech Manufacturing's cost price for one microwave is $100. This price covers all production costs and overhead, positioning the company to set a retail price that achieves their desired profit margin.

Example 2: Cost Price with Indirect Costs

Let's consider another example with a company called SoftWear Apparel, which manufactures clothing. The cost details for producing one t-shirt are:

- Materials: $15

- Labor: $10

- Overheads: $5

- Indirect Costs (like utilities and rent): $3

To calculate the Cost Price:

| Cost Price = | Materials + Labor + Overheads + Indirect Costs |

Cost Price = $15 + $10 + $5 + $3 = $33

With a cost price of $33 per t-shirt, SoftWear Apparel needs to set a selling price that not only covers these costs but also generates a profit, taking into consideration the competitive market prices.

Determining Costs and Overheads

Understanding how to accurately categorize and calculate direct costs, indirect costs, and overheads is crucial for precise cost price calculation. Here's a guide on how to identify these components:

Direct Costs

Direct costs are expenses that are directly associated with the production of goods or services. These costs include:

- Materials: The raw materials used in the manufacture of a product.

- Labor: Wages paid to employees who are directly involved in the production process.

To determine direct costs, add up all expenses that are consumed during the production process. For services, it includes labor and any materials used directly in providing the service.

Indirect Costs

Indirect costs are not directly attributable to a specific product but are necessary for the overall operation of the business. Examples include:

- Utilities: Power and water necessary for production facilities.

- Rent: Costs of leasing office or production space.

- Administration: Salaries of administrative personnel, office supplies.

These costs are typically allocated based on usage estimates or standard accounting practices. A common method is to allocate indirect costs based on the percentage of space a particular department occupies in a facility.

Overheads

Overheads are ongoing expenses that are not linked to any specific business activity but are required to maintain the business. These include:

- Depreciation: The reduction in value of assets over time.

- Insurance: General business insurance expenses.

- Marketing: Costs associated with advertising and promoting the business.

Overheads are generally fixed costs, and they need to be spread across all units produced or services provided to calculate the true cost price accurately.

By accurately determining these costs, businesses can set prices that cover all expenses and ensure profitability. This understanding also aids in financial planning and helps identify potential areas for cost savings.

Connections Between Selling Price, Cost Price, Margin, Revenue, and Profit

Understanding the relationship between selling price, cost price, margin, revenue, and profit is crucial for businesses to make informed pricing and production decisions. Here's how these financial metrics are interconnected:

Selling Price and Cost Price

The selling price is the amount at which a business offers its goods or services to customers, while the cost price represents the total expense incurred to produce those goods or services. The difference between the selling price and cost price directly influences a business's profitability.

Margin

Margin, often expressed as a percentage, is the difference between the selling price and the cost price relative to the selling price. It is a measure of how much out of every dollar of sales a company actually keeps in earnings. A higher margin indicates a greater buffer which helps sustain profitability against fluctuations in cost or selling price.

| Margin = | ((Selling Price - Cost Price) / Selling Price) × 100 |

Revenue and Profit

Revenue is the total amount of money generated from sales before any expenses are subtracted. When you subtract the cost of goods sold, including production and other related costs, from revenue, you get profit, specifically net profit. This figure is crucial for assessing the overall financial health of a business.

| Profit = | Revenue - Cost Price |

Each of these elements plays a significant role in pricing strategy and financial planning, ensuring that a business can maintain profitability while competitively pricing their products.

Frequently Asked Questions

-

What is cost price?

Cost price refers to the total expense incurred to manufacture, acquire, or produce a product or service. This includes materials, labor, and other direct and indirect costs associated with the production.

-

How do you calculate cost price?

To calculate cost price, sum up the total cost of materials, labor, and overhead expenses associated with the product. For products that require manufacturing, include costs such as raw materials and labor. For services, include labor costs and any additional expenses needed to provide the service.

-

What is the difference between cost price and selling price?

Cost price is the expense incurred to create a product, whereas selling price is the amount for which a product is sold to the consumer. The difference between these two prices is the profit margin for the business.

-

Why is it important to know the cost price?

Knowing the cost price is crucial for setting the selling price, managing budgets, and maintaining profitability. It helps in financial planning and ensures that pricing strategies are competitive and profitable.

-

How can a business reduce its cost price?

Businesses can reduce cost price by optimizing production processes, negotiating better terms with suppliers, reducing waste, and utilizing technology to increase efficiency. Regularly reviewing and adjusting procurement and production strategies can also lead to significant cost savings.

Further Reading

To deepen your understanding of cost price calculations and their impact on business operations, explore the following resources:

- Investopedia's Cost vs. Price: What's the Difference? - Provides a detailed explanation of what cost price is, including how it is calculated and its significance in various industries.

- AccountingTools on Cost vs. Price - Offers insights into the differences between cost and price, explaining how each affects financial decision-making.

- Corporate Finance Institute on Cost of Goods Sold (COGS) - This article explores the concept of Cost of Goods Sold, a crucial part of understanding cost pricing in product-based industries.